Overview of the Al Arafah Islami Bank RTGS Form

The Al Arafah Islami Bank RTGS form is a crucial document designed for customers who wish to execute real-time gross settlement transactions through the bank. This form facilitates the transfer of funds between accounts, ensuring immediate processing and high-value payments.

Key Features of the RTGS Form

- Instant Payment: The RTGS system allows for real-time transfers, prioritizing urgent or high-value payments.

- Transaction Limit: Generally, RTGS transactions require a minimum amount, commonly set at a threshold that varies by bank policy.

- Bank Validation: The Al Arafah Islami Bank RTGS form includes necessary validations to ensure that both the sender and receiver accounts are active and maintain sufficient funds.

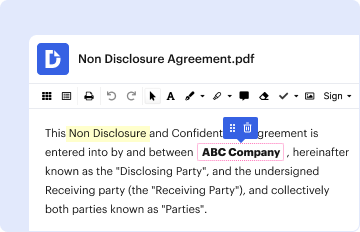

Completing the Al Arafah Islami Bank RTGS Form

To correctly fill out the RTGS form, users should follow these steps:

- Account Information: Input the sender's account details, including account number and name.

- Beneficiary Information: Provide the recipient's account number, bank name, and branch details to ensure proper routing.

- Transaction Amount: Clearly specify the amount being transferred and ensure it meets the minimum requirements.

- Purpose of Transfer: Some banks require a declaration of the purpose for the transaction; including this can help expedite processing.

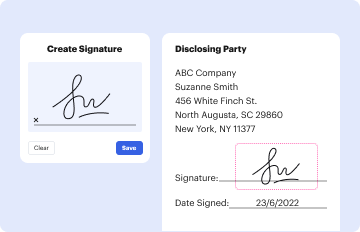

- Signature: The form must be signed by the sender to authorize the transaction.

Important Terms Related to the RTGS Process

Understanding specific terminology associated with the RTGS form can enhance clarity and ensure compliance:

- RTGS: Real-Time Gross Settlement; a system for continuous real-time settlement of transactions.

- Beneficiary: The individual or entity receiving the funds.

- Sender: The individual or entity initiating the transfer from their bank account.

Legal Considerations in Using the RTGS Form

Users of the RTGS form must be aware of several legal and compliance aspects:

- Anti-Money Laundering: Compliance with laws designed to prevent money laundering and fraud is mandatory.

- Data Privacy: Any personal information on the form is protected under applicable data protection legislation, ensuring that customer data is handled securely.

- Transaction Record: Keep a copy of the completed RTGS form for record-keeping and proof of transaction.

Types of Users for the RTGS System

The Al Arafah Islami Bank RTGS form is commonly used by:

- Individuals: For personal transfers or payments, especially involving high amounts that cannot be handled through conventional methods.

- Businesses: Companies making supplier payments, payroll, or real estate transactions often utilize the RTGS for its reliability and speed.

- Government Entities: For rapid disbursement of funds, including subsidies and grants.

Submission Methods for the RTGS Form

The RTGS form can be submitted in various ways, depending on the bank’s practices:

- In-Person: Customers may visit a branch to submit the form directly.

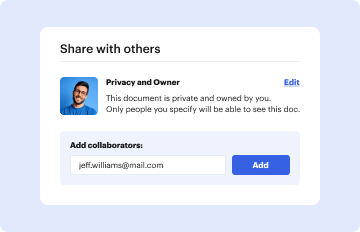

- Online: Some banks offer online portals for RTGS transactions, where the form can be filled out digitally and submitted electronically.

- Mobile Banking: If available, mobile banking apps may also facilitate RTGS transactions with simplified form fields.

Variants and Alternatives to the RTGS Form

While the RTGS form is specific to Al Arafah Islami Bank, other banks have their own versions, which might include:

- AIBL RTGS Form: A specific variation for similar transactions within Al-Arafah Islami Bank.

- Islamic Bank RTGS Forms: Other Islamic banks may have unique forms tailored to their systems, reflecting different rules and guidelines.

Tips for Smooth Processing of RTGS Transactions

To ensure a smooth transaction, customers should:

- Verify Details: Double-check all entered information for accuracy to avoid delays.

- Check Limits: Be aware of any transaction limits imposed by the bank to prevent unexpected rejections.

- Contact Customer Support: If unsure about any process, reaching out to customer support can clarify expectations and requirements.

By understanding the Al Arafah Islami Bank RTGS form, customers can navigate their banking transactions more effectively, enhancing their experience and ensuring compliance with necessary protocols.