Definition & Meaning

The California Department of Tax and Fee Administration (CDTFA) is a state agency responsible for the administration of various taxes and fees in California. The CDTFA manages sales and use taxes, fuel taxes, tobacco taxes, and other fees. The primary goal of this agency is to collect tax revenues efficiently and ensure compliance with California’s tax laws. Understanding the role of CDTFA is crucial for businesses and individuals that deal with tax obligations within the state.

The CDTFA serves as a vital resource for businesses by providing guidance on tax-related issues, offering educational resources, and helping taxpayers understand their obligations. This ensures the proper collection and allocation of funds necessary for state and local services, infrastructure, and other public resources.

How to Use the CDTFA - CA Department of Tax and Fee Administration - California

Utilizing CDTFA services requires familiarity with their online platform, where taxpayers can access a wide array of resources and services. Users can file returns, manage accounts, and make payments directly through the CDTFA's website. The digital system is designed to streamline tax management and communication with the agency.

- Account Management: After registering on the CDTFA portal, users can manage their tax profiles, which includes viewing account balances, filing returns, and making payments.

- Resources and Guides: The CDTFA provides comprehensive guides and frequently asked questions (FAQs) to help users navigate their tax obligations.

- Contact and Support: For personalized assistance, users can contact the CDTFA directly via phone or through their website's contact form.

Steps to Complete the CDTFA - CA Department of Tax and Fee Administration - California

Filing taxes with CDTFA involves a series of clear steps to ensure compliance and proper filing. Here’s a generalized procedure to help guide taxpayers through the process:

- Register or Log In: Start by logging into your CDTFA account or creating a new account if you don’t already have one.

- Determine Tax Liability: Accurately determine your tax liabilities using tools and resources available on the CDTFA website.

- Complete Forms: Fill out the relevant tax forms, making sure to provide accurate and up-to-date information.

- Submit Forms: File your completed forms through the CDTFA online platform. Review them thoroughly before submission to avoid errors.

- Pay Dues: Once filed, pay any dues using the available online payment methods. The CDTFA site supports various payment options to facilitate the transaction.

