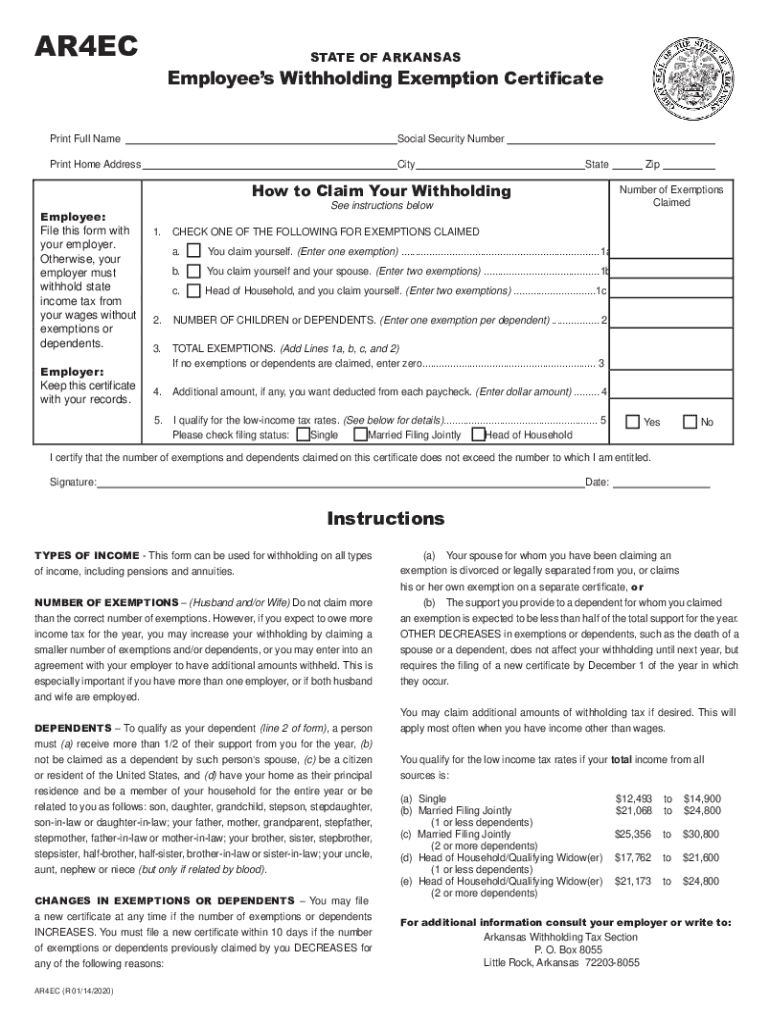

Definition & Purpose of Arkansas Employee Withholding Form

The Arkansas Employee Withholding Form is a crucial document used by employees within the state of Arkansas to specify the amount of state income tax to be withheld from their wages. It serves as an Employee's Withholding Exemption Certificate and is essential for both employees and employers. The primary function of this form is to allow employees to claim exemptions and dependents. This ensures that the correct amount of state income tax is deducted from the employee's paycheck, in line with their tax obligations and personal circumstances.

Key Elements of the Form

The Arkansas Employee Withholding Form includes several vital components. These elements facilitate accurate tax withholding:

- Personal Information: Employees must provide their full name, social security number, and home address.

- Filing Status: The form requires employees to indicate their filing status, which impacts tax withholding. Common options include single, married, or head of household.

- Exemptions and Dependents: Employees can claim personal exemptions and list qualifying dependents. This section is critical for adjusting the amount of tax withheld.

- Additional Withholding Amounts: Employees have the option to request additional amounts to be withheld from their paycheck, above the standard calculations, to account for other income or tax considerations.

Steps to Complete the Arkansas Employee Withholding Form

Filling out the Arkansas Employee Withholding Form necessitates careful attention to detail. Here is a step-by-step guide on completing it:

- Gather Required Information: Start by collecting your social security number, home address, and the number of exemptions or dependents you plan to claim.

- Enter Personal Details: Fill in your name, address, and social security number in the designated fields.

- Select Filing Status: Indicate your filing status (single, married, etc.) on the form.

- Calculate Exemptions: Determine the number of personal exemptions and dependents you are eligible to claim.

- Enter Additional Withholding Amounts: If needed, specify any extra amount you would like to be withheld from your wages.

- Review and Sign: Examine the completed form for accuracy, then sign and date it before submitting it to your employer.

How to Obtain the Arkansas Employee Withholding Form

The easiest method for obtaining the Arkansas Employee Withholding Form is through the online portal of the Arkansas Department of Finance and Administration. Alternatively, employers typically provide this form to new employees during the onboarding process. Employees can also visit their local tax offices to collect a physical copy if needed.

State-Specific Rules for the Arkansas Employee Withholding Form

Arkansas imposes certain state-specific rules regarding employee withholding:

- Employers are mandated to observe the withholding instructions provided by employees, assuming the form is completed accurately.

- Changes to filing status or the number of exemptions must be updated promptly to avoid discrepancies in tax withholding.

- Non-compliance or failure to submit the form may result in the employer applying default tax rates, potentially leading to insufficient withholding and future tax liabilities for employees.

Who Typically Uses the Arkansas Employee Withholding Form

The Arkansas Employee Withholding Form is used by a diverse range of employees across the state, including:

- Full-time and part-time employees: Those engaged in employment with steady or variable incomes, impacted by state withholding requirements.

- New employees: Individuals who are newly hired must complete the form to establish their withholding preferences.

- Employees experiencing life changes: Those who undergo significant life events, such as marriage, divorce, or the birth of a child, may need to update their withholding information accordingly.

Important Terms Related to the Arkansas Employee Withholding Form

Several terms are essential for understanding this form:

- Exemption: A deduction that reduces per-day taxable income, affecting the total amount withheld from wages.

- Dependent: Typically a qualifying child or relative who relies on the employee's financial support, influencing exemption calculations.

- Withholding Tax: The wage tax retained by an employer on behalf of the employee, remitted to the state to cover future tax liabilities.

Legal Use of the Arkansas Employee Withholding Form

The legal use of this form ensures compliance with state tax laws:

- Completing the form accurately and truthfully is a legal responsibility for employees.

- Employers must comply with the form's stipulations, applying the specified withholdings.

- Failure to adhere to legal standards can result in penalties for both employees and employers, emphasizing the importance of this document in maintaining lawful tax practices.

Filing Deadlines and Important Dates

It is crucial to adhere to filing deadlines associated with the Arkansas Employee Withholding Form to ensure proper tax management:

- Initial Submission: Employees should submit the form at the start of their employment or as soon as changes in exemptions are necessary.

- Annual Updates: It is advisable to review and, if necessary, update the form annually, especially due to changes in tax laws or personal circumstances.

- Immediate Corrections: Any errors or omissions should be corrected immediately to avoid under-withholding and potential tax penalties.

These sections collectively provide comprehensive coverage of the Arkansas Employee Withholding Form, offering a thorough understanding of its usage, requirements, and implications.