Definition & Meaning

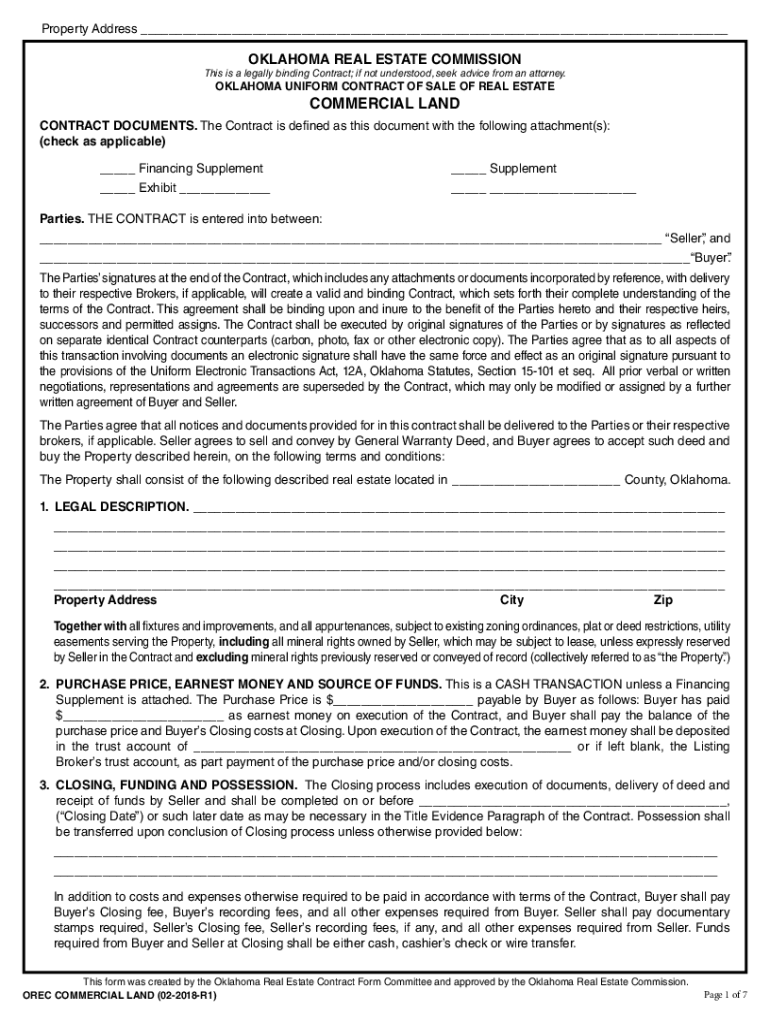

The Oklahoma Real Estate Commission (OREC) forms are standardized contractual documents used within the real estate industry in Oklahoma. These forms facilitate the negotiation and sale of real estate properties, ensuring that both buyers and sellers operate under consistent terms and conditions. They are commonly used in transactions involving various property types, such as residential, commercial, and vacant land. Using these standardized forms helps prevent misunderstandings and disputes by clearly outlining the rights and responsibilities of all parties involved.

Key Elements of the OREC Forms

OREC forms include several critical sections that ensure a seamless real estate transaction. Important components are:

- Property Description: This section provides a thorough description of the property, including its location, dimensions, and any relevant identifiers like parcel numbers.

- Purchase Price and Terms: Clearly lists the agreed-upon purchase price and any financial terms or conditions attached to the sale.

- Earnest Money: Details the amount of earnest money, its purpose, and how it will be handled.

- Closing Procedures: Outlines the steps to finalize the transaction, including expected timelines.

- Inspections and Contingencies: Lists any inspections needed and contingencies that must be satisfied before closing.

- Title Evidence: Specifies the requirements for proving ownership, ensuring the buyer obtains clear title to the property.

- Breach of Contract Provisions: Details the consequences if either party fails to fulfill contractual obligations.

Steps to Complete the OREC Forms

Completing OREC forms requires meticulous attention to detail:

- Gather All Necessary Information: Include all relevant property details, financial terms, and personal information of buyers and sellers.

- Complete Each Section Accurately: Fill out each section, such as property description, financial terms, and any contingencies.

- Review Terms and Conditions: Carefully review all conditions and ensure they reflect the agreed-upon terms of the transaction.

- Seek Legal Advice if Needed: Consult an attorney specializing in real estate law to ensure all contractual obligations are clear and enforceable.

- Obtain Approval from All Parties: Both the buyer and seller must review the completed form and agree to all terms before signing.

- Sign the Document: All involved parties should sign to confirm their acceptance and agreement to the terms outlined in the form.

Legal Use of the OREC Forms

OREC forms are legally binding documents once all parties involved sign them. They serve as an official record of the real estate transaction and detail each party's rights and responsibilities. It is crucial for both buyers and sellers to understand the implications of the form before signing, as failure to comply with any section could result in legal consequences. These forms also align with state-specific real estate laws, ensuring compliance with Oklahoma regulations.

Important Terms Related to OREC Forms

Several terms repeatedly appear in OREC forms and are key to understanding their use:

- Contingency: A condition or requirement set in the contract that must be met for the sale to proceed.

- Earnest Money: A deposit made to demonstrate the buyer's seriousness about purchasing the property.

- Title Evidence: Documentation proving the seller's legal ownership of the property.

- Closing Costs: Expenses associated with finalizing the real estate transaction, often split between the buyer and seller.

State-Specific Rules for the OREC Forms

OREC forms are specifically designed to comply with Oklahoma state laws governing real estate transactions. They integrate state-specific rules that might not be applicable in other jurisdictions. For example, Oklahoma law may have unique stipulations regarding disclosure requirements, earnest money handling, or title insurance specifics. Utilizing these forms ensures that all transactions are conducted within the framework of state legal standards.

How to Use the OREC Forms

Using OREC forms involves several straightforward steps:

- Access the Forms: Obtain the most current version of the forms through the Oklahoma Real Estate Commission's official website or partnering real estate agencies.

- Understand Each Section: Familiarize yourself with each part of the form and what it requires you to fill out.

- Collaborate with a Real Estate Agent: Working with a licensed real estate agent can aid in correctly completing the form.

- Ensure All Information is Accurate: Double-check all entries for accuracy to avoid any potential issues during the transaction.

- File and Store Copies Safely: Once completed and signed, store copies securely for future reference and legal protection.

How to Obtain the OREC Forms

OREC forms are readily available online and can be accessed by visiting the Oklahoma Real Estate Commission's official website. Licensed real estate agents often provide these forms, ensuring they are the latest approved versions. You may also access them through various real estate platforms that offer a suite of tools for document management. It's crucial to verify that you're using current versions to ensure compliance with any updates in state regulations.

Who Typically Uses the OREC Forms

OREC forms are predominantly used by real estate agents, brokers, buyers, and sellers involved in property transactions in Oklahoma. Real estate professionals rely on these forms to provide clients with secure, standardized agreements. While primarily used in professional transactions, individuals conducting private sales may also utilize these forms to ensure their sale adheres to state regulations and to streamline the process.

Tips for Ensuring a Smooth Transaction

To facilitate a smooth real estate transaction using OREC forms:

- Double-Check All Details: Ensure all information entered is complete and correct, avoiding potential disputes.

- Maintain Open Communication: Keep all parties informed throughout the process to mitigate any misunderstandings.

- Standardize Procedures: Use the standard form to promote consistency and fairness in transactions.

- Stay Updated: Keep track of any changes in state laws or updates to the forms to maintain compliance.