Definition and Importance of the BPI Manager's Check Form

The BPI manager's check form is a vital financial instrument used for secure transactions, particularly when large sums of money are involved. This specialized check is issued by a bank manager, ensuring that the funds are guaranteed by the bank itself. Unlike personal checks, which carry the risk of insufficient funds, a manager's check holds intrinsic security, making it a preferred method for various banking services.

Key Purposes of the BPI Manager's Check Form

- Guaranteed Funds: A manager's check is backed by the bank, ensuring that it is a risk-free form of payment for the recipient.

- Wide Usability: It serves multiple financial needs, including payments for real estate transactions, major purchases, and settling debts efficiently.

- Easier Transactions: Businesses and individuals often choose manager's checks over cash for larger transactions to keep a clear paper trail while minimizing potential theft or fraud.

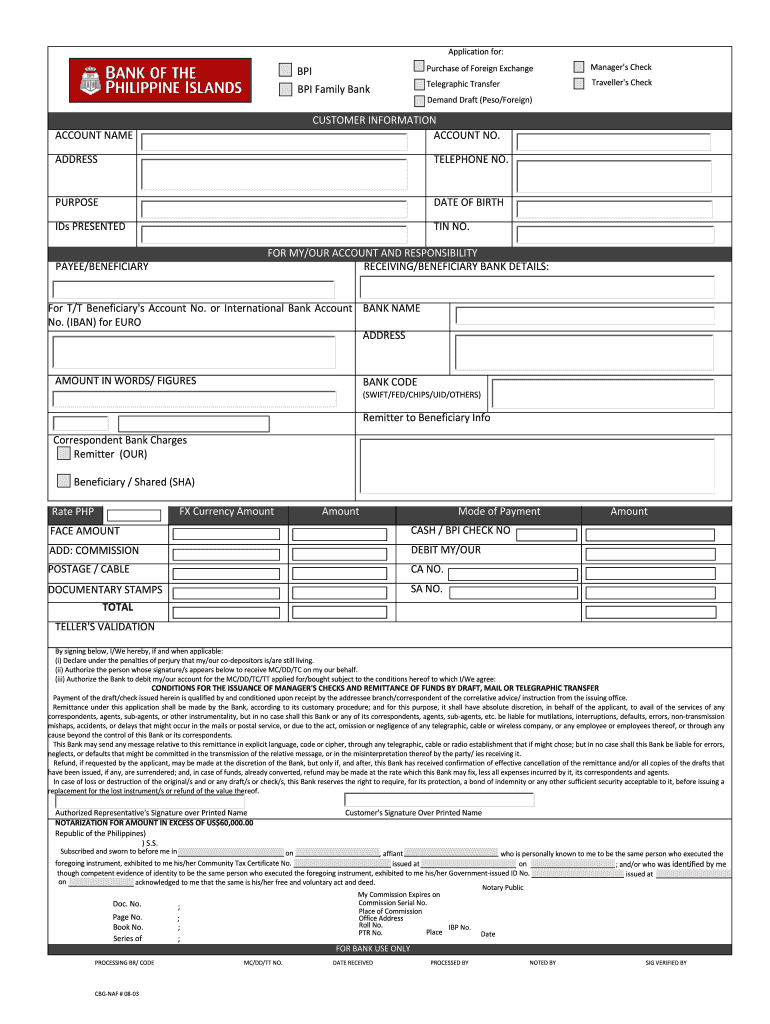

Steps to Complete the BPI Manager's Check Form

Completing the BPI manager's check form effectively is crucial for ensuring your transaction proceeds without delays. The following steps outline the process:

-

Gather Required Information: Before filling out the form, collect all necessary details such as the recipient’s name, the amount to be issued, and any specific purpose for the check.

-

Fill in Account Details: Include your BPI account number from which the funds will be drawn. This is essential for the bank to verify available funds.

-

Specify Payment Amount: Clearly write the amount in numerical format and spell it out in words to eliminate any confusion.

-

Provide Transaction Purpose: Articulate the reason for issuing the check, as this may be necessary for record-keeping both for you and the bank.

-

Submit the Form for Processing: Once completed, submit the form in-person at a BPI branch or through designated banking methods as stated by the bank, along with any required forms of identification.

Important Considerations During Completion

- Accuracy is Key: Incorrect details can lead to delays or complications in processing the check. Always double-check entries for errors.

- Identification Requirements: Be prepared to present valid identification, as the bank will require this for verification at the time of submission.

Important Terms Related to the BPI Manager's Check Form

Understanding the terminology related to the BPI manager's check form can enhance your ability to navigate the financial landscape effectively. Here are several essential terms:

- Payee: The individual or entity designated to receive the funds indicated on the check.

- Drawer: The account holder (you) who initiates the check, and whose funds will be used to fulfill it.

- Endorsement: The process of signing the back of the check by the payee to authorize the transfer of funds.

- Payment Order: A formal request made to the bank to fulfill the check’s terms as specified by the drawer.

Legal Use of the BPI Manager's Check Form

The BPI manager's check form serves as a binding legal document under U.S. law. Its acceptance is largely due to the financial guarantees it provides, which are recognized in various legal contexts. Key legal uses include:

-

Business Transactions: Often utilized for business dealings where reliable payment methods are necessary to maintain professional trust.

-

Contractual Obligations: The check can serve as a form of settlement in agreements, ensuring all parties fulfill their financial commitments.

Compliance with Banking Regulations

- FDIC Insurance: The funds held in manager's checks may be eligible for FDIC coverage, providing additional security for recipients.

- Anti-Money Laundering: Banks are required to adhere to AML regulations during issuance and acceptance, ensuring that transactions are legitimate.

Who Typically Uses the BPI Manager's Check Form?

The BPI manager's check form is frequently utilized by various groups and individuals:

- Homebuyers: Individuals engaged in real estate transactions commonly prefer using manager's checks for down payments to streamline the process.

- Businesses: Corporations may issue manager's checks for larger payments such as vendor invoices, ensuring prompt and secure transactions.

- Legal Professionals: Attorneys often use manager's checks in the settlement of cases where precise financial transactions are necessary.

Typical Scenarios for Use

- Real Estate Closings: A manager’s check is often required to close the sale of a property.

- Business Transactions: A business might use a manager's check to pay for equipment or services, providing assurance to suppliers.

How to Obtain the BPI Manager's Check Form

Acquiring the BPI manager's check form is straightforward:

-

Visit a BPI Branch: The most direct method is to visit your local BPI branch, where you can request the form in person.

-

Downloadable Forms: BPI customers can also access and download the form from the official BPI website. Ensure you have the latest version to avoid any discrepancies.

-

Customer Service: Calling BPI's customer service may provide alternative ways to obtain the form or clarify any requirements that may be specific to your situation.

Tips for Efficient Form Acquisition

- Check Availability: Calling ahead to confirm the form's availability at your chosen branch can save time.

- Be Prepared with Information: Have your account details handy to facilitate the process when requesting the form.