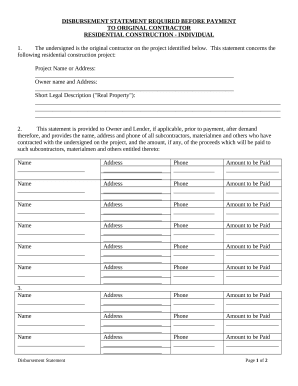

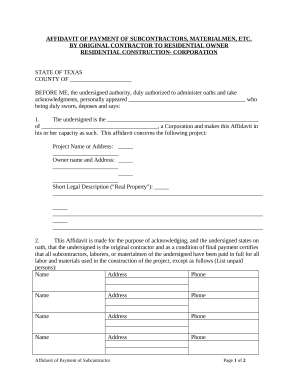

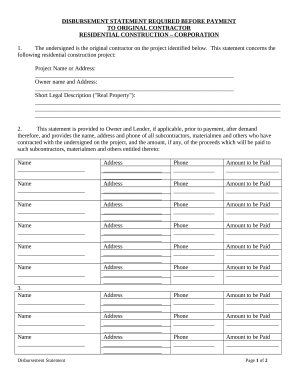

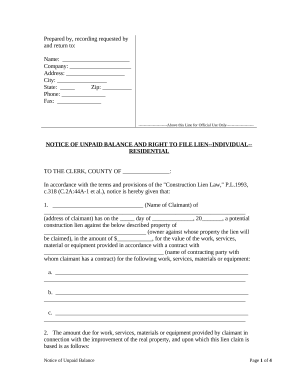

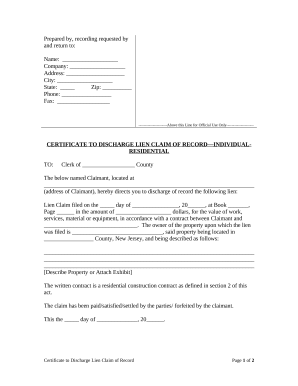

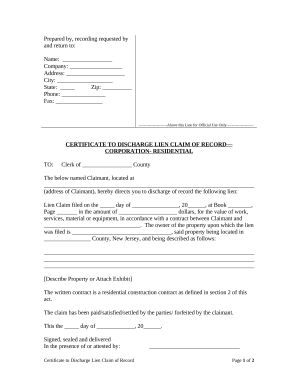

Your workflows always benefit when you can easily obtain all of the forms and documents you may need at your fingertips. DocHub delivers a a huge collection of documents to relieve your daily pains. Get a hold of Residential Construction Liens category and easily discover your form.

Start working with Residential Construction Liens in a few clicks:

Enjoy smooth document management with DocHub. Explore our Residential Construction Liens collection and look for your form right now!