Definition & Meaning

Surety bonds are legal agreements involving three parties: the principal (who needs the bond), the surety (who issues the bond), and the obligee (who requires the bond). The surety bond template is a pre-structured form used to outline these responsibilities and financial assurances. It provides a standardized format to ensure compliance with specific regulations, such as those found in the Illinois Appraisal Management Company Registration Act. This particular bond specifies a $25,000 obligation to cover potential fines or fees due to non-compliance by appraisal management companies in Illinois.

How to Use the Surety Bond Template

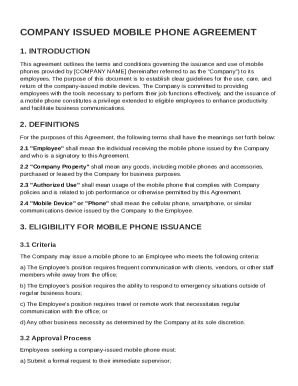

Utilizing a surety bond template involves selecting the appropriate template that fits the specific regulatory requirements of the business or organization. Begin by ensuring that all roles — the principal, surety, and obligee — are clearly defined within the document. Next, fill in the necessary details, including the bond amount, the expiration terms, and any state-specific clauses. Always review the filled template with legal counsel to ensure its accuracy and compliance, especially in nuanced scenarios that could involve state-specific regulations.

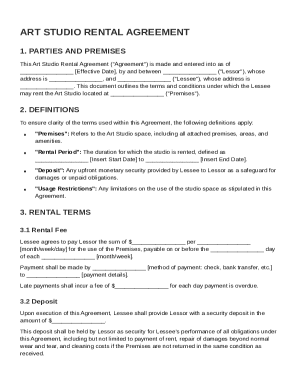

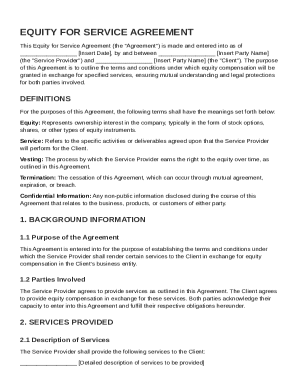

Key Elements of the Surety Bond Template

The surety bond template typically includes several critical components:

- Names and Roles: Identification of the principal, surety, and obligee.

- Bond Amount: The financial obligation that the surety guarantees.

- Effective Dates: The initiation and expiration dates of the bond.

- Terms and Conditions: The specific obligations and responsibilities of each party.

- State Requirements: Provisions necessary to meet state-specific laws, such as those required by the Illinois Appraisal Management Company Registration Act.

- Signature Lines: Areas designated for signatures of all parties to validate the agreement.

These sections ensure clarity and comprehensiveness in outlining the financial and legal responsibilities tied to the bond agreement.

State-Specific Rules for the Surety Bond Template

When dealing with surety bonds, various states may have unique requirements that need to be addressed in the template. In the context of Illinois, for instance, the appraisal management companies must comply with the Illinois Appraisal Management Company Registration Act. Ensure that the bond amount, in this case, $25,000, reflects the state's mandates. Review the template against local regulations to avoid discrepancies that could impact compliance and enforceability.

Steps to Complete the Surety Bond Template

Filling out the surety bond template involves several detailed steps:

- Gather Information: Collect all necessary details about the principal, surety, and obligee.

- Complete Personal and Bond Information: Fill in names, addresses, and the specific bond amount.

- Review Requirements: Ensure state-specific conditions are met.

- Include Dates and Duration: Clearly specify the start and end date of the bond.

- Obtain Signatures: Secure required signatures from all involved parties.

- Review and Finalize: Cross-check the completed document with legal counsel to confirm accuracy.

These steps help ensure that the template is accurately completed and legally sound.

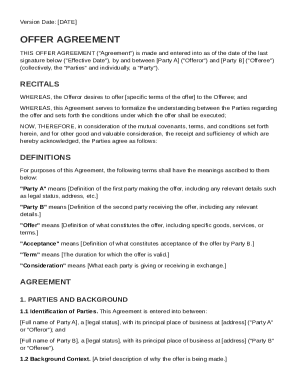

Legal Use of the Surety Bond Template

The legality of a surety bond is contingent on complying with the relevant regulatory framework and accurately filling out the template. Ensure that the template aligns with pertinent state laws, like those in Illinois for appraisal management companies. Legal counsel can help navigate specific legal requirements, confirming that the bond is valid and enforceable under state law. Using a properly crafted template helps safeguard against potential disputes arising from misunderstandings or misrepresentations within the bond agreement.

Who Typically Uses the Surety Bond Template

Surety bond templates are commonly used by businesses and entities that require financial assurance to comply with regulatory bodies. Appraisal management companies, contractors, and service providers might use these templates to guarantee their adherence to state-mandated rules and protect against financial liabilities. The template provides a structured method for these entities to establish credibility and trust with clients and regulatory authorities.

Examples of Using the Surety Bond Template

Consider an appraisal management company in Illinois needing to comply with the state's regulations. The company would use the surety bond template to meet the stipulated $25,000 bond requirement, protecting against non-compliance fines. Additionally, contractors may employ surety bonds to back their performance and payment obligations on projects. These real-world applications demonstrate the flexibility and necessity of surety bonds across various industries, ensuring financial protection and legal compliance.

Penalties for Non-Compliance

Failure to adhere to the conditions outlined in the surety bond template can result in significant penalties. For instance, if an appraisal management company in Illinois does not comply with the Illinois Appraisal Management Company Registration Act, they could be liable for any unpaid fines or fees, up to the $25,000 surety bond amount. In non-compliance cases, companies might also face suspension of their operating licenses, legal disputes, or additional financial liabilities, underlining the importance of accurate and diligent adherence to these bond agreements.