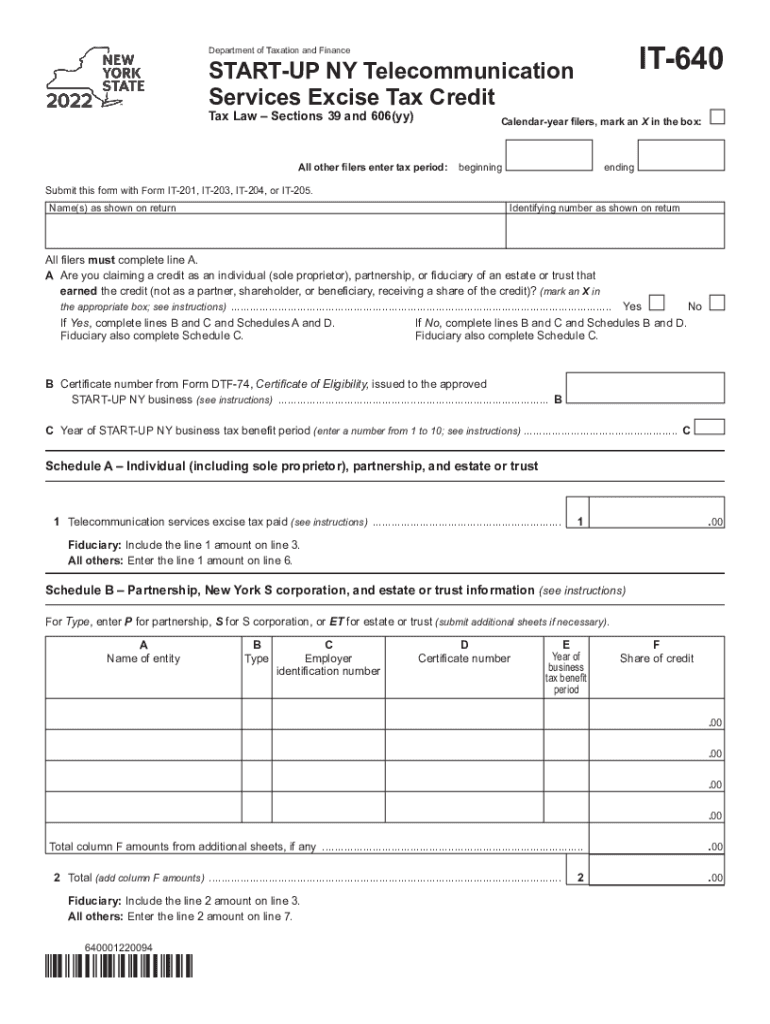

Definition & Meaning of Form IT-640

Form IT-640 is essential for businesses and individuals participating in the START-UP NY program to claim the Telecommunication Services Excise Tax Credit for the tax year 2022. This form helps filers report telecommunication services excise tax paid and calculate their eligible tax credits based on established criteria and schedules by the New York Department of Taxation and Finance. The design of Form IT-640 ensures the accurate evaluation of tax benefits associated with telecommunication services for businesses under the START-UP NY initiative.

Eligibility Criteria for Form IT-640

To utilize Form IT-640, businesses must meet specific eligibility requirements. Primary eligibility is reserved for companies involved in the START-UP NY program, which promotes business growth and job creation by providing tax incentives within designated areas in New York. Additionally, businesses must demonstrate that they have incurred excise taxes on telecommunication services. To confirm eligibility, companies should ensure alignment with the program's criteria and verify their participation in tax benefit periods as stipulated by the state regulations.

Common Eligibility Scenarios

- New Businesses: Often fresh startups within designated zones.

- Existing Companies with Expansion Plans: Firms expanding operations into eligible START-UP NY areas.

- Industry-Specific Businesses: Sectors that routinely encounter telecommunications excise taxes.

Key Elements of the Form IT-640

Understanding the core components of Form IT-640 is crucial for accurate filing. The form includes sections for:

- Identification: Essential details such as the business name, address, and taxpayer identification number.

- Certificate Numbers: Proper documentation regarding the business's approval and registration under the START-UP NY program.

- Tax Credit Calculation: Detailed schedules that guide taxpayers in calculating the precise amount of credit they are eligible to claim based on their telecom excise tax payments.

Certificate Numbers

These are unique identifiers provided to businesses approved for benefits under the START-UP NY program, which helps track and verify eligibility and credit claims.

Steps to Complete Form IT-640

Filing Form IT-640 requires careful attention to detail, ensuring all sections accurately reflect the business's tax situation:

- Gather Required Documents: Collect all necessary records on telecommunication services and excise taxes paid.

- Complete Basic Identification: Enter the business's legal name, address, and tax identification information.

- Input Certificate Information: Provide approved program certificate numbers for claiming tax benefits.

- Calculate Tax Credits: Use the provided schedules to determine the exact credit, filling in necessary details about excise taxes and applying the correct credit rate.

- Review and Submit: Double-check all entries for accuracy and completeness before submission.

Necessary Documents

Ensuring the availability of proper documentation is key to efficient form preparation. Important documents include:

- Telecom service invoices

- START-UP NY approval and certificate documentation

- Previous tax filings for consistency

How to Obtain Form IT-640

Form IT-640 can be accessed via the New York Department of Taxation and Finance's official website. Businesses may download the form directly in PDF format for digital completion or print it for manual entry. Additionally, paper forms can be requested from the department by mail or phone for those who prefer traditional submission methods.

Online Access

- Visit the Department of Taxation and Finance website.

- Navigate to the forms section and search for “IT-640”.

- Download the PDF to your computer.

Who Typically Uses Form IT-640

Participants in the START-UP NY program primarily use Form IT-640. This includes:

- Entrepreneurs and Startups: New companies looking to maximize tax incentives.

- Expanding Firms: Businesses growing into eligible geographic locations.

- Telecommunication-Heavy Industries: Firms with significant telecom expenditures.

Legal Use and Compliance for Form IT-640

To ensure compliance when using Form IT-640, businesses must align with New York State's tax regulations and program guidelines. The form must be accurately completed with verifiable information, as discrepancies can lead to audits or adjusted credits. Businesses should maintain thorough records of all filed tax documents and supporting materials.

Penalties for Non-Compliance

Failure to comply with the proper filling and submission of Form IT-640 can result in penalties such as disallowed tax credits, interest, and additional penalties levied by the Department of Taxation and Finance. Hence, businesses must adhere strictly to filing deadlines and ensure the accuracy of their tax credit claims to avoid potential legal and financial repercussions.