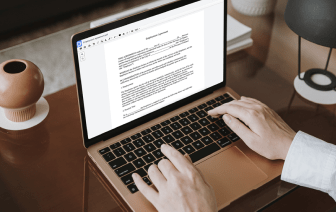

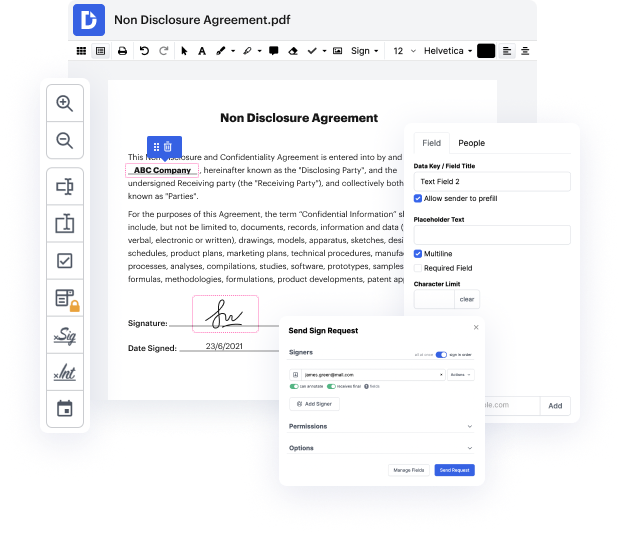

Time is a vital resource that every organization treasures and tries to transform into a gain. In choosing document management software, take note of a clutterless and user-friendly interface that empowers customers. DocHub gives cutting-edge tools to optimize your document administration and transforms your PDF editing into a matter of a single click. Insert Line in the Claims Reporting Form with DocHub in order to save a ton of time as well as enhance your efficiency.

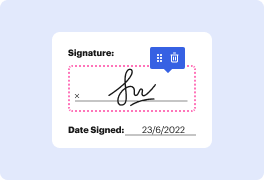

Make PDF editing an simple and intuitive operation that helps save you plenty of valuable time. Easily adjust your documents and deliver them for signing without adopting third-party options. Concentrate on relevant tasks and improve your document administration with DocHub today.

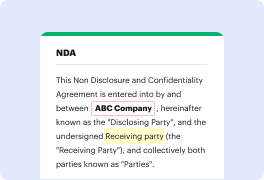

The 1099 is a tax form issued by your brokerage firm to help you report your taxable investment income when filing your taxes with the IRS. Brokerages are required by the IRS to send out 1099 forms by February 15. However, most firms will try to send 1099s out sooner. In this video, well walk through some of the main sections of the 1099 and what they mean. This is just an overview, so remember to speak with a tax professional for issues specific to your account. Lets look at the form itself. At the top of your 1099, youll see general information that includes names and addresses. Note the Document ID, which youll enter if you use tax preparation software. Next is the Summary Information, which consolidates information from throughout the 1099 form. Each section is detailed later in the report. Lets look at each. The Dividends and Distributions, or 1099-DIV, section documents payments you may have received as a shareholder of some investments. There are two types of dividends list