Boost your document management with the Real Estate Deed Forms collection with ready-made templates that meet your requirements. Get the document template, edit it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with your documents.

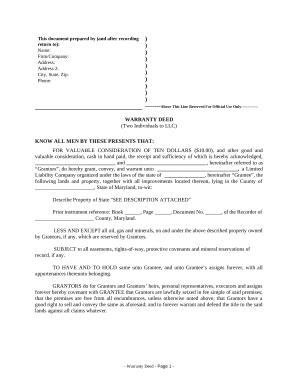

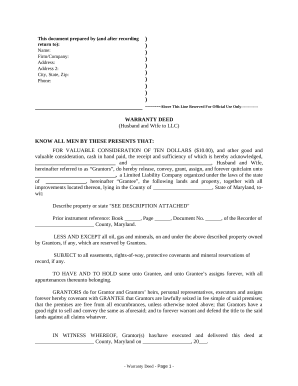

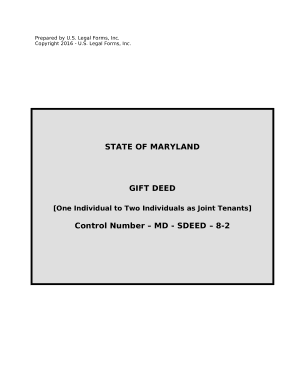

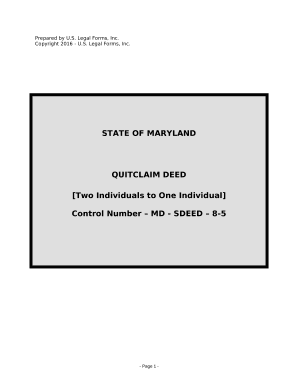

How to use our Real Estate Deed Forms:

Explore all of the possibilities for your online document administration using our Real Estate Deed Forms. Get your free free DocHub profile right now!