Definition and Meaning of a Memorandum of Trust

A memorandum of trust serves as an important document that certifies the existence of a trust. It is primarily used to provide evidence of the trust's establishment, outline its terms, and provide transparency to third parties, such as financial institutions and legal entities. This document encompasses critical details about the trust, including:

- Name of the Trust: Identifies the specific trust in question.

- Date of Establishment: Specifies when the trust was created.

- Tax Identification Number: Vital for tax purposes and financial reporting.

- Trustee Information: Details about the individual or entity responsible for managing the trust.

- Trust Powers: Describes the authority of the trustee regarding the management of trust assets, which may include investments, asset allocation, and distributions to beneficiaries.

Understanding these components is essential for anyone looking to create or manage a trust effectively.

Key Elements to Include in a Memorandum of Trust

The memorandum of trust must include several key elements to ensure it complies with legal standards and adequately conveys the necessary information to stakeholders. Important components include:

- Identification Information:

- Name of the trust and trustee

- Date of formation

- Governing jurisdiction

- Nature of Powers Granted: Clearly outlines what powers the trustee holds, which may encompass the authority to buy, sell, or lease property.

- Trustee Duties: Specifies the obligations of the trustee, which include the management of trust assets and distributions to beneficiaries.

- Continuity Statement: Affirms that the trust remains effective and outlines how it will operate in differing circumstances.

- Signatures: Ends with the trustee’s signature and may require a notary public acknowledgment for added legitimacy.

These elements collectively lend the document legal validity and ensure clarity in the terms of the trust.

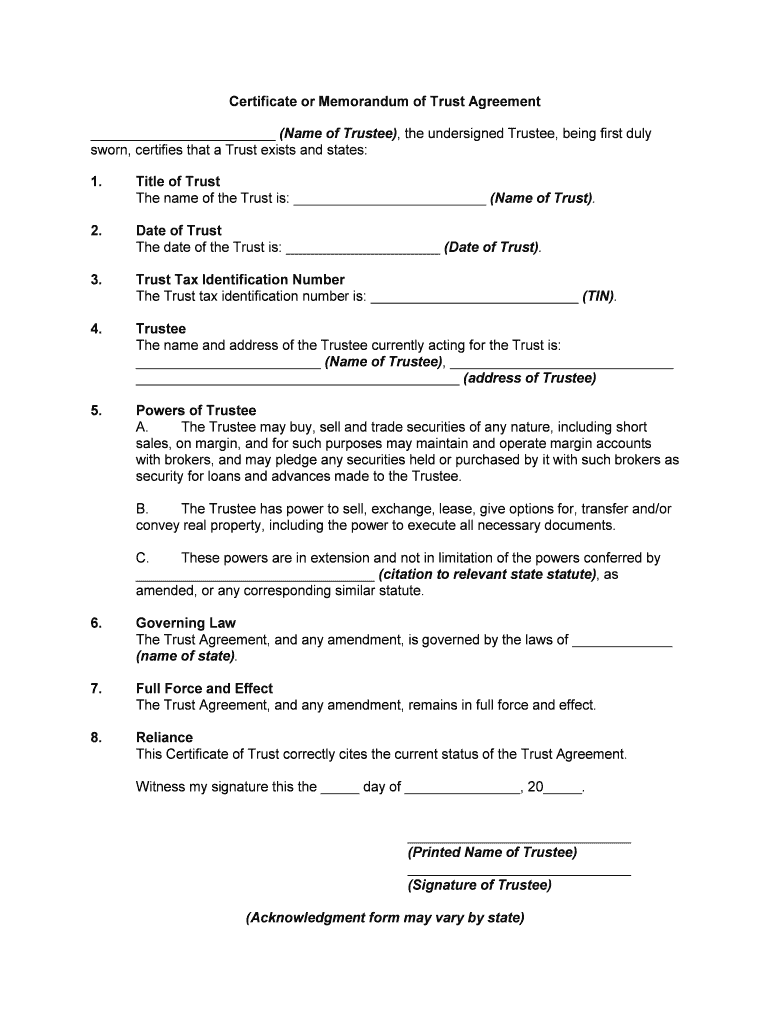

Steps to Complete a Memorandum of Trust Sample

Completing a memorandum of trust sample involves several organized steps to guarantee accuracy and compliance. The process includes:

- Gather Information: Compile all necessary details about the trust, including information about the trustee, beneficiaries, and the trust's objectives.

