Definition & Meaning

A Limited Power of Attorney (LPOA) is a legal document that grants a designated individual, known as the attorney-in-fact, specific authority to act on behalf of the principal within Montana. Unlike a general power of attorney, which grants broad powers, an LPOA delineates particular actions the attorney-in-fact may undertake. This targeted delegation often includes responsibilities such as managing certain financial accounts, signing particular real estate documents, or conducting specific legal transactions. The document allows for precise control, thus safeguarding the principal’s interests by limiting the scope of authority. This delineation ensures clarity in roles and responsibilities, minimizing potential misuse of power.

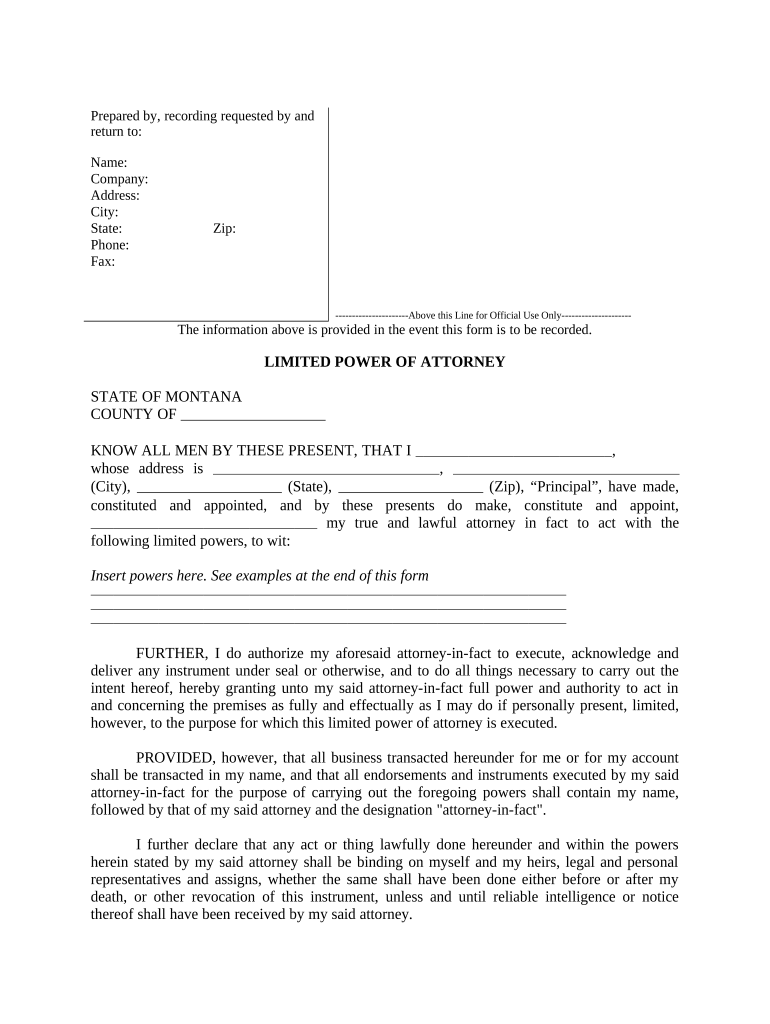

Key Elements of the Limited Power of Attorney

The Limited Power of Attorney in Montana comprises several critical sections:

- Principal’s Details: Includes full legal name, address, and contact information.

- Attorney-in-Fact Information: The appointed person’s name, address, and contact numbers.

- Specific Powers Granted: Explicitly defines what actions the attorney-in-fact is authorized to perform, such as selling property, managing bank accounts, or handling tax returns.

- Effective Date and Duration: States when the LPOA comes into effect and its expiration date, ensuring the attorney-in-fact understands the period of authority.

- Revocation Clause: Describes the principal’s right to revoke the LPOA at any time, providing flexibility and control over the delegation.

These elements collectively define the framework of authority and operational boundaries within which the attorney-in-fact operates.

Steps to Complete the Limited Power of Attorney

Creating a Limited Power of Attorney in Montana involves several steps:

- Draft the LPOA Document: Begin with a template that matches Montana state requirements, ensuring it includes all necessary sections.

- Detail Specific Powers: Clearly list all the specific powers being granted, ensuring there is no ambiguity about the attorney-in-fact’s role.

- Designate the Attorney-in-Fact: Provide detailed information about the person receiving the power, including full name and contact details.

- Notarize the Document: Montana requires LPOAs to be notarized, so both the principal and attorney-in-fact must sign the document in the presence of a notary public.

- Store the Document Safely: Keep the original document in a secure location, providing copies to involved parties, such as financial institutions or legal advisors.

By following these steps, principals can create a legally binding document that aligns with Montana's regulations.

State-Specific Rules for Montana

When drafting a Limited Power of Attorney in Montana, several state-specific guidelines must be adhered to:

- Notary Requirement: A notary public must witness signatures, adding a layer of authenticity and legality to the document.

- Witness Requirements: Although not mandatory, having witnesses can provide additional validation and may prevent potential disputes.

- Legal Capacity: The principal must be of sound mind, ensuring the decision to delegate authority is informed and voluntary.

- Revocation Provisions: The document should include clear instructions on revocation procedures, ensuring the principal retains control over the arrangement.

Ensuring compliance with these rules is crucial for the document’s enforceability in Montana.

Legal Use of the Limited Power of Attorney

An LPOA in Montana can be utilized in various legal contexts, providing structured delegation in situations such as:

- Real Estate Transactions: Authorizing an attorney-in-fact to manage property sales or refinancing activities.

- Financial Management: Delegating tasks like tax filing or banking transactions.

- Legal Proceedings: Empowering representation in specific legal instances, ensuring the principal’s interests are protected without personal involvement.

Each use case benefits from the precision and legal backing of an LPOA, enabling efficient transaction management.

Examples of Using the Limited Power of Attorney

Consider these practical scenarios where an LPOA might be applied:

- Selling a Home: A Montanan homeowner traveling abroad empowers an attorney-in-fact to handle the sale process, from negotiations to final signing.

- Bank Account Management: Elderly individuals grant limited access to trusted relatives for bill payments and account monitoring, maintaining financial oversight while receiving necessary assistance.

- Business Transactions: Entrepreneurs delegate specific contract signings to partners or staff, ensuring continuity of operations during their absence.

These examples illustrate the LPOA’s versatility and utility in everyday life.

Who Typically Uses the Limited Power of Attorney

Individuals from various walks of life might find an LPOA beneficial:

- Traveling Professionals: Those frequently away from home utilize LPOAs to maintain operations in their absence.

- Elderly Individuals: Seniors often delegate specific financial tasks to relatives, ensuring their affairs remain organized.

- Business Owners: Entrepreneurs appoint trusted associates to manage particular business functions, enabling efficient management even when they are unavailable.

Each demographic benefits from the document's adaptability and precision, addressing specific needs.

Important Terms Related to Limited Power of Attorney

Understanding the terminology associated with LPOAs can enhance clarity:

- Principal: The individual granting certain powers to the attorney-in-fact.

- Attorney-in-Fact: The person receiving powers to act on the principal’s behalf.

- Revocation: The process of canceling the granted powers, restoring full authority to the principal.

- Durable vs. Non-Durable: Durability in an LPOA dictates whether the authority survives the principal's incapacitation, an important distinction.

Recognizing these terms ensures clear communication and understanding among all parties involved.