Overview of the Pag-IBIG Salary Loan Online Application 2021

The Pag-IBIG Salary Loan Online Application 2021 is a streamlined digital process designed to facilitate loan requests for members of the Pag-IBIG Fund, a key government initiative in the Philippines aimed at providing housing and financial assistance. This form is specifically geared towards qualified employees looking for salary loans to meet various financial needs, such as unexpected expenses or investments. The platform ensures users can conveniently submit their applications without needing to visit a physical office, allowing for an efficient and accessible experience.

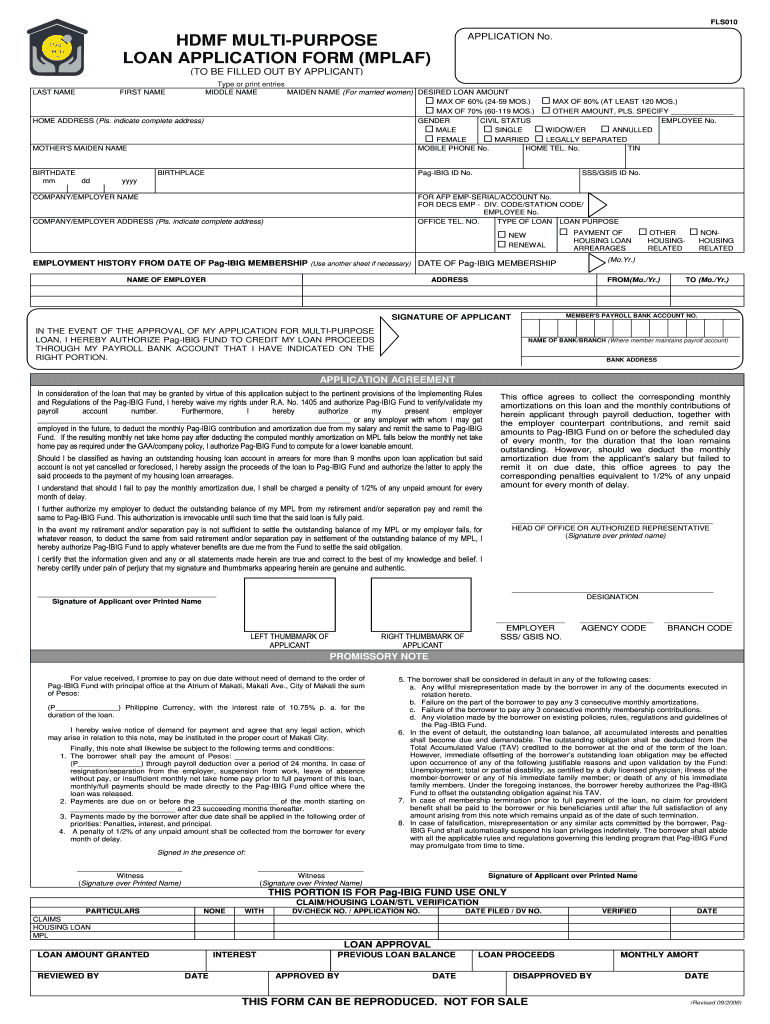

Steps to Complete the Pag-IBIG Salary Loan Online Application 2021

Completing the Pag-IBIG salary loan online application involves several specific steps. Here’s a clear breakdown of the process:

- Access the Online Portal: Begin by visiting the official Pag-IBIG Fund website or the designated online application portal.

- Log in to Your Account: If you are an existing member, log in using your credentials. New applicants may need to create an account by providing personal information.

- Fill Out the Application Form: The online application form requires detailed personal information, including:

- Full name, address, and contact details

- Employment information, such as employer name and position

- Desired loan amount and purpose

- Submit Required Documents: Upload necessary documents, which may include proof of employment, identification, and proof of income. Ensure that all uploads meet specified size and format requirements.

- Review and Confirm Submission: Carefully review the information entered to avoid discrepancies and confirm submission of the application.

- Track Application Status: After submission, use your account to monitor the status of your loan application.

Each of these steps is crucial in ensuring a successful application process for the Pag-IBIG salary loan.

Required Documents for Pag-IBIG Salary Loan Application

Understanding the necessary documentation is essential for a smooth application process. The following documents are commonly needed for the Pag-IBIG salary loan application:

- Valid Identification: A government-issued ID (e.g., passport, driver's license).

- Proof of Employment: A certificate of employment or pay slip.

- Loan Purpose Documentation: Depending on the reason for the loan, you may need to provide additional documents that validate your request.

- Pag-IBIG Fund Membership Details: This includes your Membership ID (MID) number for verification.

Organizing these documents prior to starting the application can save time and streamline the process.

Eligibility Criteria for Pag-IBIG Salary Loan

To apply for a Pag-IBIG salary loan, specific eligibility criteria must be met:

- Membership Status: Applicants must be active members of the Pag-IBIG Fund and have contributed for at least 24 months.

- Loan Amount: The amount requested usually depends on the member's contributions and can range based on various factors.

- Income and Employment: Proof of stable employment and sufficient income is necessary to validate repayment capability.

- No Outstanding Loans: Typically, applicants must not have any overdue loans with Pag-IBIG.

Meeting these criteria is essential for loan approval, and potential applicants should review these requirements carefully.

Important Terms Related to Pag-IBIG Salary Loan

Familiarity with essential terms related to the Pag-IBIG salary loan can enhance understanding of the application process:

- Interest Rate: Refers to the percentage of the loan amount charged by Pag-IBIG for borrowing.

- Loan Tenure: The duration over which the loan must be repaid, typically ranging from two to five years.

- Monthly Amortization: This is the monthly payment amount that includes interest and principal repayment.

- Salary Deduction Agreement: A document granting Pag-IBIG permission to deduct loan payments directly from your monthly salary.

Understanding these terms can help applicants navigate their loan agreements and associated responsibilities effectively.

Legal Use of the Pag-IBIG Salary Loan Application

The Pag-IBIG salary loan application is governed by specific laws and regulations to ensure legal compliance:

- Data Privacy: The application process adheres to data privacy laws protecting personal information provided by members during the loan application.

- Consumer Rights: Pag-IBIG Fund upholds consumer rights by ensuring transparency in loan terms, responsibilities, and fees.

- Legal Binding: Once approved, the loan agreement becomes a legally binding contract between the applicant and Pag-IBIG, mandating adherence to agreed repayment terms.

Being aware of these legal aspects assists applicants in understanding their rights and obligations when applying for a Pag-IBIG salary loan.