Definition and Purpose of the Metropolitan Life Insurance Company GUL Beneficiary Form

The Metropolitan Life Insurance Company GUL Beneficiary Form is a crucial document that allows policyholders to designate who will receive the proceeds from a Group Universal Life (GUL) insurance policy upon their death. This form ensures that benefits are distributed according to the insured's wishes, providing a chance to name both primary and contingent beneficiaries. A primary beneficiary is the first in line to receive the proceeds, while a contingent beneficiary would inherit if the primary beneficiary is unable to do so. The form is legally binding and essential for estate planning, aiming to prevent disputes over who should receive the policy benefits.

Key Elements of the Metropolitan Life Insurance Company GUL Beneficiary Form

This form includes several important sections that must be thoroughly completed:

- Beneficiary Information: Requires detailed information about both primary and contingent beneficiaries, including their names, addresses, and relationships to the insured.

- Trust Designations: If a trust is designated as a beneficiary, crucial information about the trust and the trustee must be included.

- Submission Instructions: Provides guidelines on how to accurately fill out and submit the form, ensuring it is processed correctly.

- Revocation Clause: Any previous beneficiary designations are revoked when a new form is submitted, ensuring the most recent wishes of the policyholder are honored.

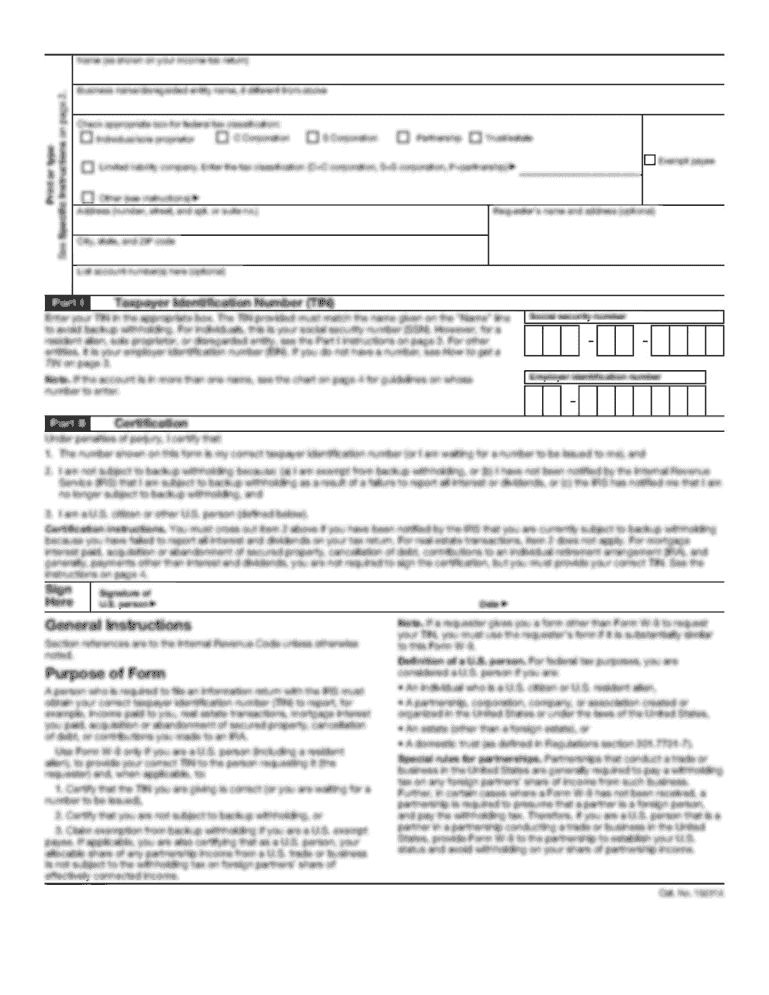

Steps to Complete the Metropolitan Life Insurance Company GUL Beneficiary Form

Completing the GUL Beneficiary Form involves several detailed steps to ensure accuracy:

- Gather Necessary Information: Collect the full names, addresses, and Social Security numbers of all intended beneficiaries.

- Fill Out the Form: Carefully input the relevant information into each required section. Double-check for spelling errors and inaccuracies.

- Sign and Date: Ensure that the policyholder's signature and date are included, as this validates the form.

- Review: Before submission, review the form for completion and accuracy to avoid processing delays.

- Submit the Form: Follow the instructions provided for submission, which may include mailing or submitting electronically depending on the carrier's guidelines.

Important Terms Related to the GUL Beneficiary Designation

Understanding specific terminology is essential for accurately completing and interpreting the GUL Beneficiary Form:

- Primary Beneficiary: The main person or entity designated to receive the benefits of the insurance policy.

- Contingent Beneficiary: A secondary recipient who receives benefits if the primary beneficiary is unable or unwilling to do so.

- Revocation: Canceling previous beneficiary designations by submitting a new form. This ensures that the current wishes of the policyholder are executed.

- Trust: A legal arrangement whereby a trustee holds and manages assets or funds for the benefit of a beneficiary.

How to Obtain the Metropolitan Life Insurance Company GUL Beneficiary Form

Acquiring the GUL Beneficiary Form is a straightforward process:

- Contact MetLife: Reach out to your MetLife representative or visit the company’s official website to obtain the form.

- Financial Advisor: Consult with a financial advisor who can provide the form and assist with its completion.

- Policy Portal: Access through the online portal if available, allowing for direct downloading and submission.

Who Typically Uses the Metropolitan Life Insurance Company GUL Beneficiary Form

The primary users of the GUL Beneficiary Form are individuals who hold a Group Universal Life insurance policy offered by their employer:

- Employees: Typically those participating in a company’s group life insurance plan.

- Policyholders with a Trust: Those seeking to leave benefits to a trust require this form.

- Estate Planners: Individuals in the process of estate planning might need to fill out these forms for organization and clarity.

Legal Use and Compliance of the GUL Beneficiary Form

This form serves as a legal document under U.S. insurance laws:

- Legal Binding: Once signed and submitted, the form becomes a legally binding document dictating the distribution of insurance benefits.

- Compliance with State Laws: While it operates under federal law, state-specific regulations may affect the completion and submission processes. Awareness of such rules is crucial for ensuring legal compliance.

Form Submission Methods for the Metropolitan Life Insurance Company GUL Beneficiary Form

How to submit the completed form for efficient processing:

- Online Submission: Many providers, including MetLife, allow for electronic submission via a secure portal, offering convenience and speed.

- Mail: Physical submission through postal mail remains an option, requiring sufficient mailing time for processing.

- In-Person: Forms can often be submitted directly at local branches or through an employer's HR department, ensuring personal delivery.

By adhering to these guidelines and understanding the form's nuances, policyholders can securely manage their life insurance beneficiary designations, ensuring that their preferences are honored and that the transfer of benefits is both seamless and legally sound.