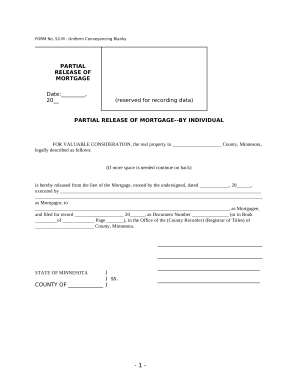

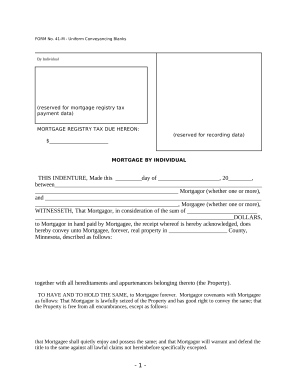

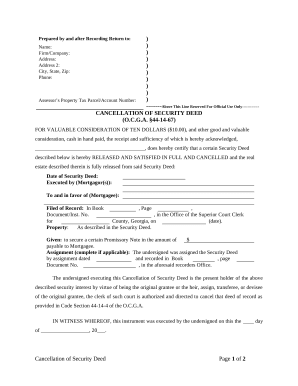

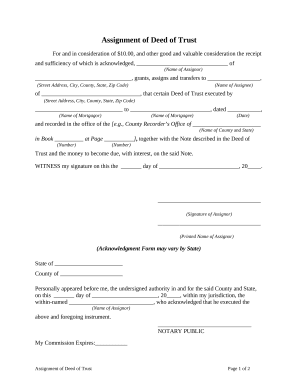

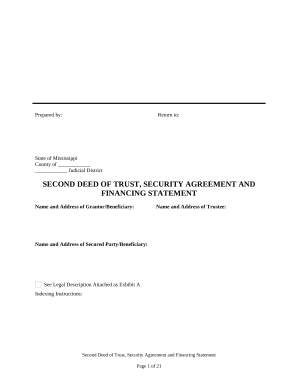

Your workflows always benefit when you can easily get all the forms and files you will need on hand. DocHub gives a a huge library of forms to ease your daily pains. Get a hold of Mortgage Paperwork category and easily discover your document.

Start working with Mortgage Paperwork in a few clicks:

Enjoy easy form managing with DocHub. Explore our Mortgage Paperwork collection and get your form right now!