Definition and Purpose of NYC S 2021

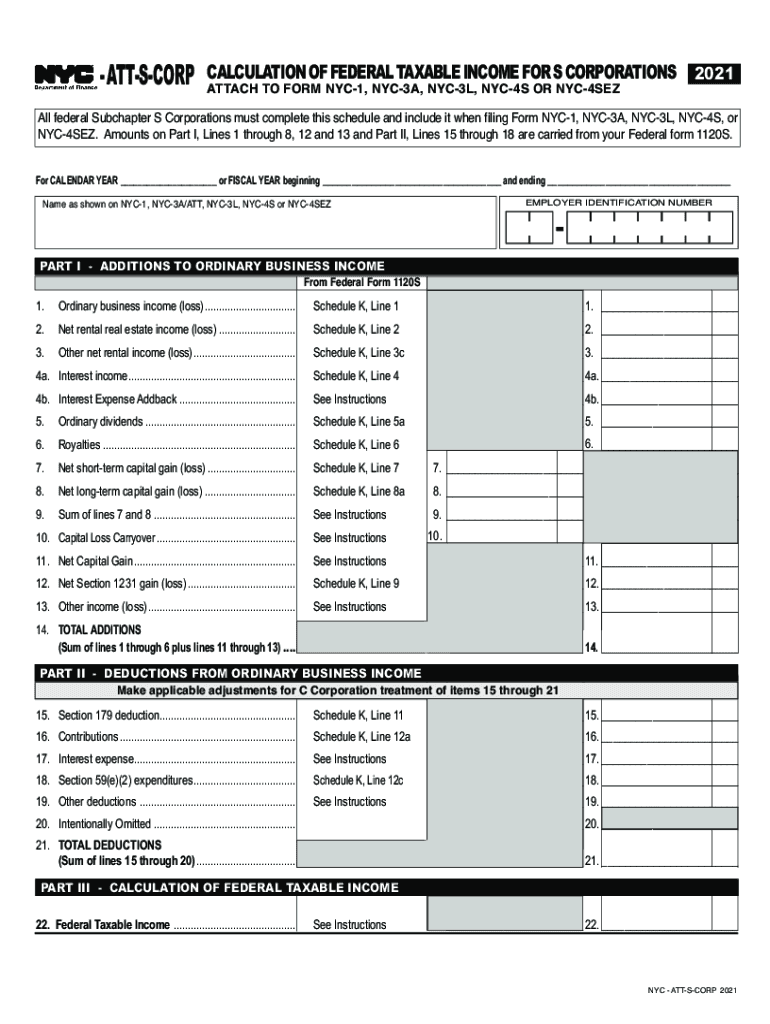

The NYC S 2021 form is specifically designed for S Corporations operating within New York City. It plays a critical role in determining the federal taxable income that such corporations must report for the tax year 2021. The form outlines the methodology for calculating taxable income by incorporating various additions and deductions to ordinary business income. This comprehensive guide is essential for ensuring compliance with federal tax regulations and accurately reporting income and deductions.

Components of the Calculation

- Additions to Income: The form provides detailed instructions for adding specific income items that may not initially appear in the business's ordinary income.

- Deductions from Income: S Corporations must also follow guidelines for subtracting allowable deductions, ensuring an accurate taxable income calculation.

- Final Calculations: The form assists in arriving at the federal taxable income after considering all additions and deductions, which becomes critical for accurate tax filing.

How to Use the NYC S 2021 Form

Filing the NYC S 2021 requires a nuanced approach, starting with understanding the structure of the form and its required entries.

Steps for Effective Use

- Familiarize with the Form: Begin by reviewing the form to understand its sections and the information required.

- Gather Necessary Data: Collect all relevant financial documents, including income statements and records of allowable deductions.

- Complete the Form: Follow the instructions to accurately input data, ensuring each section aligns with the business's financial records.

- Review for Accuracy: Double-check calculations and entries to prevent errors that could affect compliance.

Steps to Complete the NYC S 2021

Completing the NYC S 2021 form requires careful attention to detail and methodical completion of each field.

Detailed Step-by-Step Process

- Reading Instructions: Before filling out the form, thoroughly read the accompanying instructions to ensure understanding of each line item.

- Inputting Information: Begin entering required data, starting with general information about the S Corporation and moving through specific financial calculations.

- Calculating Additions and Deductions: Carefully calculate both additions to and deductions from ordinary income, using additional schedules if necessary.

- Finalizing the Form: Ensure that all sections are complete and verify final calculations before submission.

Required Documents for Filing

Completing the NYC S 2021 form necessitates a comprehensive collection of supporting documents.

Key Documents Include:

- Income Statements: Detailed records of income accrued during the fiscal year.

- Expense Receipts: Documentation of deducted expenses to facilitate accurate deduction claims.

- Prior Year Tax Returns: Reference for any carryovers or consistent items from previous filings.

Digital vs. Paper Submission

Corporations have several options for submitting the NYC S 2021, each with its advantages.

Submission Choices

- Digital Submission: Allows for quicker processing times and immediate confirmation of receipt. Ideal for those familiar with online tax platforms.

- Paper Submission: Traditional method that some may prefer due to its tangible nature, though it often involves longer processing times.

IRS Guidelines and Compliance

Adhering to IRS guidelines when using the NYC S 2021 form is paramount for avoiding compliance issues.

Essential IRS Rules

- Timely Filing: Ensure submission by the specified deadline to avoid penalties.

- Accurate Reporting: Maintain integrity by accurately reporting income and deductions, as errors can lead to audits or penalties.

Penalties for Non-Compliance

Failure to properly complete the NYC S 2021 can result in severe repercussions.

Consequences of Errors

- Financial Penalties: Inaccuracies can lead to fines or additional interest charges on overdue taxes.

- Legal Repercussions: Serious discrepancies may result in audits or legal action from tax authorities.

Business Entity Types Suited for the Form

The NYC S 2021 is particularly relevant to certain business structures within New York City.

Applicable Entities

- S Corporations: Specifically designed for these entities, given their unique tax implications and reporting requirements.

- LLCs Filing as S Corporations: LLCs electing to be taxed under Subchapter S must also complete this form accurately.

By following these guidelines and understanding the detailed requirements of each section, businesses can ensure compliance and accurate reporting using the NYC S 2021 form.