- Choose a Template: Select a reliable memorandum of trust sample that best fits the specific requirements of the trust.

- Fill in the Details: Include crucial information in the template:

- Full name of the trust

- Date of establishment

- Tax identification number

- Powers of the trustee

- Review for Accuracy: Ensure all information is correct and that the document accurately reflects the trust's terms.

- Sign the Document: The trustee must sign the memorandum, and it may need to be notarized for validation.

- Distribute Copies: Provide copies to relevant parties, including financial institutions and legal representatives.

Following these steps closely helps ensure the completed document effectively serves its purpose.

Important Terms Related to a Memorandum of Trust

Understanding specific terminology is crucial when dealing with a memorandum of trust. Key terms include:

- Trustee: The individual or entity responsible for managing the trust and fulfilling its terms.

- Beneficiaries: Individuals or groups entitled to receive assets or benefits from the trust.

- Revocable vs. Irrevocable Trust: A revocable trust can be altered or terminated by the settlor, whereas an irrevocable trust typically cannot.

- Trust Agreement: The foundational document that outlines the terms of the trust.

- Asset Allocation: The strategy for distributing trust assets among beneficiaries.

Familiarity with these terms ensures a comprehensive understanding of trust management and operation.

Who Typically Uses a Memorandum of Trust Sample?

The memorandum of trust sample is primarily utilized by a diverse range of individuals and entities. Common users include:

- Trustees: Those appointed to manage a trust and execute its terms will often rely on a memorandum for documentation and operation.

- Beneficiaries: Parties entitled to benefit from the trust, who may require this document for clarity on their entitlements.

- Financial Institutions: Banks and investment firms that need formal documentation of a trust's existence to manage or accept trust accounts.

- Legal Professionals: Attorneys who assist with trust formation or management may use memorandums as part of their client documentation.

- Estate Planners: Individuals or firms engaged in estate planning utilize trust samples to ensure clients' wishes are accurately implemented.

This variety in users underscores the document's importance in legal, financial, and personal contexts regarding trust management.

Legal Use of a Memorandum of Trust

The legal standing of a memorandum of trust is pivotal in establishing the legitimacy and enforceability of the trust. Key legal aspects include:

- Establishing Validity: The memorandum acts as legal proof that a trust exists and that the trustee has authority to manage trust assets.

- Compliance with State Laws: Each state may have specific requirements for trusts; consequently, the memorandum should align with local regulations to be fully enforceable.

- Protection Against Challenges: A well-structured memorandum can help protect against disputes regarding the trust's validity or the trustee's authority.

- Clear Guidelines for Execution: By outlining the powers and duties of the trustee, the memorandum aids in minimizing misunderstandings amongst parties involved.

Understanding the legal implications of a memorandum of trust serves to protect both the trust and its beneficiaries from potential conflicts or issues.

Examples of Using a Memorandum of Trust Sample

Practical applications of a memorandum of trust sample can vary across different scenarios. Here are a few examples:

- Purchase of Real Estate: A trustee may use the memorandum when acquiring property on behalf of the trust, ensuring all parties recognize the authority vested in them.

- Opening a Trust Bank Account: Financial institutions often require a memorandum to verify the trust exists and confirm the trustee's authority, facilitating the establishment of bank accounts acting in the trust's name.

- Distribution of Trust Assets: When distributing assets to beneficiaries, trustees may rely on the memorandum to clarify the terms set forth in the trust agreement.

- Legal Documentation in Court Proceedings: In cases of dispute, a trust memorandum can provide essential proof in legal proceedings, establishing the validity of the trust and delineating trustee powers.

These examples illustrate the vital role that a memorandum of trust plays in both daily operations and legal matters concerning trusts.