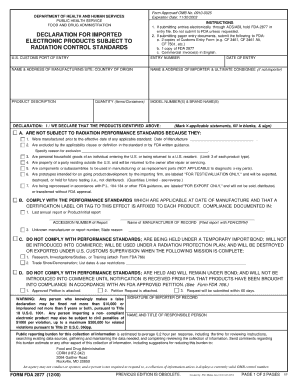

Definition and Meaning of Contractor Fringe Statement Form

The contractor fringe statement form is a vital document that outlines the fringe benefits provided by contractors to their employees. These benefits may include health and welfare, pension contributions, vacation and holiday pay, and training allowances. It serves to ensure that contractors comply with relevant labor laws and regulations regarding employee compensation.

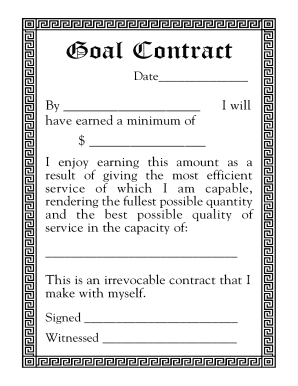

Primarily, the contractor fringe benefit statement consolidates information for various classifications of work, indicating how much each employee is entitled to in terms of benefits. This form often requires contractors to provide detailed descriptions of the plans and programs associated with these benefits. Certification of payment status is a critical component, holding contractors liable under penalty of perjury for the accuracy of the information provided.

Important Terms Related to Contractor Fringe Statement Form

Understanding specific terminology related to the contractor fringe benefit statement is essential for proper utilization and compliance:

- Fringe Benefits: These are additional benefits provided to employees beyond their regular salary; they can include health insurance, retirement plans, and paid leave.

- Certification: Refers to the contractor's affirmation that the information supplied on the fringe statement is complete and truthful. Incorrect information can lead to legal penalties.

- Classifications of Work: This refers to different job categories, which can affect the fringe benefits each employee is entitled to receive.

- Employer Contributions: Payments made by employers toward fringe benefit programs, essential for determining total compensation.

Steps to Complete the Contractor Fringe Statement Form

Completing the contractor fringe statement form requires careful attention to detail to ensure compliance and accuracy. Here are the essential steps:

- Gather Employee Information: Start by collecting names, job classifications, and employment status for all individuals listed on the form.

- Detail Fringe Benefits: Specify all fringe benefits being offered. These might include health insurance premiums, pension contributions, and any other form of compensation.

- Calculate Amounts: Determine the total dollar value for each type of fringe benefit associated with each employee. Accurate calculations help to maintain compliance with labor laws.

- Complete Required Sections: Fill out each section of the form accurately, ensuring that all required fields are completed. This may involve stating the name of the benefit provider and outlining the benefits' terms.

- Review for Accuracy: Before submission, conduct a thorough review to confirm that all information is correct. Any discrepancies could lead to significant penalties or compliance issues.

- Sign and Certify: The final step is to sign the document, certifying that all information is true and accurate under penalty of perjury. This act is crucial for legal compliance.

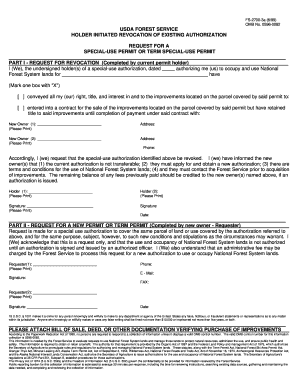

Legal Use of the Contractor Fringe Statement Form

Legally, the contractor fringe statement form must adhere to specific guidelines established by federal and state regulations. This form is particularly significant for ensuring that contractors provide appropriate fringe benefits to their employees, as mandated by laws like the Davis-Bacon Act and similar state laws.

Compliance and Regulation

Maintaining compliance with the contractor fringe statement involves several key considerations:

- Penalties for Non-Compliance: Failing to accurately complete or submit the form can result in fines, disqualification from future contracts, or legal action.

- Record Keeping: Contractors must retain copies of completed forms for audit purposes. The retention period varies by state but typically lasts for several years.

- Employee Rights: This form serves to protect employee rights by ensuring they receive the benefits to which they are entitled, fostering a fair work environment.

Examples of Using the Contractor Fringe Statement Form

The contractor fringe statement form can be utilized in numerous scenarios, demonstrating its versatility across different industries. Here are some practical examples:

- Construction Companies: A construction contractor submits a fringe statement for workers on a public project, detailing health insurance contributions and retirement benefits based on hours worked.

- Consulting Firms: A consulting agency uses the form to report on benefits provided to consultants, ensuring compliance with contract stipulations requiring certain fringe benefits.

- Service Providers: Service providers in hospitality may use the form to detail fringe benefits such as paid vacation and health benefits for different job roles like management versus service staff.

State-Specific Rules for the Contractor Fringe Statement Form

Different states have unique regulations governing the contractor fringe statement form. Understanding these state-specific rules is crucial for compliance:

- State Labor Laws: Each state sets its requirements regarding the types and amounts of fringe benefits that must be reported. Contractors should familiarize themselves with the specific laws applicable in their jurisdiction.

- Reporting Frequency: Some states may mandate periodic submission of fringe statements, while others may only require annual reporting.

- Enforcement Agencies: Learn which state agencies regulate the contractor fringe statements to ensure you are reporting accurately and timely. Each state may have distinct agencies that govern labor law compliance.

By thoroughly understanding and completing the contractor fringe statement form, contractors can promote transparency and protect themselves from potential legal issues, while ensuring that their employees receive the benefits they are entitled to.