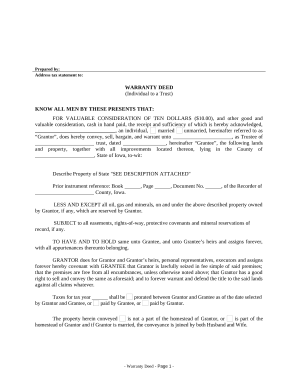

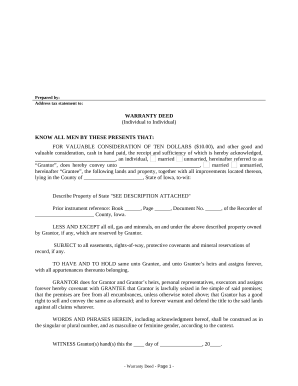

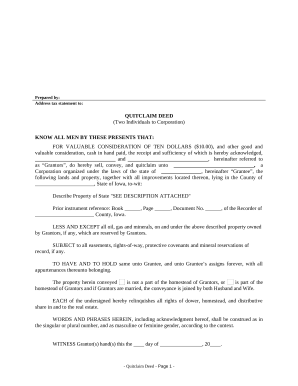

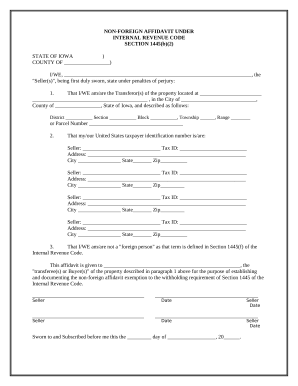

Accelerate your file administration using our Real Estate Legal Forms in Iowa library with ready-made document templates that meet your requirements. Access the document, edit it, fill it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the forms.

The best way to manage our Real Estate Legal Forms in Iowa:

Explore all of the possibilities for your online file administration with the Real Estate Legal Forms in Iowa. Get a totally free DocHub account today!