Definition and Meaning of State Tax Exemption Forms

State tax exemption forms are official documents used to declare an individual's or organization’s eligibility for tax exemptions under specific state laws. These forms essentially allow eligible taxpayers to claim certain deductions, waivers, or reductions in state taxes owed. The precise requirements and the allowed exemptions can vary significantly from state to state, necessitating a clear understanding of the specific terminologies and guidelines associated with each form.

Typically, state tax exemption forms are employed by businesses, educational institutions, and non-profit organizations seeking to minimize their tax burdens legally. For example, a non-profit organization may utilize a state tax exemption form to avoid sales tax on purchases made for its charitable activities. Clearly outlining the eligibility and the reasons for requesting the exemption is essential to the effective use of these forms.

How to Obtain State Tax Exemption Forms

Acquiring state tax exemption forms can entail various approaches depending on the state in question. Many states provide these forms through their official tax department websites, where they are typically available for download as PDF files. Such online accessibility allows taxpayers to obtain up-to-date versions of the necessary forms without any hassle.

Additionally, taxpayers can request physical copies directly from state tax offices. It is advisable to also check local government offices, as some municipalities may have specific forms or additional documentation requirements. Engaging with a tax professional can provide clarity on which forms are required and whether any state-specific protocols must be followed.

Steps to Complete State Tax Exemption Forms

Filling out state tax exemption forms can entail several distinct steps, which often include:

-

Identify the Correct Form: Ensure you have the appropriate state tax exemption form corresponding to your specific exemption reason.

-

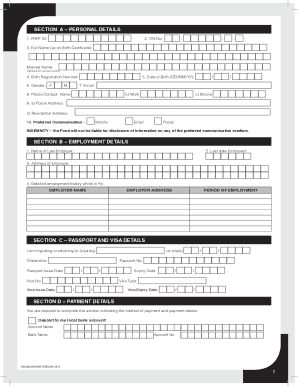

Provide Business Information: Fill in details about the organization or individual requesting the exemption. This may include name, address, and tax identification number.

-

Declare Exemption Reason: Clearly state the basis for seeking the exemption, what category it falls under, such as non-profit status or specific business activities that qualify for tax relief.

-

Collect Supporting Documents: Attach any needed documentation that substantiates the claim for exemption. This could comprise financial records, organizational bylaws, or proof of non-profit status.

-

Review and Submit: Double-check all entered information for accuracy, ensuring compliance with state requirements before submitting the form through designated channels (online, mail, or in person).

