Definition & Meaning

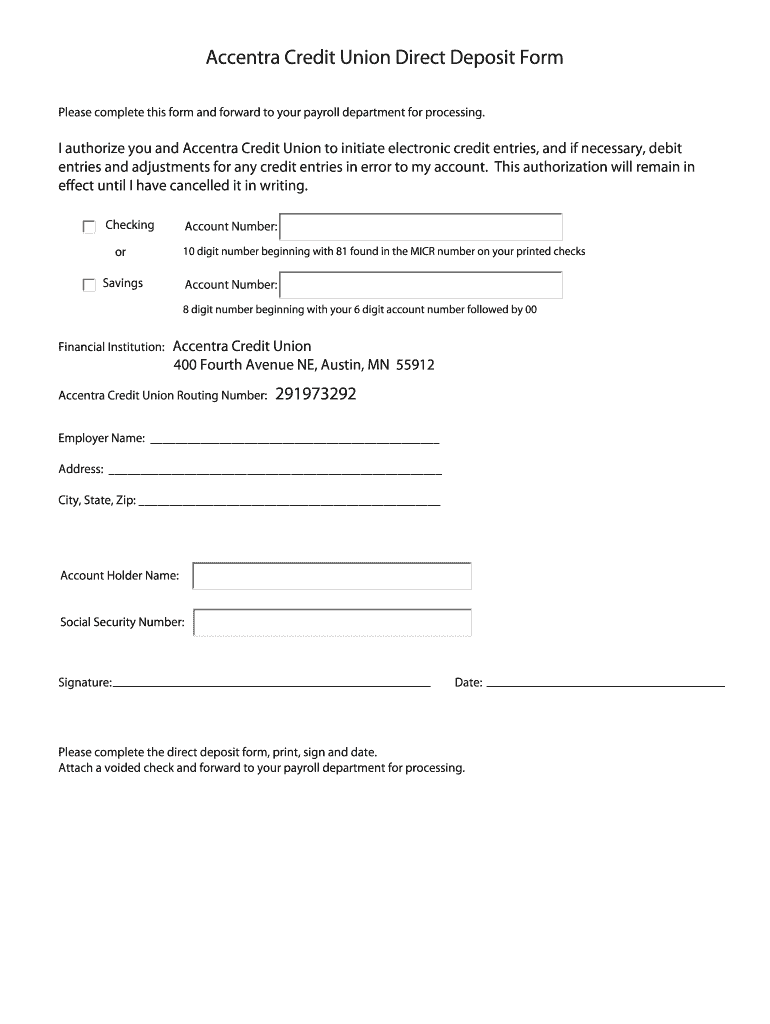

The Accentra Credit Union Direct Deposit Form is a financial document used to authorize electronic credit and debit entries to the account specified by the account holder. This form simplifies the process of receiving payments directly into your Accentra Credit Union account, eliminating the need for paper checks. It typically requires information such as the account holder's banking details, employer information, and personal identification. By submitting this form, you permit the automatic transfer of funds, whether from an employer for payroll purposes or from other income sources.

How to Obtain the Accentra Credit Union Direct Deposit Form

Accessing the Accentra Credit Union Direct Deposit Form can be achieved through several convenient methods:

- Online: You might find the form available for download on the official Accentra Credit Union website or through your online banking portal.

- In-Person: Visit a local Accentra Credit Union branch to obtain a physical copy of the form.

- Email or Mail Request: Contact Accentra's customer service to request a copy via email or have it mailed to your address.

These options provide flexibility, ensuring that account holders can easily access the form in their preferred manner.

Steps to Complete the Accentra Credit Union Direct Deposit Form

Filling out the Accentra Credit Union Direct Deposit Form correctly is crucial for a successful setup:

- Enter Personal Information: Fill in your name, address, and contact details accurately.

- Provide Account Details: Input your Accentra Credit Union account number and routing number.

- Employer Information: Include your employer's name and address, or details of another income source.

- Account Type Specification: Indicate whether the funds will be deposited into a checking or savings account.

- Signature and Date: Sign and date the form to authorize the direct deposit.

- Attach a Voided Check: Include a voided check to verify account details.

Ensure each section is completed accurately to avoid any processing delays or errors.

Key Elements of the Accentra Credit Union Direct Deposit Form

- Account Information: The form requires your account number and routing number to direct the deposit to the correct account.

- Authorization Signature: Your signature provides legal consent for electronic transactions.

- Employer Details: Necessary for setting up payroll deposits.

- Deposit Distribution: Options to specify multiple accounts for deposits, if applicable.

These elements are critical to the proper execution and processing of direct deposit arrangements.

Legal Use of the Accentra Credit Union Direct Deposit Form

Using the Accentra Credit Union Direct Deposit Form aligns with legal banking practices in the United States. It serves as a binding agreement for electronic fund transfers, governed by both federal and state regulations. It ensures compliance with the Electronic Fund Transfer Act (EFTA), which offers protection against unauthorized transactions. Users must be aware of their rights to report errors and dispute unauthorized transactions.

Who Typically Uses the Accentra Credit Union Direct Deposit Form

This form is primarily used by:

- Employees: For setting up direct deposit for payroll.

- Freelancers and Independent Contractors: To receive payments from clients.

- Retirees: Collecting pension or Social Security payments.

- Students: Receiving stipends or financial aid disbursements.

The form's versatility makes it applicable across various income situations, enhancing financial management and convenience.

Form Submission Methods

The method of submitting the Accentra Credit Union Direct Deposit Form can vary based on the institution's policies:

- Online Submission: Upload the completed form through the Accentra Credit Union's secure portal.

- In-Person Submission: Submit the form directly at a branch location.

- Mail Submission: Send the form via postal mail to the specified address on the form instructions.

Submission methods offer flexibility, catering to individual preferences for online or traditional approaches.

Penalties for Non-Compliance

Failing to comply with the proper submission or providing incorrect information on the Direct Deposit Form can lead to complications:

- Delayed Payments: Incorrect details can result in payment delays, impacting cash flow.

- Compliance Issues: Non-compliance with submission protocols might lead to additional verification requests or rejection of the form.

- Security Risks: Providing inaccurate banking details can increase security risks or unauthorized transactions.

Understanding and adhering to form requirements is crucial to avoid these potential pitfalls.