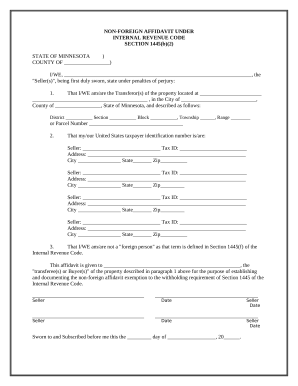

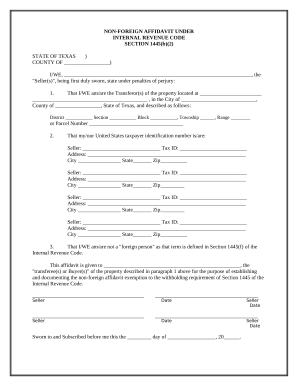

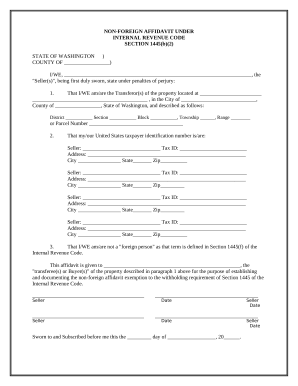

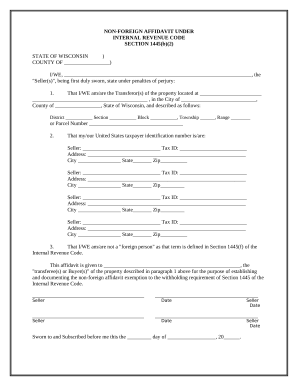

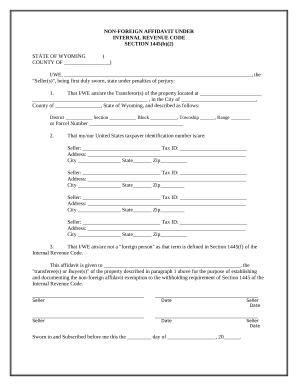

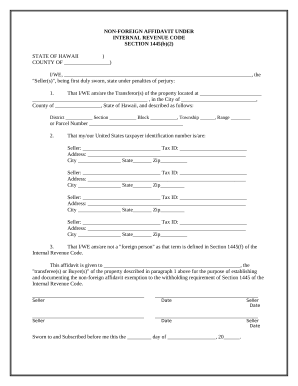

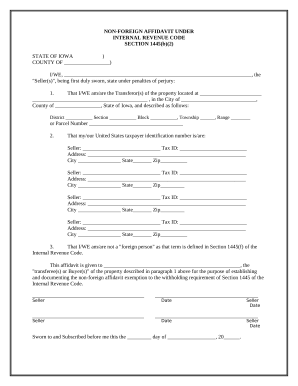

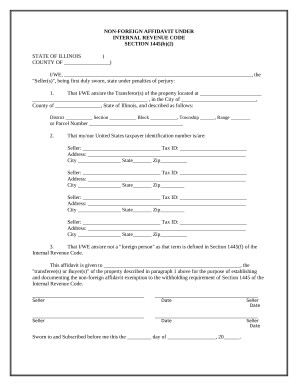

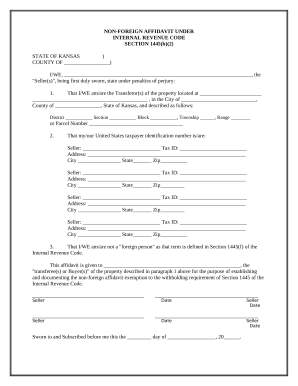

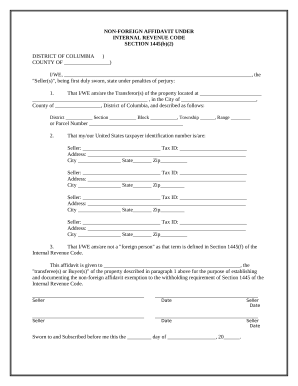

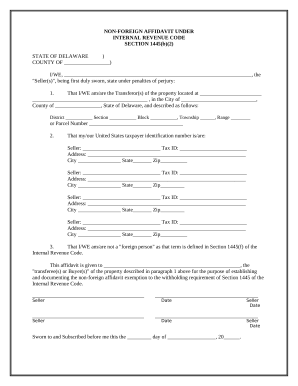

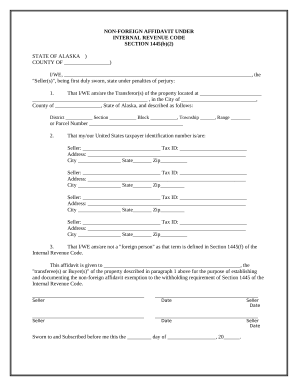

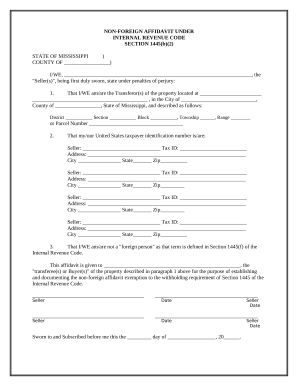

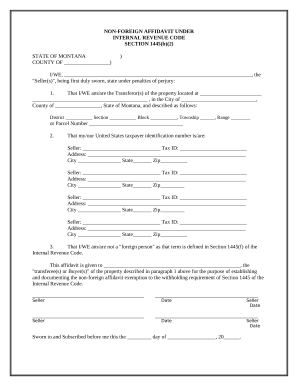

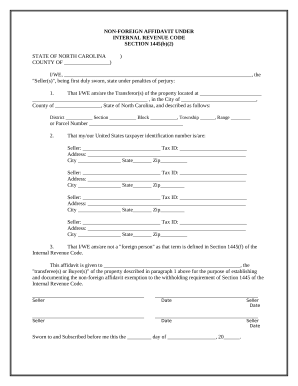

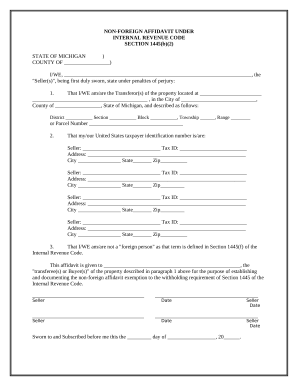

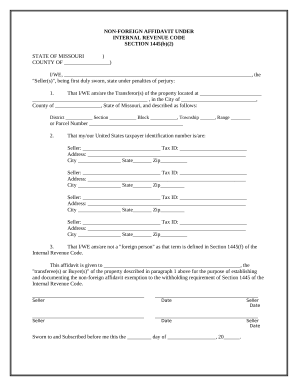