Key Elements of State Tax Exemption Forms

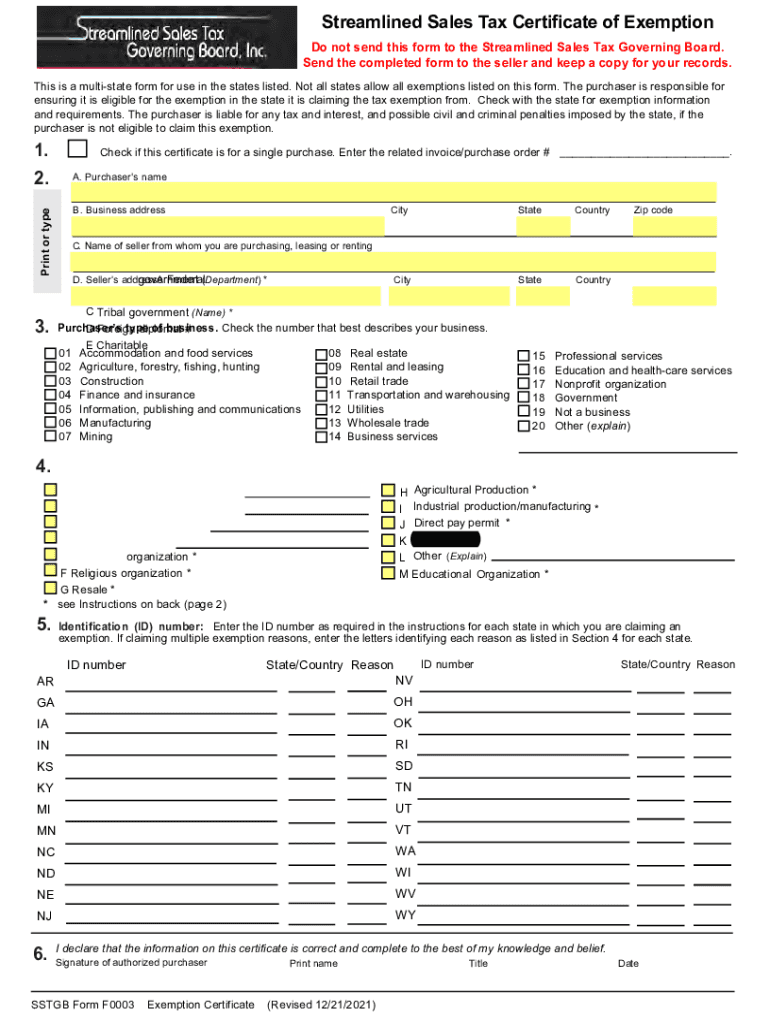

State tax exemption forms often encompass several critical elements designed to substantiate each exemption claim:

-

Applicant Information: Contact details of the individual or organization applying for the exemption.

-

Taxpayer Identification Number: This is crucial for linking the exemption request to the appropriate tax records.

-

Reason for Exemption: A section documenting the specific reason for the exemption request, which should align with state tax laws.

-

Signature and Date: This confirms the authenticity of the claim and the applicant's acknowledgment of the penalties for false information.

-

Instructions for Submission: Directions outlining how and where to file the completed form.

Ensuring complete and accurate information in each of these sections is vital to avoid delays or rejections.

Important Terms Related to State Tax Exemption Forms

Understanding the terminology connected to state tax exemption forms is essential for successful completion and compliance. Key terms include:

-

Exemption Certificate: A document verifying that a purchaser qualifies for exempt status on purchases, often required by sellers for sales tax purposes.

-

Eligibility Criteria: The specific guidelines detailing who qualifies for tax exemptions, varying from non-profit organizations to specific classes of businesses.

-

Non-compliance Penalties: Consequences for failing to adhere to state guidelines or improperly claiming exemptions, which can include fines or back-tax assessments.

-

Tax Identification Number: A vital identifier for entities that file taxes, necessary for all exemption claims.

Familiarizing yourself with these terms can greatly enhance clarity throughout the process.

Examples of Using State Tax Exemption Forms

State tax exemption forms find diverse applications across various sectors. For instance, a non-profit educational institution may utilize these forms to avoid state sales tax on purchasing educational materials necessary for their programs. Similarly, a manufacturer may apply for a sales tax exemption on equipment purchases used directly in the production process to facilitate business operations.

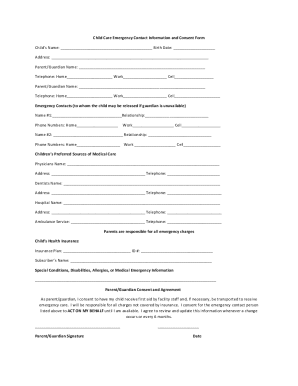

Consider the case of a small business applying for a tax exemption due to its non-profit status. They would need to fill out the appropriate exemption form, provide their tax ID, and attach proof of non-profit status. This process allows the business to purchase supplies without incurring sales tax, effectively reducing overhead costs.

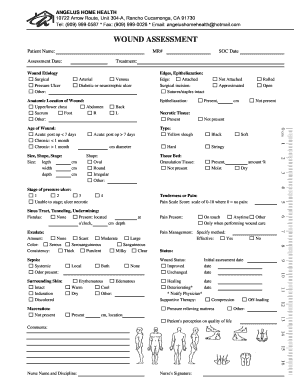

Another example involves a healthcare institution that can claim exemptions related to medical supplies and equipment under specific state guidelines. By leveraging state tax exemption forms properly, the institution can allocate more resources toward patient care.

State-Specific Rules for State Tax Exemption Forms

Each state possesses distinct regulations regarding tax exemption forms, which dictate eligibility criteria, required documentation, and submission guidelines. For instance, some states may require additional documentation to prove exemption eligibility, while others operate with a more streamlined process.

In states like California, businesses must provide additional proof, such as their IRS designation as a 501(c)(3) charity, when claiming non-profit status. In contrast, states like Texas may have a more lenient submission protocol, requiring fewer supporting documents for exemption claims.

It is vital for individuals or organizations to familiarize themselves with their specific state's rules and to consult official state tax websites or resources to ensure compliance with these varying regulations. Keeping abreast of any changes in state tax laws is also crucial, as tax exemptions and requirements can evolve.