Definition and Purpose of the Affidavit of Surviving Spouse

An affidavit of surviving spouse is a legal document that serves as a declaration by the surviving spouse of a deceased individual. This affidavit affirms the affiant’s relationship with the decedent and highlights their entitlement to the deceased’s estate according to state laws. It essentially establishes the affiant as the rightful heir, which is crucial for settling the estate's affairs, such as accessing bank accounts, transferring property titles, or managing financial assets.

Importance in Estate Management

- Legal Recognition: The affidavit provides legal recognition of the surviving spouse’s right to inherit the estate.

- Streamlined Process: It can simplify inheritance claims by obviating the need for lengthy probate processes, depending on the state's laws.

- Access to Assets: Surviving spouses often need immediate access to joint assets; this affidavit facilitates that process.

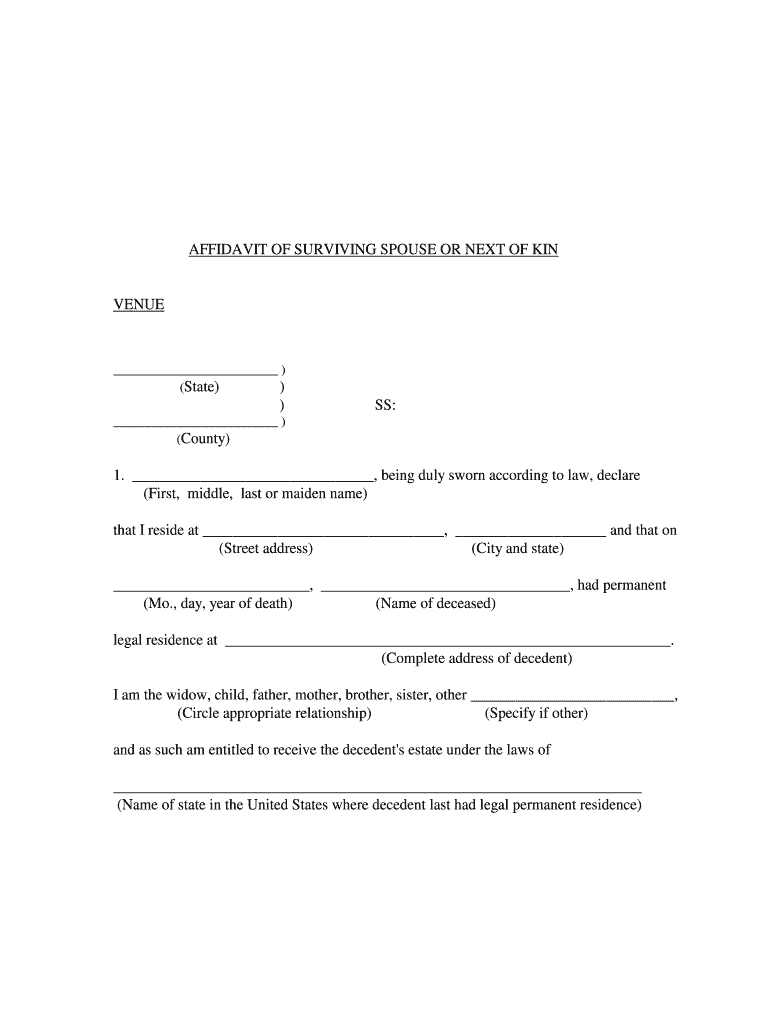

How to Complete the Affidavit of Surviving Spouse

Filling out an affidavit of surviving spouse requires careful attention to detail and the inclusion of specific information. Below are the fundamental steps involved in completing this document:

-

Gather Required Information: Collect personal details of both the affiant and the deceased, including full names, addresses, dates of birth, and marriage information.

-

List Surviving Relatives: Identify any other surviving family members, as this is crucial for establishing the affiant’s legal status and the decedent's heirs. Ensure that the names are listed in order of kinship.

-

Provide Details of the Decedent: Include the date of death and any relevant information about the estate, such as known assets that require management.

-

Affirmation Section: Fill out the section that requires the affiant to affirm their legal standing as the surviving spouse and state their entitlement to the estate.

-

Signature and Notarization: The document must be signed in the presence of a notary public, who will then notarize the affidavit, adding an essential layer of legal authenticity.

Tips for Accuracy

- Use Clear Language: Avoid ambiguous terms and ensure clarity in all details provided.

- Double-Check Information: Verify that all names and details match official documents to prevent potential issues during the execution.

Important Legal Considerations

The validity of an affidavit of surviving spouse hinges on several legal factors:

- State-Specific Requirements: Each state may have unique laws governing inheritance and the requirements for executing an affidavit.

- Date of Death: The date of death may affect rights to certain assets and claims, as some jurisdictions have specific timeframes within which such affidavits must be filed.

- Enforceability: While the affidavit can facilitate access to the estate, it's crucial that it adheres to legal standards to be enforceable in any disputes related to the estate.

State-Specific Rules and Variations

Different states hold varying rules regarding the affidavit of surviving spouse, reflecting local laws governing inheritance and estate management. For instance:

-

California: In California, a surviving spouse can often use a simplified affidavit if the decedent’s estate does not exceed a certain value.

-

Georgia: Georgia’s law allows a surviving spouse to claim a homestead exemption and may provide additional rights concerning jointly owned property.

-

Texas: Texas outlines specific forms and may require additional documentation, although many smaller estates can bypass formal probate with a simple affidavit.

Scenarios Requiring Different Procedures

- Complex Estates: Large estates with extensive assets may necessitate more elaborate documentation compared to simpler, smaller estates.

- Disputed Claims: Situations where there are competing claims from other relatives can complicate the use of an affidavit, potentially necessitating legal counsel.

Required Documentation for Submission

To complement the affidavit of surviving spouse, a variety of documents may be needed to corroborate the claims made in the affidavit:

- Death Certificate: Almost universally required to verify that the individual is deceased.

- Marriage Certificate: This is often required to prove the legal relationship between the affiant and the deceased.

- Identification: A government-issued ID of the affiant may also be necessary during the notarization process.

Typical Submission Methods

- Online: Some jurisdictions may allow online filing of the affidavit through government websites.

- In-Person: Typically, an affidavit must be filed in person at a local court or relevant government office.

- Mail: Certain jurisdictions allow for submission via postal service, although this may lengthen processing times.

Examples of Usage in Different States

Understanding how the affidavit functions across states can clarify its application:

-

California: A widow in California can secure a home title by presenting an affidavit if the total estate qualifies for simplified probate.

-

New York: In New York, the affidavit must include detailed information on both the affiant’s and decedent’s situations and adhere to strict format guidelines.

-

Minnesota: Here, the affidavit can be combined with a petition to expedite estate settlement, facilitating faster access to family assets.

Summary of Benefits

- Rapid Access to Funds: Utilizes the affidavit to access joint accounts swiftly.

- Minimized Legal Fees: Less need for attorney involvement can lower overall estate costs.

- Efficient Resolution: Conclusively settles estate matters without prolonged court disputes.

These comprehensive sections outline the key components and considerations surrounding the affidavit of surviving spouse, ensuring that users are well-informed about its functions and usage.