Definition & Meaning of the W-9 Form in Pennsylvania

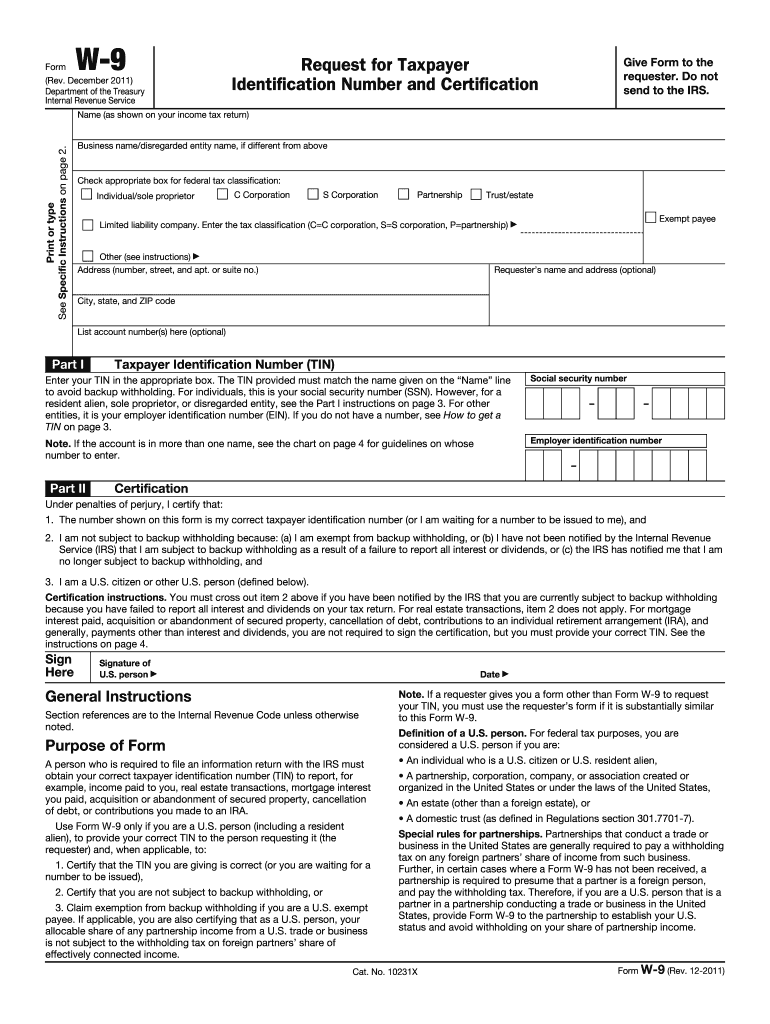

The W-9 form is a key document utilized in the United States, specifically for taxpayers to provide their correct taxpayer identification information to others who need to report the income paid to them. In Pennsylvania, the W-9 form serves as a certification of a taxpayer's identification, which may be an individual’s Social Security number or a business’s Employer Identification Number (EIN). Businesses and individuals use this form to ensure compliance with IRS regulations.

- Purpose: The W-9 form is mainly used to facilitate reporting for tax purposes, specifically for the issuance of 1099 forms.

- Usage: Commonly utilized by freelancers, contractors, and vendors who provide services to businesses.

- Compliance: Ensures the requester has accurate identification information to fulfill tax compliance obligations regarding backup withholding.

Steps to Complete the W-9 Form in Pennsylvania

Filling out the W-9 form is straightforward if you follow these steps. It is important for the accuracy of your details, as errors might lead to tax issues later.

- Download the W-9 Form: Obtain the most recent version from the IRS website or other trusted sources, such as a business or tax platform like DocHub.

- Complete Personal Information: Enter your name and business name (if applicable). Make sure the name matches what is registered with the IRS.

- Tax Classification: Check the appropriate box that indicates your federal tax classification. Options may include individual/sole proprietor, corporation, partnership, etc.

- Taxpayer Identification Number (TIN): Fill in your Social Security Number or Employer Identification Number. Accurate entry is crucial.

- Certification: Sign and date the form, certifying that the information provided is true and correct. This is a critical step for validity.

Completing the W-9 correctly is essential to avoid complications, especially for independent contractors and businesses receiving payments.

Filing Deadlines and Important Dates for the W-9 Form

The W-9 form itself does not have a filing deadline since it is not submitted to the IRS. Instead, it must be requested and kept on file by the requester (the entity that will be reporting the income). However, awareness of key dates associated with income reporting is important.

- 1099 Form Deadline: The entity paying you must file Form 1099 with the IRS by January thirty-first of the year following the tax year of payment.

- Recipient Copies: Recipients must receive their copies of the 1099 form by January thirty-first, allowing for timely filing of personal tax returns.

- Tax Return Due Dates: Keeping track of individual filing dates, typically April fifteenth, is essential for self-employed individuals or those receiving 1099 income.

Understanding these deadlines is crucial for proper tax compliance and to avoid penalties.

Required Documents for Submitting a W-9 Form

When submitting a W-9 form in Pennsylvania, no additional documents are typically required. However, the following items may be useful or necessary in specific scenarios:

- Identification: Although a W-9 does not need to be submitted with ID, having a valid government-issued ID might be necessary for establishing identity in certain business contexts.

- Prior Tax Returns: Tax returns may provide historical context, particularly if there are discrepancies in identification numbers.

- Tax Identification Number Verification: If unsure about your TIN, having documents like a Social Security card or IRS correspondence can facilitate accurate completion.

While the W-9 itself is straightforward, ensuring relevant identification documentation is readily available can expedite the process.

Digital vs. Paper Version of the W-9 Form

The W-9 form is available in both digital and paper formats, offering flexibility to users depending on their preferences and circumstances.

-

Digital Version:

- Can be filled out using various software tools, including electronic filing systems.

- Often allows for easier corrections and faster data submission.

- May include features such as auto-filling and electronic signatures, which streamline the process.

-

Paper Version:

- Traditionally used when submitting by mail or for in-person requests.

- Allows for physical records and manual signatures.

- May be preferred in environments where digital solutions are not feasible.

When deciding between the formats, consider factors such as accessibility, ease of use, and the preferences of the entities involved.

Taxpayer Scenarios for W-9 Utilization in Pennsylvania

The W-9 form is commonly used across various taxpayer scenarios, impacting individuals and businesses of different types. Here are a few key situations:

- Freelancers: Independent contractors, including writers and consultants, use the W-9 to ensure that businesses they work for report their earnings correctly to the IRS on Form 1099.

- Small Business Owners: Sole proprietors or LLCs may use the W-9 to provide identification to clients and maintain compliance with federal reporting.

- Students: College students taking on internships that require payments exceeding a certain threshold may need to submit a W-9 in order to ensure correct reporting of income.

Understanding how the W-9 applies to different taxpayer scenarios helps in recognizing its importance for accurate tax reporting.

Important Terms Related to the W-9 Form in Pennsylvania

Familiarity with the terminology associated with the W-9 form can greatly enhance understanding and ease of use.

- Taxpayer Identification Number (TIN): A unique identification number assigned to individuals and businesses for tax purposes, which can be a Social Security Number or an Employer Identification Number.

- Form 1099: A tax form used to report income from self-employment and freelance work, often requiring information from the W-9.

- Backup Withholding: A standard tax that applies when taxpayers do not provide accurate TIN or fail to certify their details on forms like the W-9.

Understanding these terms allows for better comprehension of the W-9's role in the broader context of tax reporting and compliance.