Definition & Meaning

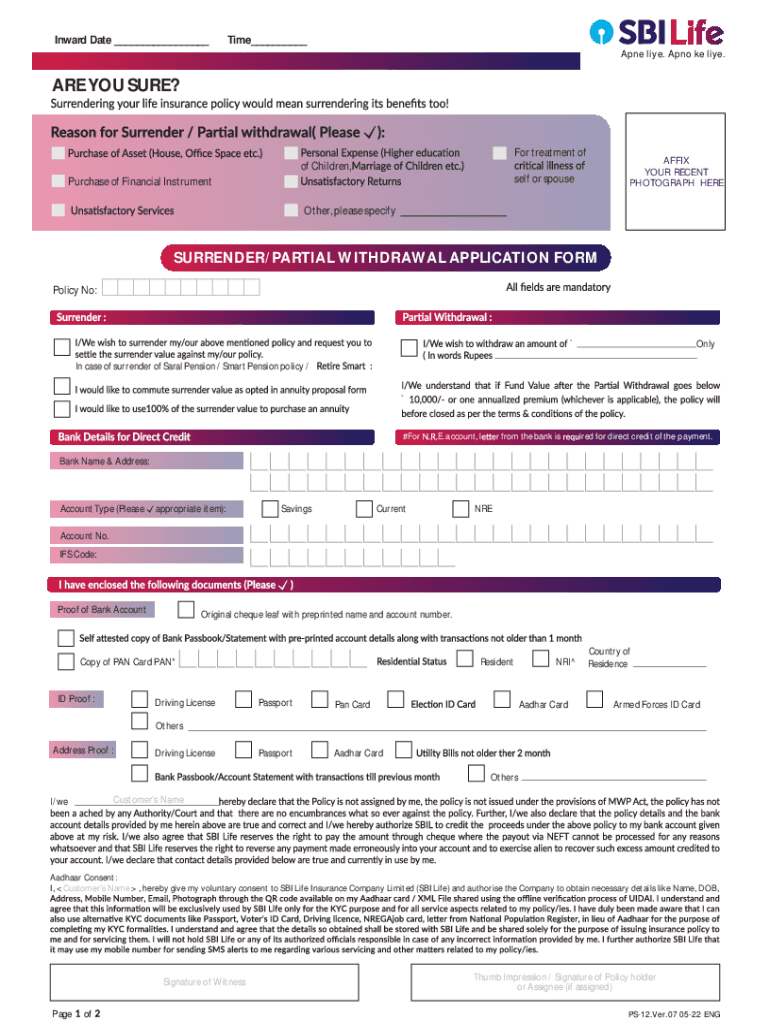

The "Surrender Partial Withdrawal Request Form Eng - sudlife" is primarily utilized by individuals who wish to initiate a surrender or partial withdrawal from their pension or life insurance policy with SUD Life, a reputable life insurance company. This form serves as an official application to either exit the policy entirely or withdraw a portion of the accrued funds, depending on the policyholder's needs. Understanding the purpose and specific use of this form is critical. It ensures that individuals accurately convey their intentions to the insurance provider, leading to prompt and appropriate processing.

Steps to Complete the Surrender Partial Withdrawal Request Form Eng - sudlife

Filling out the form involves several important steps that must be followed diligently:

-

Personal Details: Begin by entering your full name, policy number, and contact details. Ensure this information is correct to avoid delays.

-

Withdrawal Details: Specify whether you wish to surrender the policy or make a partial withdrawal. Indicate the amount if you choose a partial withdrawal.

-

Bank Information: Enter your bank account details, as this is where the funds will be transferred upon approval. Verify the account number and IFSC code for accuracy.

-

Consent & Declaration: Carefully read the consent section. Agree to the terms and provide your signature to authorize the process.

-

Attachments: Include relevant documents such as a copy of your ID and address proof, and any other supporting documentation required by SUD Life.

-

Submission: Once completed, submit the form through the designated channels, which could be online, by mail, or in person at a local branch.

How to Use the Surrender Partial Withdrawal Request Form Eng - sudlife

The process of utilizing this form effectively requires understanding its purpose and components:

- Purpose Alignment: Ensure that your need aligns with the options provided by the form; either full surrender or partial withdrawal of funds.

- Consultation: Consider consulting with a financial advisor to comprehend the implications of surrendering or withdrawing funds from your policy.

- Timeliness: Fill out and submit the form well in advance of any deadlines to avoid unnecessary complications or penalties.

Why Should You Surrender Partial Withdrawal Request Form Eng - sudlife

There are several compelling reasons why a policyholder might decide to use this form:

- Financial Needs: Unforeseen expenses or financial needs might necessitate accessing the funds in your policy.

- Policy Reassessment: Changes in life circumstances or financial goals may prompt a reassessment of your insurance needs.

- Benefit Utilization: Taking advantage of guaranteed returns or accrued bonuses by withdrawing part of the funds can be a strategic financial decision.

Key Elements of the Surrender Partial Withdrawal Request Form Eng - sudlife

Understanding the form's essential components is vital for accurate completion:

- Identification Sections: Personal and policy identification sections ensure the request is correctly matched to your account.

- Financial Fields: Sections that detail the financial aspects of the request, such as withdrawal amounts and bank information.

- Legal Confirmation: Areas requiring your consent and signature reflect the legal binding nature of the application.

Important Terms Related to Surrender Partial Withdrawal Request Form Eng - sudlife

Familiarity with key terms associated with this form enhances comprehension:

- Policy Surrender: Exiting the policy completely, which typically results in the termination of subsequent benefits.

- Partial Withdrawal: Removing a portion of funds without fully terminating the policy, allowing continued policy benefits.

- Consent: Your agreement and permission regarding the terms of fund withdrawal.

Legal Use of the Surrender Partial Withdrawal Request Form Eng - sudlife

Ensuring legal compliance is essential:

- Signature Requirement: The legally binding nature of your signature confirms your consent and agreement to the terms of withdrawal.

- Documentation Compliance: Ensure all attached documents, like identification and address proof, are valid and up-to-date to avoid legal discrepancies.

Required Documents

The form requires specific documents for successful processing:

- Identification Proof: A government-issued ID for identity verification.

- Address Proof: Documentation to substantiate your current address for record accuracy.

- Policy Documentation: Any prior communication or documents related to the policy or withdrawal request.

Form Submission Methods (Online / Mail / In-Person)

Depending on your preference or urgency, the form can typically be submitted through various channels:

- Online: Utilizing SUD Life's digital platform offers a fast and efficient method.

- Mail: Traditional mailing ensures a tangible record of submission but may take longer.

- In-Person: Visiting a local branch can provide immediate confirmation and assistance with form details.