Definition and Meaning of S Corporation Tax Forms

S corporation tax forms are critical documents used by S corporations to report financial activity to tax authorities such as the IRS and state tax departments. These forms help determine the appropriate tax liability based on the corporation's income, deductions, and credits. In the U.S., S corporations pass corporate income, losses, deductions, and credits through to shareholders for federal tax purposes. Unlike traditional corporations, S corporations avoid double taxation on the corporate income. These forms assist in calculating each shareholder’s share of the income or loss to be reported on their individual tax returns.

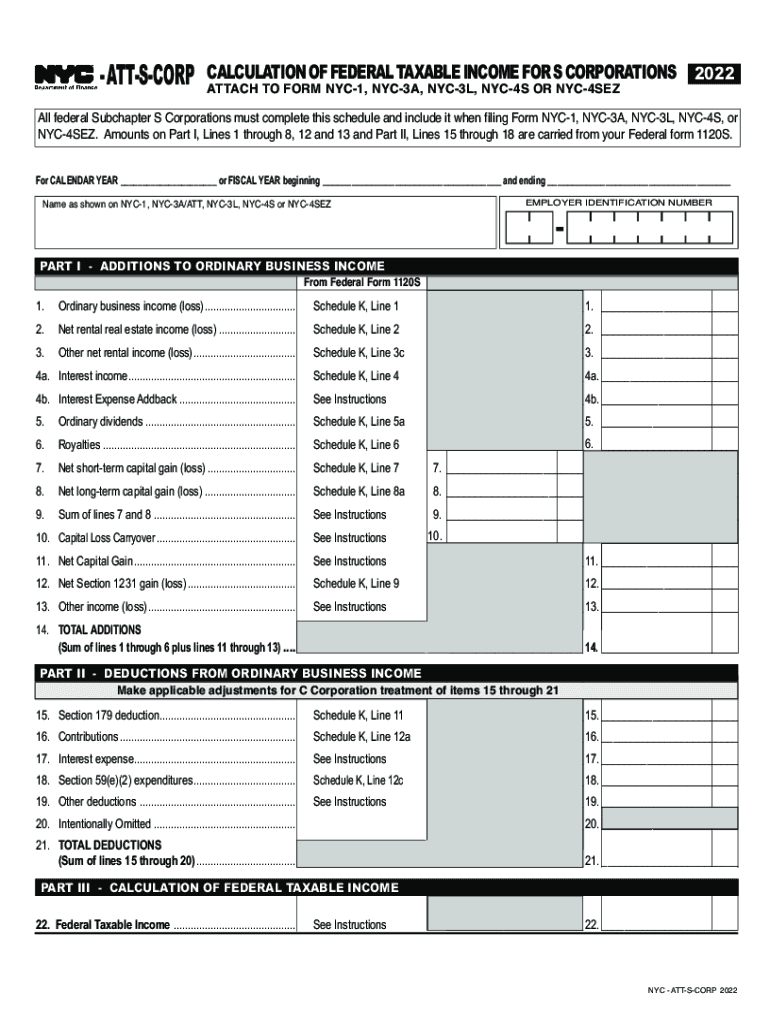

Key Elements of S Corporation Tax Forms

Understanding the key components of S corporation tax forms is crucial for proper compliance. The forms typically include:

- Income Statement: Identifies gross receipts and sales, cost of goods sold, and overall earnings.

- Deductions and Credits: Provides sections for listing business expenses and tax credits that reduce taxable income.

- Schedule K-1: Reports each shareholder’s share of income, deductions, and credits, required for individual tax returns.

- Balance Sheet: Important for presenting the company’s financial position at the end of the tax year.

Steps to Complete S Corporation Tax Forms

Completing S corporation tax forms requires careful attention to detail. The process includes:

- Gather Information: Collect financial records, including income statements, balance sheets, and shareholder details.

- Complete Form 1120S: Fill out this primary IRS form for S corporation income reporting. Include details about income, expenses, and net earnings.

- Prepare Schedule K-1: Allocate income and deductions to shareholders based on their ownership percentage.

- Review State Requirements: Ensure compliance with specific New York City tax filings and any additional state forms.

- Assure Accuracy: Double-check all entries for mathematical and typographical errors.

Software Compatibility

Using tax software like TurboTax or QuickBooks can simplify the filing process. These platforms often support e-filing of Form 1120S and provide guidance on state-specific requirements, ensuring the accuracy and efficiency of submissions.

Who Typically Uses S Corporation Tax Forms

Primarily, business owners of smaller, closely-held corporations use S corporation tax forms. These businesses often elect S corporation status to benefit from pass-through taxation, where income is taxed at the shareholder level, avoiding double taxation common with C corporations. Owners of LLCs that have elected to be taxed as S corporations also utilize these forms.

Business Types that Benefit Most

- Family-owned Businesses: Can leverage tax advantages while maintaining control over distributions.

- Professional Services Firms: Such as legal or medical practices where ownership is restricted to licensed professionals.

- Any Scalable Business: That qualifies for S corporation status and seeks simplified tax structuring.

Legal Use of the S Corporation Tax Forms

The use of S corporation tax forms must comply with legal stipulations under the IRS regulations. Proper completion is essential for:

- Verification of Corporate Eligibility: The corporation must meet eligibility criteria such as having no more than 100 shareholders and only one class of stock.

- Adherence to Deadline and Filing Requirements: Forms must be filed by March 15th, or a six-month extension must be requested to avoid penalties.

IRS Guidelines and Filing Deadlines

The IRS provides explicit instructions for completing S corporation tax forms, including guidelines for calculating various financial metrics critical for tax liability assessment. Adhering to these guidelines helps avoid misreporting and potential audits. Key deadlines are:

- Annual Filing Date: March 15 for calendar-year corporations.

- Extension Availability: Form 7004 can be filed to request a six-month extension.

State-Specific Rules for New York

New York has unique filing requirements that S corporations operating within the state must adhere to. These may include additional forms and schedules specific to New York State and New York City taxes. Corporations are required to report:

- New York Modifications: Adjustments to federal income calculations specific to state tax law.

- State-Level Credits: Including those related to employment, research, and investments that differ from federal credits.

Penalties for Non-Compliance

Failure to comply with filing requirements for S corporation tax forms can lead to penalties. Common issues include:

- Late Filing: Results in substantial daily fines automatically after the March deadline.

- Incorrect Form Submission: May lead to additional taxes and interest on underpayments.

- Inaccurate Information: Can trigger IRS audits resulting in further fines and potential legal action.

Understanding these elements of S corporation tax forms is essential for accurate and compliant tax reporting. Each section of the forms contributes to a clear documentation of the corporation's financial activity, ensuring legal compliance and optimized tax outcomes.