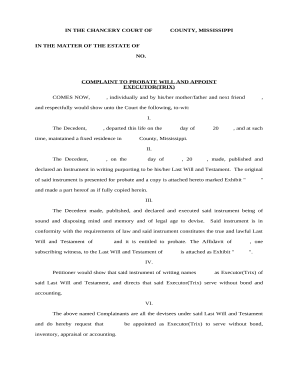

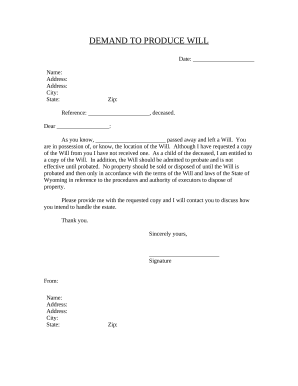

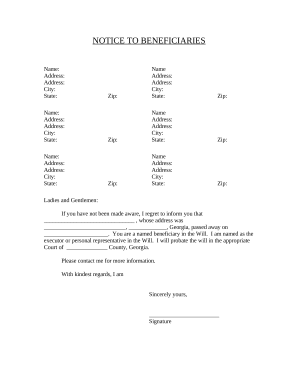

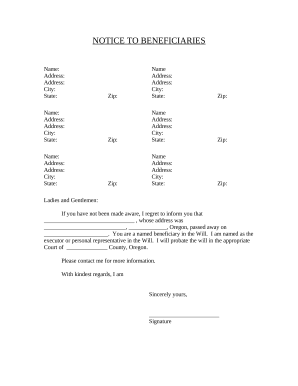

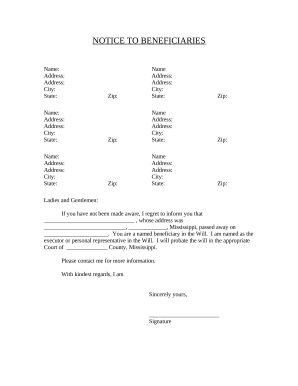

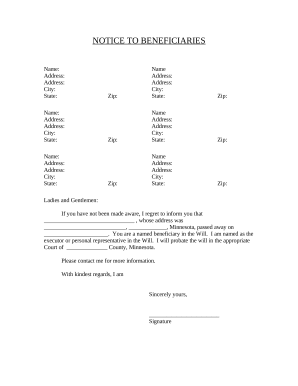

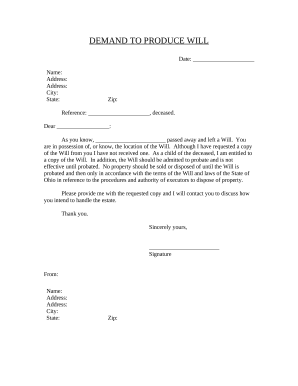

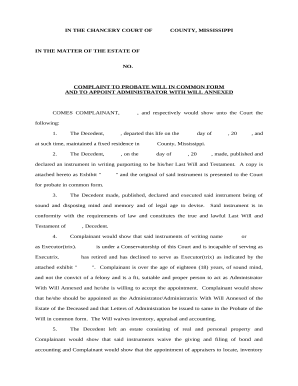

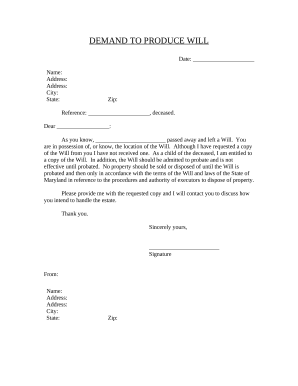

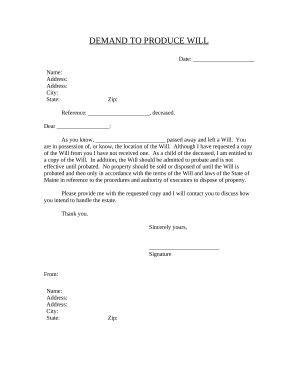

Boost your form management using our Testate Estate Forms online library with ready-made document templates that suit your requirements. Access the document, edit it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively with your forms.

How to use our Testate Estate Forms:

Discover all the possibilities for your online document management with our Testate Estate Forms. Get your free free DocHub account right now!