Definition & Purpose of the Authorization to Debit Account Form

The Authorization to Debit Account form serves as a legal document enabling organizations, such as billing companies, to withdraw funds directly from a customer's bank account. Designed for use within the United States, this form is pivotal in streamlining bill payments by authorizing real-time debits. The document confirms an agreement between the customer and the billing entity, ensuring that transactions are conducted securely and according to predefined terms.

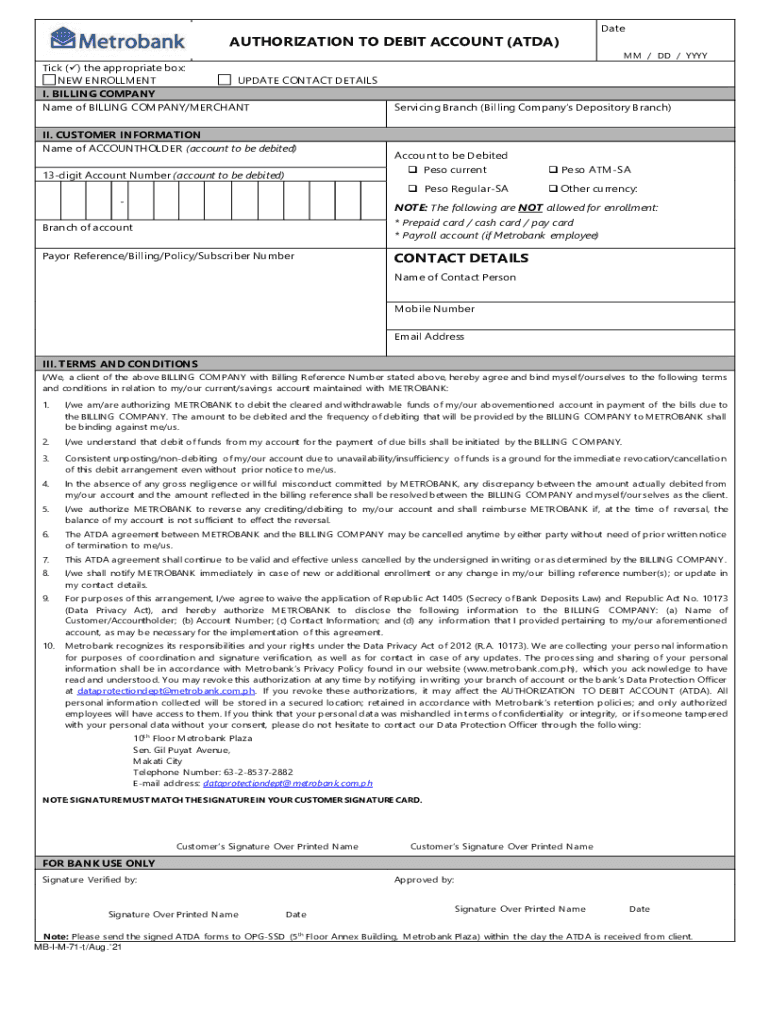

Key Elements of the Authorization to Debit Account Form

Several critical components are included in the Authorization to Debit Account form to ensure clarity and enforceability:

-

Customer Information: This section gathers essential details about the account holder, such as name, address, and contact information, to verify their identity.

-

Bank Account Details: The account number and bank routing number are required to facilitate the fund transfer.

-

Terms and Conditions: These outline the responsibilities of both parties, including stipulations about insufficient funds, privacy considerations, and procedures for cancellation.

-

Signature Block: The customer's signature is crucial, signifying their consent to the automatic debits and acceptance of the terms and conditions outlined in the form.

How to Use the Authorization to Debit Account Form

Organizations typically provide these forms in conjunction with service agreements or billing enrolments:

-

Form Completion: The customer fills in their personal and banking information.

-

Agreement to Terms: The customer reads and agrees to the stipulated conditions, acknowledging their understanding and acceptance through a signature.

-

Submission: The completed form is then submitted to the billing company either physically or digitally, depending on the provider's preference.

For digital submissions, platforms like DocHub facilitate this process by allowing users to submit securely and efficiently online.

Steps to Complete the Authorization to Debit Account Form

The process of filling out this form involves several straightforward steps:

-

Gather Personal Information: This includes your full name, contact details, and address.

-

Provide Bank Details: Accurately enter your banking information, such as account and routing numbers.

-

Review Terms and Conditions: Careful examination of the agreement’s terms is crucial to avoid any misunderstandings.

-

Sign and Date: Your signature is a legal acknowledgment of your consent to the agreement’s conditions.

-

Submit the Form: Depending on the service provider, this might involve online submission via platforms like DocHub, mailing the form, or in-person submission.

Why Use the Authorization to Debit Account Form

Using this form offers several advantages:

-

Convenience: Automating payments simplifies the process for customers, reducing the likelihood of missed payments.

-

Security: Banks employ stringent security measures, ensuring that funds are safely and accurately transferred.

-

Efficiency: Real-time debiting optimizes the billing cycle, benefiting both companies and customers.

Important Terms Related to the Authorization

Understanding certain key terms enhances comprehension of the form’s implications:

-

Real-Time Debit: Immediate processing of payments upon authorization rather than batch processing.

-

Direct Debit: A payment method where the payer allows the payee to withdraw funds directly from their account.

-

Withdrawal Authorization: The account holder’s legal consent for funds to be withdrawn by a third party.

Legal Use & Compliance

The Authorization to Debit Account form must comply with federal regulations, such as the Electronic Fund Transfer Act. It is a legally binding agreement; thus, compliance with all terms and conditions is essential to avoid disputes or legal issues. Both parties, the customer and the service provider, must retain copies for their records. Misuse or unauthorized debits can be contested and reversed under specific conditions, reinforcing the importance of understanding the agreement fully before signing.

State-Specific Rules and Considerations

While federal guidelines govern this form's use, certain states may impose additional regulations. Businesses are encouraged to consult with legal professionals to ensure compliance with both state and federal laws. Variations in consumer protection laws between states could influence how terms are enforced. Customers should be aware of the specific rights afforded to them based on their state's regulations, particularly concerning unauthorized transactions and the process for revoking authorization.