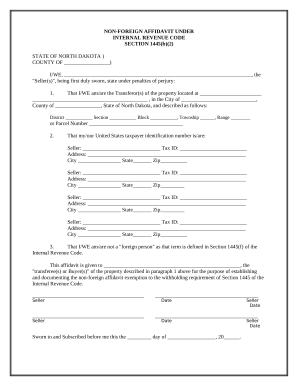

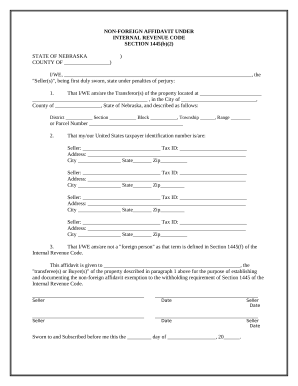

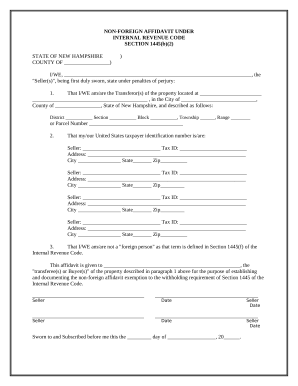

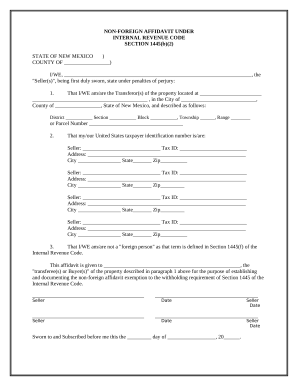

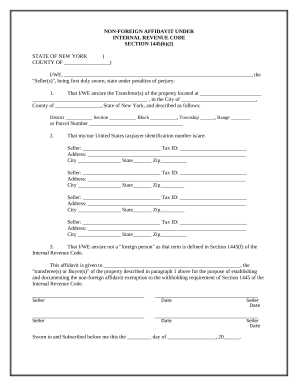

Accelerate your file managing with our Non-Foreign Affidavit Forms category with ready-made document templates that suit your needs. Get the document, edit it, complete it, and share it with your contributors without breaking a sweat. Begin working more efficiently with the documents.

The best way to manage our Non-Foreign Affidavit Forms:

Explore all of the possibilities for your online document management with the Non-Foreign Affidavit Forms. Get a totally free DocHub account right now!