Definition and Meaning of the Capital Infusion Certificate

A capital infusion certificate is a formal document used to certify the fixed capital investment made by a business toward new enterprises, expansions, or diversification projects. This certificate is crucial for entities looking to secure financing, as it substantiates the financial inputs regarding assets necessary for business operations. The document typically details the assets involved, including land, buildings, machinery, and associated installations essential for commencing commercial production. It is frequently issued by a Chartered Accountant (CA), who provides a declaration of accuracy regarding the financial information presented.

Importance of Capital Infusion Certificate

The certificate serves several purposes:

- Financing: Essential for securing loans or investments by demonstrating a business's commitment and financial backing.

- Regulatory Compliance: It may be required by certain regulatory bodies to ensure transparency in capital investments.

- Tax Benefits: Businesses could avail themselves of specific tax benefits tied to these investments when properly documented.

Key Elements of the Capital Infusion Certificate

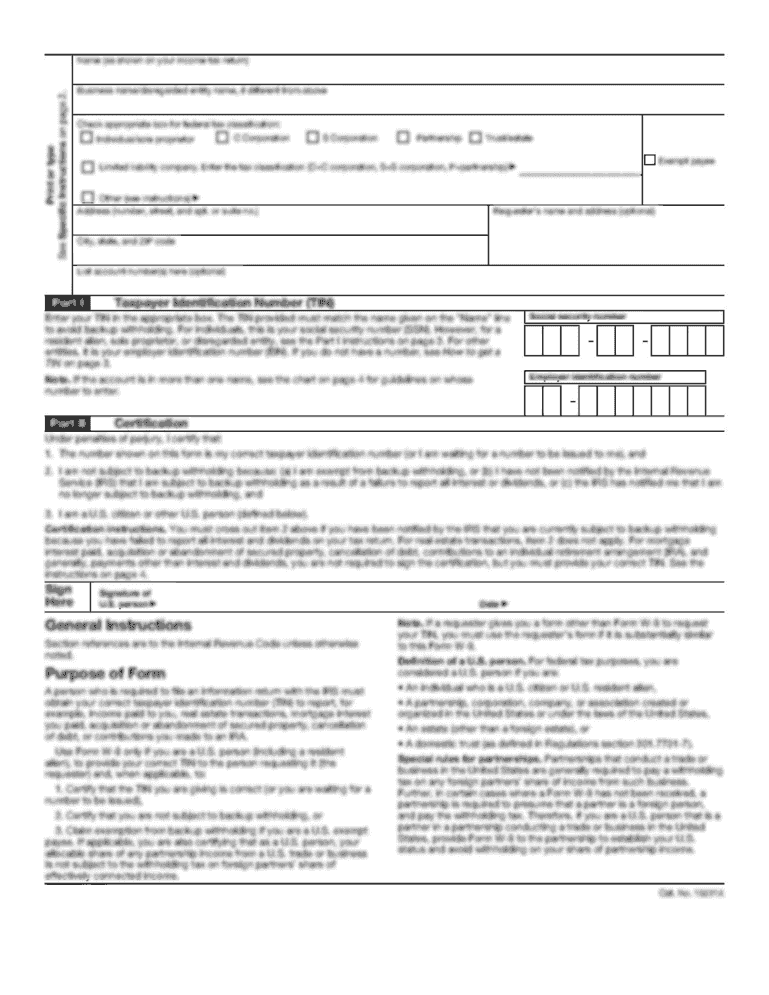

A well-structured capital infusion certificate must include critical components to be deemed valid and functional. Important elements typically featured in the document are:

-

Business Details:

- Name and address of the business

- Business registration number or tax identification number

-

Investment Details:

- A detailed account of the assets being funded, such as machinery and infrastructure

- The total amount of capital infused into the business

-

Declaration by Chartered Accountant:

- Signature and certification from the Chartered Accountant, confirming the authenticity of the information provided

- Mention of the date of issuance and validity

-

Annexures:

- Supporting documents or lists that detail specific machinery and installation features that will be funded or utilized

These components ensure that the capital infusion certificate is comprehensive and credible, meeting various stakeholders' criteria.

Who Typically Uses the Capital Infusion Certificate?

The capital infusion certificate is primarily utilized by businesses looking to enhance their operations or start new initiatives. Typical users include:

- Start-ups: New businesses often use these certificates to provide assurance to investors about their capital investments.

- Established Corporations: Firms seeking expansion or diversification may require these documents to substantiate their financial capital for obtaining loans.

- Financial Institutions: Banks and other funding organizations demand the certificate to assess the viability of a loan application.

- Government Agencies: Certain regulatory bodies may require these documents to ensure compliance with investment and operational guidelines.

Steps to Complete the Capital Infusion Certificate

Completing a capital infusion certificate involves several structured steps to ensure accuracy and compliance with the relevant standards. The process generally includes:

-

Gathering Necessary Information:

- Compile all relevant financial data, including fixed capital investments and descriptions of assets.

-

Consulting a Chartered Accountant:

- Engage a CA to review the details and provide expertise in structuring the document according to legal requirements.

-

Filling Out the Certificate:

- Input all gathered details into the capital infusion certificate format, ensuring accuracy in figures and descriptions.

-

Review and Verification:

- Have the CA verify the completed certificate for accuracy and compliance, adjusting any discrepancies.

-

Issuance and Signing:

- The CA will then sign off on the certificate, finalizing the document for submission to banks or regulatory entities.

-

Documentation:

- Maintain copies of the signed certificate and any accompanying documents for records and future reference.

Examples of Using the Capital Infusion Certificate

In practice, the capital infusion certificate can facilitate various operational outcomes. Here are two scenarios illustrating its application:

-

Scenario 1: A New Manufacturing Plant A manufacturer looking to establish a new plant obtains a capital infusion certificate detailing the investment in machinery and infrastructure. This document is presented as part of a loan application to a bank, ensuring compliance with financial verification protocols.

-

Scenario 2: Expansion of a Service-Based Business A tech service company seeks to broaden its service offerings. The company uses a capital infusion certificate to document investments in advanced software systems and training. This allows the company to demonstrate commitment to growth and transparency in capital management when seeking external funding.

These examples underscore the utility of capital infusion certificates in various business contexts, showcasing their importance in securing financing and ensuring compliance.