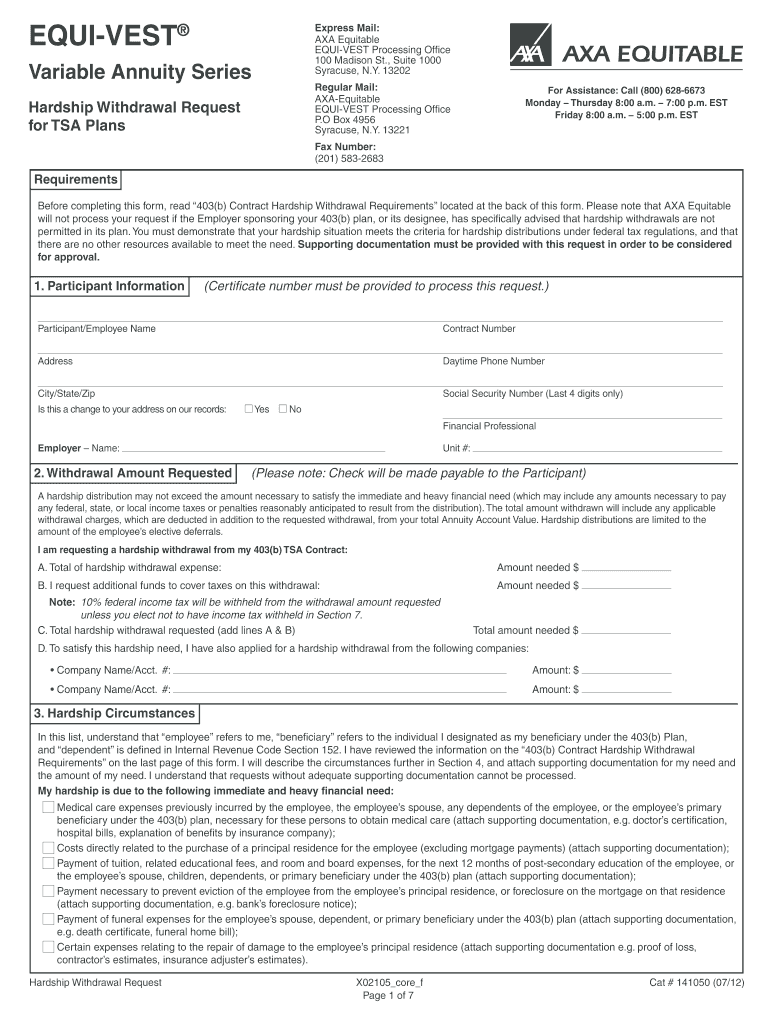

Understanding the AXA Equitable Withdrawal Form

The AXA equitable withdrawal form is an essential document used to request a withdrawal from an AXA Equitable account, typically for funds held in a 403(b) TSA plan or an annuity. Completing this form correctly is crucial for timely process and fund release.

Eligibility Criteria for Withdrawals

Before submitting the AXA equitable withdrawal form, it is important to understand the eligibility requirements, which may vary depending on the specific plan or product.

-

Qualified Circumstances: Withdrawals might be permissible under certain conditions such as:

- Medical expenses

- Purchase of a primary residence

- Educational fees

- Preventing eviction or foreclosure

-

Account Type: You must confirm that your account type allows for withdrawals. Certain types of accounts, such as some annuities, may impose restrictions.

-

Age Requirement: For some plans, reaching the age of 59 and a half may also permit penalty-free withdrawals.

Step-by-Step Instructions for Form Completion

Filling out the AXA equitable withdrawal form involves several critical steps to ensure accuracy and adherence to the requirements.

-

Download the Form: Obtain the latest version of the equitable withdrawal form in PDF format, ensuring you're using the correct version for your specific account ("equitable withdrawal form PDF").

-

Provide Personal Information: Fill in your name, account number, and contact details in the designated sections of the form. Accuracy in this step ensures that your request is processed without delay.

-

Indicate Withdrawal Type: Specify whether your request is for a hardship withdrawal or other types of withdrawals available within your account.

-

Complete the Financial Need Section: If applicable, detail your financial situation that necessitates the withdrawal. Supporting documentation may be required to justify your request.

-

Signature and Date: Finally, sign and date the form. This affirms that the information provided is accurate and that you agree to any terms outlined in the withdrawal process.

Important Required Documents

Along with the AXA equitable withdrawal form, you may need to provide various supporting documents to validate your request for withdrawal. Commonly required documents include:

-

Proof of Financial Need: Documentation like medical bills, tuition invoices, or letters from lenders may be necessary for hardship withdrawals.

-

Identification: A government-issued ID may be required to verify your identity.

-

Previous Account Statements: This can help substantiate your claims regarding account status and withdrawal details.

Delivery Options for Submission

After completing the AXA equitable withdrawal form, consider the submission methods available to ensure your request is processed efficiently.

-

Mail: You can send the completed form to the designated AXA Equitable mailing address. Be mindful of postage time, especially if there are deadlines involved.

-

Online Submission: Some account holders might have the option to submit the form online through the AXA Equitable portal. You will need to log in to your account to access this feature.

-

In-Person: If preferred, you can visit an AXA Equitable branch office. This may allow for a quicker response, and you can ask any questions directly.

Tax Implications of Withdrawals

Withdrawal from an AXA Equitable account typically has tax implications that you should be aware of during planning.

-

Income Taxes: Funds withdrawn may be subject to ordinary income tax. The specific tax rate will depend on your overall taxable income for that year.

-

Early Withdrawal Penalties: If you withdraw funds before reaching 59 and a half, you may incur an additional 10% early withdrawal penalty, unless exceptions apply.

-

Reporting Requirements: You will need to report any withdrawals on your tax return. It’s advisable to keep thorough records of your withdrawals and their purposes.

Alternatives to Withdrawal

If a withdrawal isn't suitable or possible, alternative options may exist depending on your financial needs.

-

Loans: Some plans allow you to take loans against your account funds, which can provide necessary cash without reporting taxable income.

-

Account Closure: In certain scenarios, closing your account may be the preferred choice. This process may involve completing a separate equitable surrender form or a closure application.

-

Hardship Distributions: If you qualify for a hardship distribution, this avenue might be available without incurring penalties when specific criteria are met.

Contacting AXA Equitable for Assistance

If you face challenges while completing the AXA equitable withdrawal form or have questions regarding the process, reaching out to AXA Equitable customer service can provide valuable assistance.

-

Phone Support: Instances may arise where speaking directly to a representative can clarify doubts about submission or requirements.

-

Online Resources: The AXA Equitable website is an excellent resource for FAQs and guidance related to account withdrawals.

By understanding the processes, documents, and implications surrounding the AXA equitable withdrawal form, individuals can navigate their financial needs with confidence and clarity.