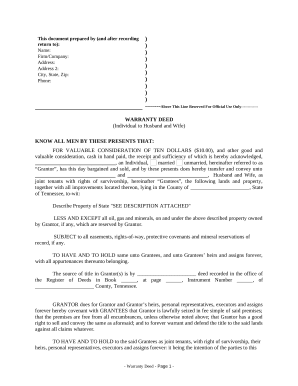

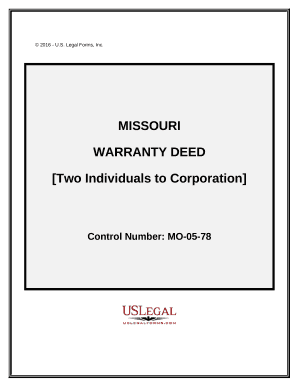

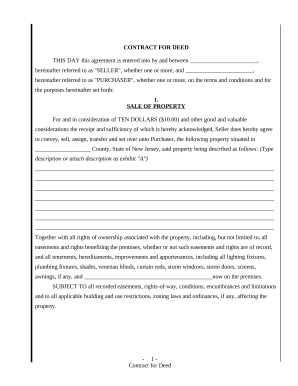

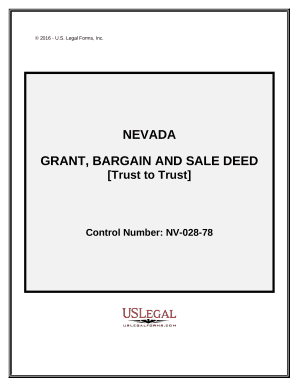

Accelerate your file operations using our Property Sale Deeds category with ready-made templates that meet your requirements. Access the document, edit it, fill it, and share it with your contributors without breaking a sweat. Begin working more effectively together with your documents.

The best way to use our Property Sale Deeds:

Explore all the opportunities for your online document administration using our Property Sale Deeds. Get a free free DocHub profile right now!