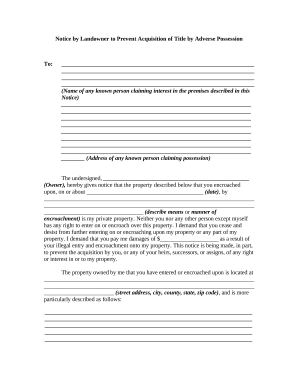

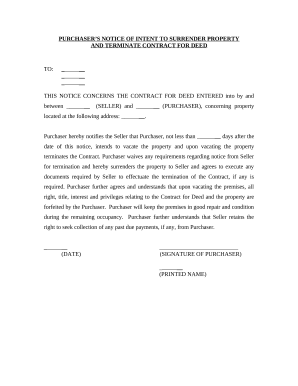

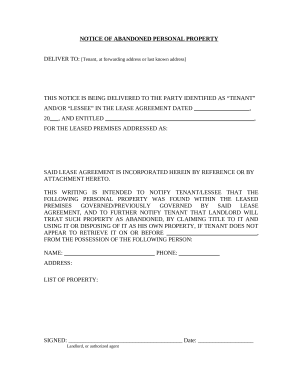

Your workflows always benefit when you are able to find all the forms and files you need at your fingertips. DocHub supplies a wide array of document templates to relieve your everyday pains. Get hold of Property Notices category and quickly find your form.

Start working with Property Notices in a few clicks:

Enjoy fast and easy document administration with DocHub. Check out our Property Notices online library and get your form today!