Definition and Meaning of the Request for Withdrawal Form

The "Request for Withdrawal" form is utilized to formally initiate the process of withdrawing funds from various retirement plans managed by institutions like Manulife. It serves as an official document that captures all necessary details required to process a withdrawal request. This includes member information, withdrawal specifics, and authorization details.

- The form plays a key role in ensuring that permitted fund withdrawals are carried out in a structured manner, adhering to company protocols and legal requirements.

- It helps outline the important considerations such as associated fees and penalties, ensuring that all necessary data is available to proceed with the transaction without unnecessary complications.

Steps to Complete the Form

Completing the Request for Withdrawal form involves several specific steps to ensure accuracy and compliance with the required procedures:

-

Fill in Personal Information: Start by entering your full name, account number, and contact details. This section ensures that the request is properly attributed to the correct account holder.

-

Specify Withdrawal Details: Clearly indicate the amount you wish to withdraw and the retirement plan from which the funds should be deducted. Include any preferred payment methods or account details where the funds should be deposited.

-

Authorize the Request: Sign the designated authorization areas within the form to legitimize the transaction. Your signature acts as your commitment to undertaking the withdrawal and understanding the potential implications as outlined in the terms.

-

Submit Required Documentation: Attach any necessary supporting documents, such as identification or proof of account ownership, to comply with verification policies.

-

Review and Submit: Double-check all filled sections to ensure no information is omitted or inaccurate. Submit the completed form via the preferred channel, whether online, by mail, or in-person.

Importance of the Request for Withdrawal Form

The Request for Withdrawal form is critical for several reasons:

- Clarity and Organization: It provides a structured framework for capturing all relevant information necessary to process a withdrawal request efficiently.

- Compliance and Accountability: Ensures that all actions taken are in line with legal and organizational standards, maintaining compliance with financial regulations and avoiding potential legal conflicts.

- Security: Adds a level of security to the withdrawal process by authenticating the request through required signatures and verification documents.

Who Typically Uses This Form

Different individuals and organizations may use this form, each with specific motivations and needs:

- Retirees: Who require scheduled withdrawals for living expenses or other financial needs.

- Financial Advisors: Helping their clients manage retirement funds or make informed financial decisions.

- Corporate Account Managers: Overseeing employees' retirement plan management and processing pending withdrawal requests.

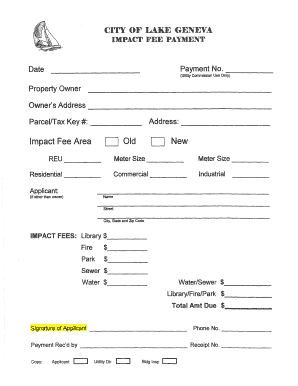

Key Elements of the Form

The form consists of several critical sections, each serving a distinct purpose in the request process:

- Member Information Section: Contains fields for entering the requesting party's personal details and identification numbers.

- Withdrawal Information Section: Requires the specification of the amount and type of withdrawal being requested.

- Authorization Area: Must be signed by the individual requesting the withdrawal to authenticate the process officially.

- Notes Section: Provides additional insights about potential fees, conditions, and helpful information to be aware of when withdrawing funds.

Legal Use of the Withdrawal Form

The form aligns with various legal stipulations that protect both the issuer and the requestor:

- ESIGN Act Compliance: Electronic submissions are legally binding, ensuring that online processing holds the same legal status as traditional paper submissions.

- Personal Data Protection: All personal information provided is handled with due regard for privacy and confidentiality, adhering to relevant laws such as data protection regulations.

Required Documents for Submission

Several documents might be necessary when submitting a Request for Withdrawal form to ensure the transaction is processed smoothly:

- Proof of Identity: Valid ID such as a driver’s license or passport.

- Plan Statements: Recent retirement plan statements for accuracy in reflecting the current balance and available funds.

- Authorization Documents: In cases where the request is submitted by a representative on behalf of the account holder, additional legal authorizations might be required.

Form Submission Methods

Submitting this form can typically be done through multiple channels, each with its own set of advantages:

- Online Submission: Offers the convenience of processing requests from anywhere with internet access, often supported by platforms like DocHub.

- Mail Submission: Provides a tangible record of the request, which might be preferred by some individuals.

- In-Person Submission: Ensures immediate verification and potentially faster processing times by directly meeting financial institution representatives.

Penalties for Non-Compliance

Understanding the consequences of failing to comply with the submission requirements is essential:

- Financial Penalties: Failure to comply with submission requirements might lead to delayed processing and possible financial penalties if funds are not withdrawn according to the stipulated conditions.

- Legal Repercussions: Non-compliance might further result in legal issues, especially if the withdrawal request conflicts with any plan-related agreements or terms of service.

Digital vs. Paper Version of the Form

With technological advancements, the form is available in both digital and paper formats to maximize accessibility and convenience:

- Digital Version: Offers the advantage of being easily accessible, editable, and shareable, enhancing efficiency and reducing processing time.

- Paper Version: Still available for those who prefer traditional submission methods or lack access to digital tools.