Definition and Meaning

The Broker's Fee Agreement BFA - the Pennsylvania Association of realtors helps define the professional relationship between a real estate broker and a seller for a property that is not listed with another broker. This document sets the groundwork for the transaction by detailing the broker's fee structure, the seller’s responsibilities regarding property disclosures, and the legal obligations tied to lead-based paint disclosures for properties constructed before 1978. Furthermore, it solidifies the broker's exclusive representation of the buyer, ensuring a clear, mutually agreed set of expectations for both parties.

Key Elements of the Broker's Fee Agreement

Several core components underpin the Broker's Fee Agreement BFA, making it vital for both brokers and sellers to familiarize themselves with these elements to avoid misunderstandings:

- Broker's Fee: Specifies the percentage or flat fee the broker is entitled to upon the completion of a transaction.

- Seller’s Obligations: Includes property disclosures, such as material defects and other known issues, to inform potential buyers.

- Legal Provisions: Addresses compliance with lead-based paint legislation, especially for homes built before 1978, safeguarding all parties from legal repercussions.

- Buyer's Representation: Affirms that the broker will act solely on behalf of the buyer, maintaining transparency and avoiding conflicts of interest.

Important Terms Related to the Broker's Fee Agreement

Understanding specific terminology is crucial for effectively navigating the Broker's Fee Agreement:

- Exclusive Representation: Ensures that the broker is the sole representative of the buyer, eliminating conflicts that might arise with other brokers.

- Deposit Money Handling: Outlines how deposit money will be managed and the conditions under which it may be retained or returned.

- Anti-Discrimination Clause: Highlights compliance with federal and state anti-discrimination laws, ensuring fair dealing with potential buyers.

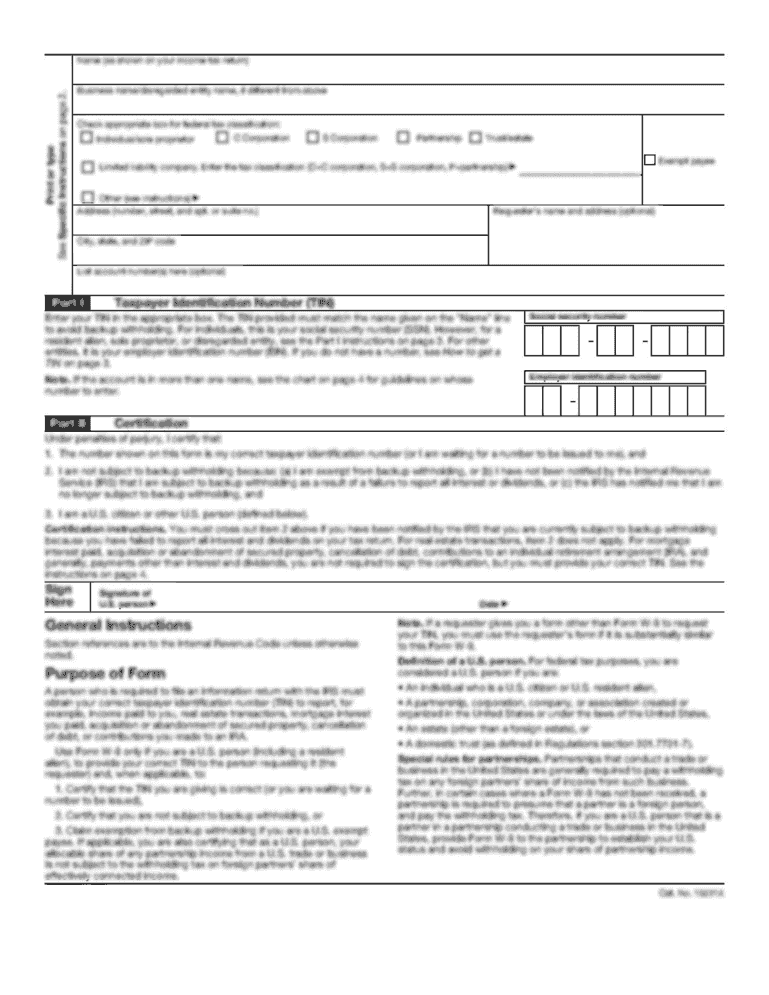

Steps to Complete the Broker's Fee Agreement

Completing the Broker's Fee Agreement involves a sequence of steps to ensure accuracy and mutual understanding:

- Review the Agreement: Both parties should thoroughly read and comprehend each section of the agreement.

- Discuss Terms: Engage in conversations around central terms, such as the broker’s fee and seller obligations, to ensure no ambiguity.

- Enter Details: Accurately fill in specific details about the transaction, including property description and proposed terms.

- Sign the Document: Once both parties have reviewed and agreed upon all terms, they should sign the agreement to make it legally binding.

Who Typically Uses the Broker's Fee Agreement

The Broker's Fee Agreement is predominantly used by:

- Real Estate Brokers: To formalize the compensation agreement for rendering their services.

- Property Sellers: To define the terms under which they will grant a broker the responsibility to attract potential buyers.

- Legal Advisors: Occasionally consulted to ensure compliance and address any legal considerations pertaining to the agreement.

Legal Use of the Broker's Fee Agreement

Legal adherence is pivotal when implementing the Broker's Fee Agreement:

- Compliance with Laws: Aligns with local and federal housing laws, such as disclosure requirements and anti-discrimination statutes.

- Handling of Discrepancies: Provides a process for resolving conflicts that may arise during the transaction, often referring disputes to arbitration or mediation.

State-Specific Rules for the Agreement

Pennsylvania laws influence certain conditions of the Broker's Fee Agreement:

- Disclosure Requirements: Pennsylvania mandates complete transparency concerning known property defects.

- Real Estate Commission Guidelines: Compliance with the Pennsylvania Real Estate Commission is required, which governs licensing and conduct standards for brokers.

Examples of Using the Broker's Fee Agreement

A few scenarios exemplify the application of the Broker's Fee Agreement:

- Unlisted Property Sales: When a property owner seeks a broker’s exclusive representation without prior listing arrangements, this agreement becomes vital in outlining roles and expectations.

- Lead Disclosure Situations: For properties built pre-1978, engaging the agreement aids in fulfilling mandatory lead disclosure obligations, protecting all relevant parties.

These blocks collectively offer a comprehensive look into the Broker's Fee Agreement BFA - the Pennsylvania Association of realtors, covering its foundational role in property transactions, the critical elements it comprises, and the utility it provides across different scenarios.