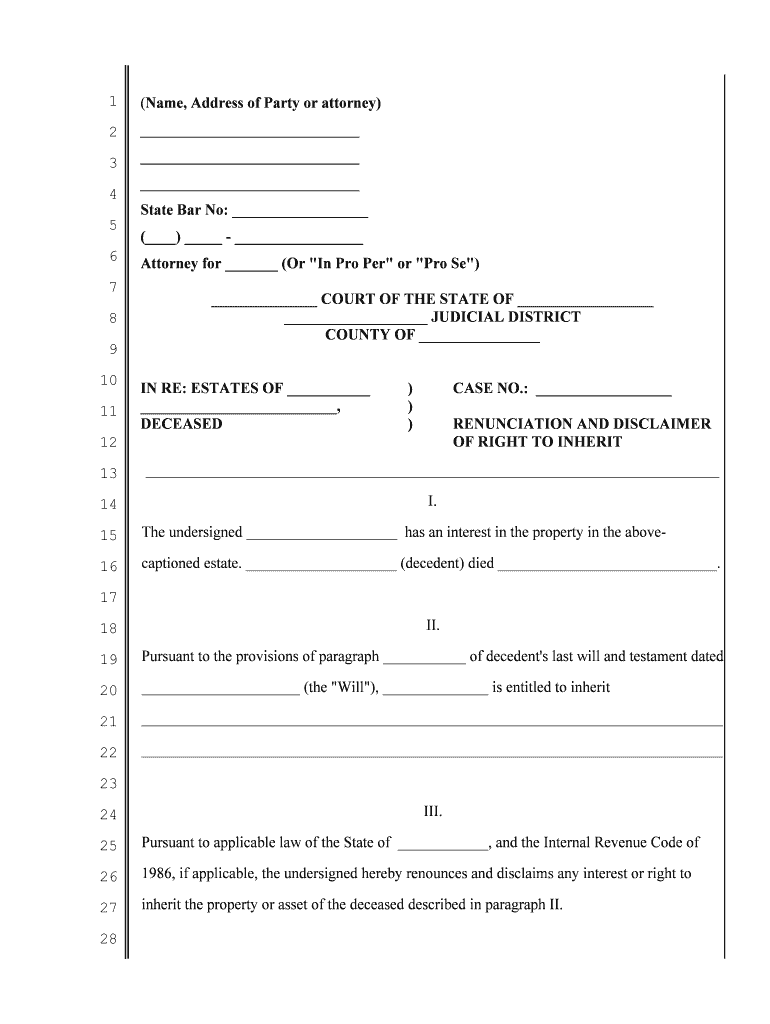

Definition and Meaning of the Renunciation of Inheritance Form

The renunciation of inheritance form is a legal document through which an individual relinquishes their right to inherit property or assets from a deceased person. This filing allows the designated individual, who is typically an heir named in a will or recognized by law, to formally decline their inheritance. By completing this form, the renouncing party ensures that the designated property will not be given to them but will instead pass to other designated heirs as if they had predeceased the decedent. This action is significant as it alters the distribution of an estate and impacts tax liabilities.

Key Terms Associated with the Form

- Decedent: The individual who has passed away, whose estate is being addressed.

- Heir: An individual entitled to inherit property under a will or through intestacy laws.

- Will: A legal document that outlines how a person wishes their assets to be distributed after death.

- Intestacy: The condition of an estate when someone dies without a valid will.

- Disclaimed Property: The assets or rights the renouncing party will not inherit.

Understanding these terms can aid individuals in grasping the implications of the renunciation of inheritance form, particularly in contexts where estate distribution can complicate legal and financial situations.

Steps to Complete the Renunciation of Inheritance Form

Completing the renunciation of inheritance form involves several steps, ensuring that the process adheres to legal requirements and preserves the interests of all parties involved.

- Obtain the Renunciation Form: The form can typically be sourced from the probate court in the jurisdiction where the decedent lived.

- Fill Out Personal Information: Include full name, address, relationship to the decedent, and details of the estate.

- State the Intent to Renounce: Clearly express the desire to decline the inheritance. This section must specify the particular assets or rights being renounced.

- Sign in Front of a Notary: The document generally must be notarized to validate the signature and confirm the identity of the signer.

- File the Form: Submit the completed and notarized form to the appropriate probate court or relevant legal authority, ensuring all required supplementary documentation is attached.

By following these steps accurately, an individual can ensure that their renunciation is legally recognized and effectively executed.

Important Considerations in Using the Renunciation of Inheritance Form

Several factors should be considered when determining whether to use the renunciation of inheritance form.

-

Tax Implications: Renouncing an inheritance can lead to specific tax consequences, potentially relieving the individual from tax obligations associated with the inherited wealth—such as estate taxes or income taxes on certain income generated by the inherited estate.

-

Legal Advice: It is advisable to consult with an attorney or estate planning specialist to understand the ramifications fully, as misunderstandings about the process can lead to complications or unintended consequences.

-

Impact on Other Heirs: Renouncing an inheritance not only affects the renouncer but also alters the distribution among remaining heirs, which may lead to advantageous or detrimental results for them, depending on the circumstances.

Overall, a thorough understanding of these considerations will inform one's decision and ensure the form is utilized appropriately.

State-Specific Rules for the Renunciation of Inheritance Form

The requirements and implications of the renunciation of inheritance form can vary notably from state to state. Each jurisdiction may have unique stipulations regarding:

-

Filing Procedures: Different states may require specific methods or formats for submitting the form, and some might necessitate additional documents.

-

Timeline Limitations: Some states impose strict deadlines on when the renunciation must be filed following the decedent's death or probate proceedings, leading to increased urgency for the renouncer.

-

Estate Size Thresholds: Various regions might allow exemptions for smaller estates or offer simplified processes that ensure quick resolution.

Being cognizant of these regional nuances helps ensure compliance with local laws and can streamline the renunciation process.

Legal Use of the Renunciation of Inheritance Form

The legal foundation of the renunciation of inheritance form lies within the statutes governing probate and estate administration. This form is typically governed by state laws that dictate:

- Acceptance of the Renunciation: Legally, an heir's renunciation is irrevocable; once filed, it permanently relinquishes their rights to the inheritance.

- Impact on Related Legal Proceedings: The form must be recognized in any probate proceedings concerning the decedent's estate to enforce its terms, ensuring that property distribution aligns with the individual's intent to renounce.

Compliance with these laws is critical, as improper handling of the form can create legal disputes or delay the settlement of the estate in question.

By understanding the form's legal context, individuals can navigate the complexities of inheritance law more effectively.