Definition & Meaning of the P45 Form

The P45 form is a crucial document in the context of employment taxation in the United Kingdom, often issued to employees when they leave a job. This form serves several key purposes, primarily notifying the employee's new employer of the individual’s tax details. It contains vital information such as an employee's tax code, National Insurance number, and the amount of income earned, as well as taxes deducted up to the point of leaving the job. Understanding the P45 form is essential not only for employees but also for employers who are responsible for correctly managing employee records and tax-related obligations.

Key features of the P45 include:

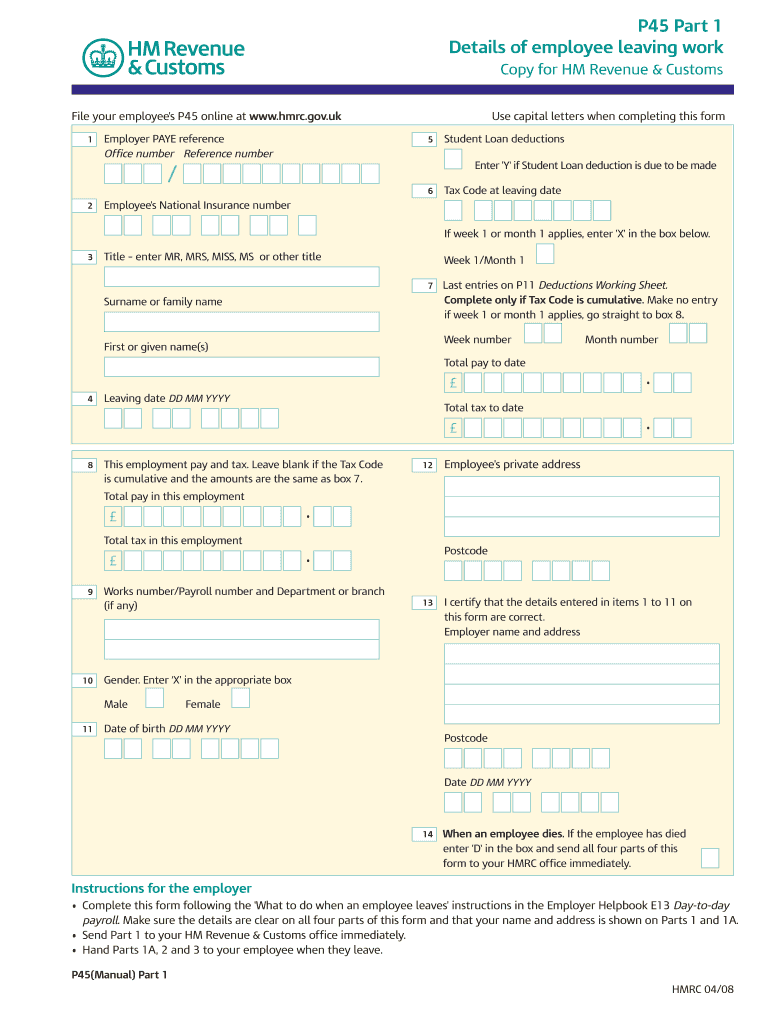

- Parts of the Form: The P45 is divided into four parts. Part 1 is sent to HM Revenue and Customs (HMRC), while Parts 1A, 2, and 3 are provided to the employee and new employer for record-keeping and tax purposes.

- Use in Tax Calculations: The information on the P45 assists in ensuring the correct amount of tax is calculated for the employee's earnings and can prevent underpayment or overpayment of taxes.

- Legal Requirement: Employers are legally obligated to issue a P45 upon termination of employment, ensuring clarity in tax matters and employee rights.

Steps to Complete the P45 Form

While the P45 is primarily the employer’s responsibility, it is essential for them to ensure accuracy and completeness to avoid complications. Here is a detailed guide on how to correctly complete the form:

- Gather Required Information: Collect details necessary for the P45, including employee name, address, National Insurance number, and tax code.

- Fill Out Employer Information: Enter the employer's name, PAYE reference, and contact details at the top of the P45.

- Detail Earnings and Deductions: Document the total pay and tax deducted for the employee to date in the appropriate boxes, paying special attention to ensure all figures are accurate.

- Sections Based on Employment Period: Make sure the information accurately reflects the employment period, and divide the earnings and deductions accordingly, especially if the employee worked multiple roles or had varied income.

- Review and Submit: Once filled out, review the form for any errors before providing the employee with Parts 1A, 2, and 3. Part 1 is submitted to HMRC.

The clarity and accuracy of each section are crucial in preventing issues with tax liabilities and ensuring that all involved parties have the correct information moving forward.

How to Obtain the P45 Form

Obtaining a P45 is a straightforward process, primarily initiated by the employer. Employees can also request a copy if they haven't received one. Here’s how it commonly works:

- Submission by Employer: When an employee leaves a job, it's the employer's duty to complete and distribute the P45 form. Employers typically have access to the form through their payroll systems or can generate it using software that handles tax documentation.

- Requesting a Replacement: If an employee does not receive their P45 upon leaving or loses it afterward, they can request a replacement directly from their previous employer. The employer is obligated to provide accurate records to the best of their ability.

- Documentation Required for Reissue: Employees may need to provide personal details such as their NI number and employment dates when requesting a new P45 to assist the employer in locating the records.

The form is generally structured to be compliant with HMRC requirements, ensuring that both parties have the proper documentation for tax purposes.

Important Terms Related to the P45 Form

Understanding specific terminology associated with the P45 form can enhance clarity regarding its purpose and usage. Here are a few key terms:

- PAYE (Pay As You Earn): A system used by HMRC to collect income tax and National Insurance contributions from employees' earnings.

- National Insurance Number (NIN): A unique identifier used in the UK for the administration of social security and taxation purposes.

- Tax Code: An alphanumeric code used by employers to determine the amount of tax to deduct from an employee’s pay.

- HM Revenue and Customs (HMRC): The UK government department responsible for the administration of tax, payments of some forms of state support, and the enforcement of customs duties.

Familiarizing oneself with these terms fosters a better understanding of the P45 form’s function within the broader tax system and employment practices in the UK.

IRS Guidelines for the P45 Form

While the P45 is specifically a UK form, its implications can affect U.S. citizens working abroad or those transitioning from UK employment back to the U.S. Here are some relevant points regarding IRS guidelines:

- Income Declaration: Individuals who have worked in the UK and received a P45 must declare foreign income to the IRS, including any taxes paid while in the UK.

- Foreign Tax Credit: Employees may be eligible for a foreign tax credit under IRS guidelines, allowing them to offset potentially double taxation.

- Tax Residency Status: The individual’s residency status affects how the income is taxed. U.S. citizens and residents must report worldwide income, which includes earnings represented on a UK P45.

Understanding these aspects is critical for U.S. taxpayers navigating international employment and tax obligations. Proper guidance ensures compliance with both UK and U.S. tax laws.

Examples of Using the P45 Form

The practical application of the P45 form can vary across different scenarios involving employment transition. Here are several examples illustrating these situations:

- Example of Employment Termination: When an employee is laid off, their employer issues a P45 summarizing their total pay and tax deductions. This document is crucial for the employee's next job application, as it helps the new employer set up the correct tax codes.

- Changing Jobs: An employee moving from one company to another can present their P45 to the new employer, ensuring a smooth transition in payroll processing and accurate tax deductions.

- Unemployment Situations: If an individual is claiming unemployment benefits after leaving a job, the P45 serves to demonstrate their previous earnings, which can influence benefit calculations.

Such examples highlight the varied purposes of the P45, showcasing its significance in both employment transitions and compliance with tax obligations.