Boost your form managing with the Wills for Single Parents with Adult Children library with ready-made form templates that meet your requirements. Access the document, modify it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with your forms.

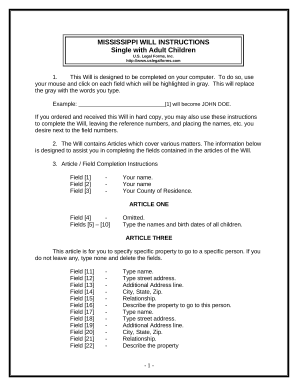

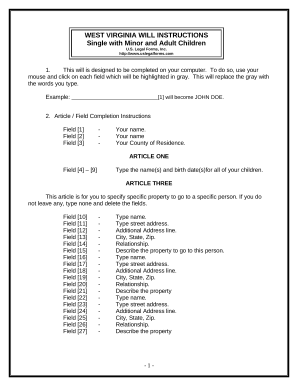

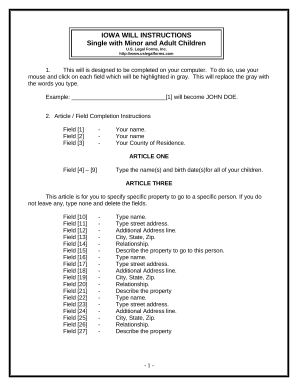

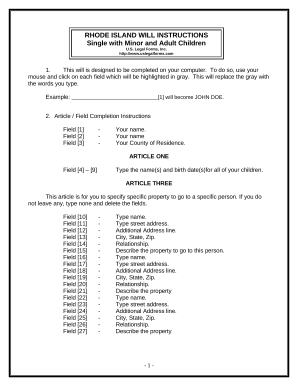

How to use our Wills for Single Parents with Adult Children:

Discover all the possibilities for your online file administration with our Wills for Single Parents with Adult Children. Get a free free DocHub account today!