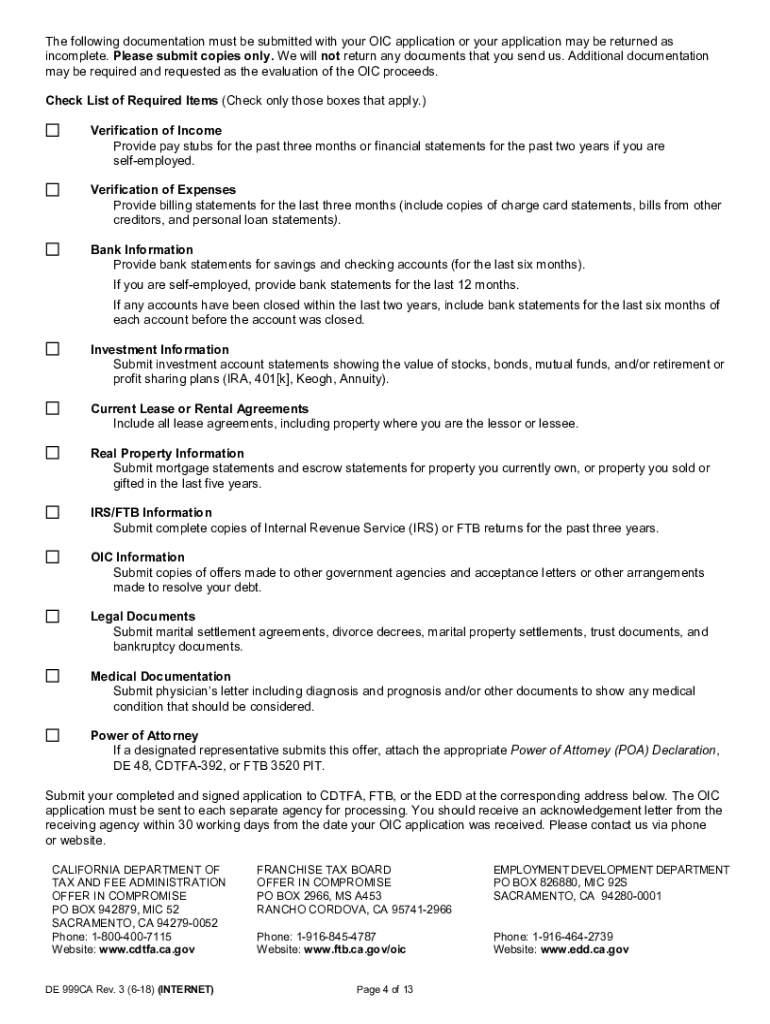

Required Documents

Filing with the CDTFA necessitates gathering pertinent documents to ensure a smooth and accurate process. These documents typically include:

- Tax Identification Documents: Taxpayer Identification Number (TIN) or Social Security Number (SSN).

- Business Information: Business registration details and permits.

- Sales and Purchase Records: Detailed documentation of sales, purchases, and other taxable transactions.

- Financial Statements: Balance sheets and income statements that support entries on tax forms.

These documents help verify the information submitted and support the accuracy of tax calculations.

Eligibility Criteria

Understanding the eligibility criteria is essential for taxpayers planning to use the services provided by the California Department of Tax and Fee Administration:

- Business Registration: Eligible businesses must be legally registered in California and meet all state requirements.

- Sales Threshold: Businesses exceeding certain sales thresholds are required to register and file with the CDTFA.

- Nexus Requirements: Businesses with a physical or economic presence in California are typically subject to state taxes.

- Fee Obligations: Entities dealing in specific goods, such as tobacco or fuel, must adhere to particular registration and reporting obligations with the CDTFA.

Filing Deadlines / Important Dates

Being aware of key deadlines is crucial for compliance with the CDTFA. Here are some significant dates to keep in mind:

- Quarterly Returns: Due on the last day of the month following each quarter (e.g., April 30th for Q1).

- Annual Returns: Typically due by January 31st of the following tax year.

- Installment Plans: Payment deadlines depend on the terms agreed upon with the CDTFA for any tax installment agreements.

Following these deadlines helps avoid penalties and ensures that businesses remain in good standing with tax authorities.

Penalties for Non-Compliance

Non-compliance with CDTFA regulations can result in several penalties, impacting both individuals and businesses financially and legally:

- Late Filing Penalties: Imposed when tax returns are submitted past the due date.

- Interest on Unpaid Taxes: Accrued daily on outstanding taxes until fully paid.

- Fines for Inaccurate Reporting: Initiated when discrepancies are found in the reported figures.

Being mindful of these potential penalties encourages timely and accurate filing.

State-Specific Rules for the CDTFA - CA Department of Tax and Fee Administration - California

California imposes specific rules and requirements that differ from other states, affecting how businesses and individuals interact with CDTFA:

- Sales Tax Variances by County: Different rates and rules depending on regional jurisdictions.

- Employee Thresholds for Tax: Specific requirements based on the size and scope of a business’s operations within California.

- Regulations on E-commerce: Businesses not physically located in California but selling within the state must also adhere to the state’s tax requirements.

Understanding these rules helps entities comply with the state’s regulations and operate smoothly.

Software Compatibility with CDTFA Services

Many businesses utilize software tools to streamline their tax filing with the CDTFA. Software compatibility is essential for a seamless integration process:

- Supported Platforms: TurboTax and QuickBooks are commonly used due to their comprehensive tax filing features.

- Direct Uploads: Most major accounting software can directly upload tax data to the CDTFA portal, reducing the risk of errors.

The integration of these platforms aids in maintaining accurate financial records and facilitates efficient interaction with the CDTFA.