Definition & Meaning of Third Party Verification Consent to Release of Information Section 8

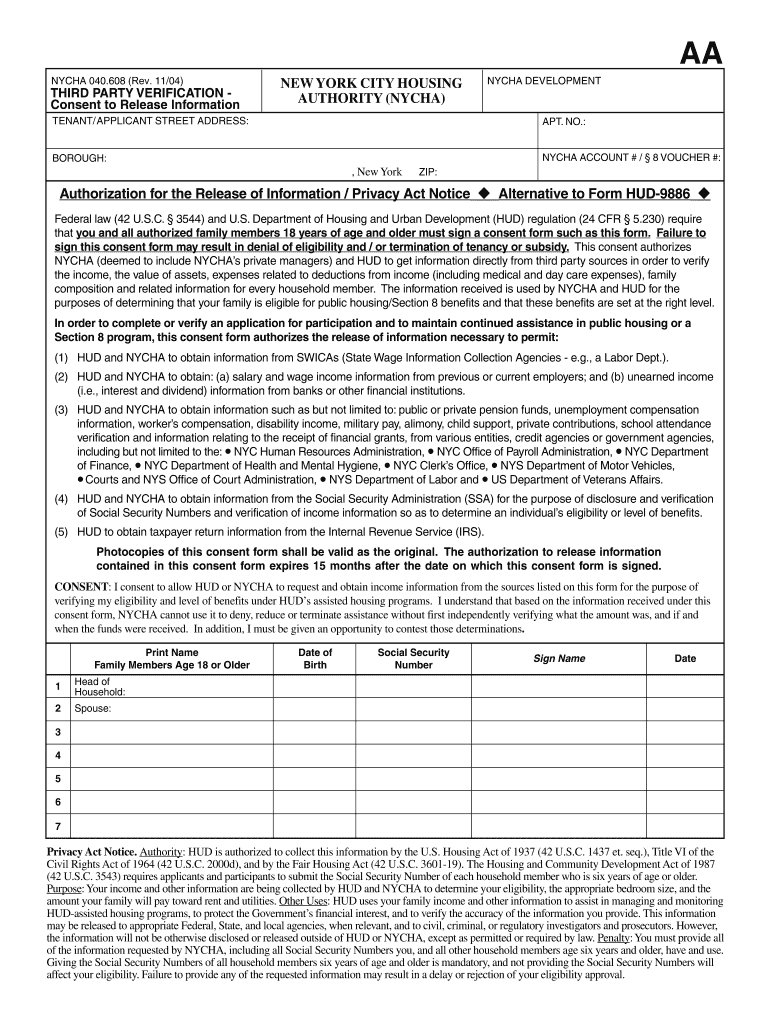

The third party verification consent to release of information section 8 is a legal document used primarily in the context of public housing programs, specifically related to the U.S. Department of Housing and Urban Development (HUD) requirements. This form authorizes the New York City Housing Authority (NYCHA) and HUD to obtain necessary personal information from sources such as employers, banks, and other government agencies in order to determine eligibility for public housing and Section 8 benefits.

- Purpose: The main goal is to verify an applicant's income and assets for the proper assessment of their eligibility for housing assistance. This verification process is crucial as it directly influences the allocation of benefits and resources to applicants.

- Legal Basis: The legal authority for collecting this information is rooted in both federal and state housing regulations. It ensures compliance and transparency in the housing assistance process.

This form is essential for applicants needing to authorize the release of personal information, safeguarding the integrity of the application process.

Importance of Accurate Information in Third Party Verification

Accurate and truthful information is critical in the third party verification process. The form emphasizes that all provided information must be complete and truthful to avoid issues such as delays or disqualification from assistance programs.

- Verification Sources: These may include:

- Employers for income verification

- Banks for asset assessments

- Government agencies for benefit checks

- Consequences of Inaccuracy: Providing false information may lead to penalties, including loss of housing assistance or legal repercussions.

Ensuring accurate information not only helps applicants maintain their integrity but also aids housing authorities in serving the community effectively.

Typical Users of the Third Party Verification Form

The third party verification form is primarily used by a diverse demographic that requires public housing assistance. Common users include:

- Low-Income Families: Families with limited financial resources applying for housing assistance.

- Elderly Individuals: Seniors who often rely on fixed incomes and may need assistance with housing.

- Disabled Persons: Individuals with disabilities seeking supportive housing options.

- Single Parents: Single mothers or fathers needing assistance to secure stable housing for their children.

Understanding the user base helps in tailoring the services and support offered by housing authorities based on the unique needs of different demographics.

Key Elements Required in the Verification Process

The process of third party verification involves several key elements that must be captured accurately in the form:

- Personal Identification: Applicants must provide their full name, address, and social security number to verify their identity.

- Income Information: Accurate declarations regarding all sources of income, including wages, Social Security benefits, and any other assistance must be included.

- Asset Declaration: Details about all assets, such as bank accounts, property ownership, and other valuable items, are crucial for a complete assessment.

- Signature and Date: A legal signature must be included to authorize the information release, along with the date of signing to establish a timeline.

Gathering this information efficiently ensures that the verification process is thorough and compliant with legal standards.

Legal Considerations Surrounding the Form

The third party verification consent form must adhere to multiple legal frameworks to protect both the applicant and the housing authority. Some critical legal aspects include:

- Privacy Regulations: Personal information is sensitive and must be handled according to federal privacy laws, including the Privacy Act of 1974.

- Consent Requirements: Consent must be informed, meaning the applicant understands what information is being released and to whom.

- Data Security: Housing authorities are responsible for safeguarding the information received and must utilize secure methods for data storage and handling.

Adhering to these legal requirements fosters trust between applicants and housing authorities and ensures compliance with broader legal standards.

How to Complete the Third Party Verification Consent Form

Completing the third party verification consent form is a straightforward process that involves a few essential steps:

-

Gather Required Information:

- Make sure you have all personal and financial information ready before starting the form.

-

Fill Out Personal Details:

- Complete the sections requesting your name, address, and contact information accurately.

-

Detail Your Income and Assets:

- List your income sources and assets comprehensively, ensuring all information is current.

-

Review for Accuracy:

- Verify that all entered information is accurate and complete to avoid potential issues with your application.

-

Sign and Date the Form:

- After double-checking all entries, sign the document and include the date to finalize your consent.

Following these steps meticulously will ensure that the form is complete, helping facilitate a smoother verification process.

Common Scenarios Requiring Third Party Verification

There are multiple scenarios where a third party verification might be needed, including:

- Applying for Section 8 Housing: Individuals applying for assistance under the Section 8 program must provide consent to allow verification of their financial backgrounds.

- Annual Recertifications: Current beneficiaries of public housing assistance often undergo annual reviews where updated information is verified.

- Change in Household Composition: When there are changes in the household, such as new members joining, this form may be necessary to reassess eligibility.

These scenarios highlight the importance of the third party verification consent to accurately reflect changes in circumstances that could affect housing assistance.

Examples of Organizations Requesting This Consent

Various organizations and entities may request third party verification consent to facilitate the data collection process, including:

- Public Housing Authorities: Such as the NYCHA, which manage housing programs and need accurate data for eligibility assessments.

- Social Service Agencies: Organizations that provide a range of social services may require consent for financial verification.

- Financial Institutions: Banks may need to confirm asset information to assist applicants in providing a complete financial picture.

Each of these organizations plays a vital role in ensuring that housing assistance programs are administered fairly and accurately through verified information.