Overview of the Business Classification Form

The business classification form is essential for businesses in the United States to accurately represent their size, type, and ownership status. This form is often used in compliance with the FAR 52.212-3 (b)(1) Annual Representations and Certifications. It captures detailed information about a business's structure and classification to ensure compliance with federal regulations. Misrepresentation can result in significant penalties, making accuracy critical.

How to Use the Business Classification Form

To utilize the business classification form effectively, companies need to follow a specific set of procedures that ensure accuracy and compliance. Here are the steps to properly use the form:

-

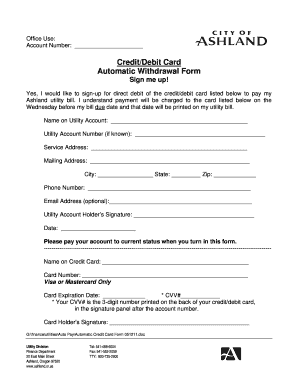

Gather Company Information: Start by collecting basic details such as the business name, address, and contact numbers.

-

Identify Business Type: Determine the nature of your business—whether it's a sole proprietorship, partnership, corporation, or LLC. Each type has distinct implications on the form.

-

Detail Size Representation: Accurately represent the size of your business, including the number of employees and financial data, to align with federal size standards.

-

Ownership Status: Include information on ownership status, specifying if the business is minority-owned, women-owned, veteran-owned, or disadvantaged.

-

Review and Submit: After filling out the form, review it for completeness and accuracy before submission to avoid potential penalties for errors.

Steps to Complete the Business Classification Form

Completing the business classification form requires a systematic approach to ensure all necessary sections are filled correctly:

-

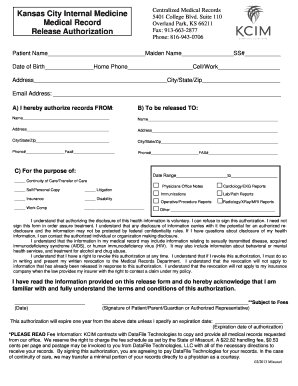

Access the Form: Obtain the form from the relevant issuing authority, which may be a government agency or a specific industry body.

-

Provide Accurate Information: Enter the information required in each section, paying close attention to fields marked as mandatory.

-

Use Supporting Documents: Attach any necessary supporting documents, such as certificated evidence of business type or financial statements.

-

Verify Details: Double-check all entries for typographical errors and inconsistencies that may lead to problems during verification.

-

Finalize Submission: Submit the form through the designated method, whether online, via mail, or in person, ensuring you retain a copy for your records.

Key Elements of the Business Classification Form

The business classification form consists of several key components essential for accurately capturing your business's profile:

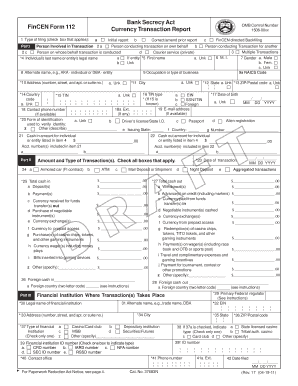

- Business Identification: Includes the legal name and registered address.

- Business Type: Classifies the business as sole proprietorship, partnership, LLC, or corporation.

- Size and Scale: Requires disclosure of the number of employees and annual revenue to categorize the business size accurately.

- Ownership and Control: Details about the ownership structure and any affiliations with other businesses.

- Certifications and Representations: Includes any certifications the business holds, such as disadvantaged or small business status.

Who Typically Uses the Business Classification Form

The business classification form is generally used by a wide range of businesses seeking to engage in federal contracting or meet regulatory requirements. The common users include:

- Vendors and Contractors: Required for contract bids and to qualify for certain government programs.

- Small and Medium Enterprises (SMEs): Often needed to take advantage of federal small business initiatives and incentives.

- Corporations and LLCs: Required for compliance purposes and to maintain accurate government records.

Legal Use of the Business Classification Form

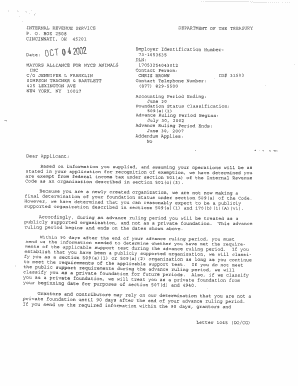

The legal use of the business classification form is governed by federal regulations to ensure that businesses comply with representation requirements. Accurate completion of this form is mandatory to:

- Qualify for Government Contracts: Businesses must present truthful representations to participate in government tenders.

- Maintain Compliance: Regular updates to the form ensure adherence to evolving regulatory demands.

- Avoid Penalties: Misrepresentation on the form can lead to legal actions or exclusion from federal contracting opportunities.

Penalties for Non-Compliance

Failure to comply with the requirements of the business classification form can result in severe consequences, including:

- Fines and Sanctions: Businesses may face monetary fines and sanctions for inaccurate information.

- Contractual Penalties: Misrepresentation can lead to the termination of existing government contracts and ineligibility for future contracts.

- Legal Repercussions: Potential legal action against the business or its representatives for fraudulent claims.

Filing Deadlines and Important Dates

Each year, businesses must be aware of specific filing deadlines associated with the business classification form:

- Annual Filing Deadline: Typically tied to fiscal year timelines, ensuring continuity in government contracting processes.

- Update Requirements: Whenever significant changes occur within the business, such as a change in ownership or structure, an updated form is often required.

- Period for Review: Designated time frames to validate the information submitted before acceptance.

State-Specific Rules for the Business Classification Form

While the business classification form adheres largely to federal guidelines, some state-specific variations do exist:

- State-Specific Additions: Certain states may have additional fields or certifications required.

- Jurisdictional Differences: The interpretation of business size and type can vary by state, requiring precise attention to detail.

- Additional Compliance Needs: Certain states may enforce tighter controls or require supplementary documentation.

Exploring these blocks will offer comprehensive guidance on the usage, completion, and importance of the business classification form, enhancing compliance and ensuring regulatory adherence for businesses.