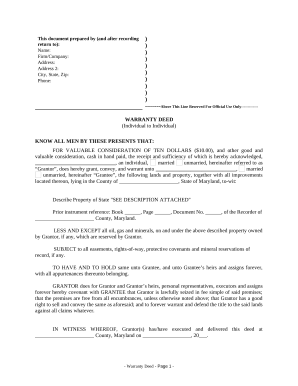

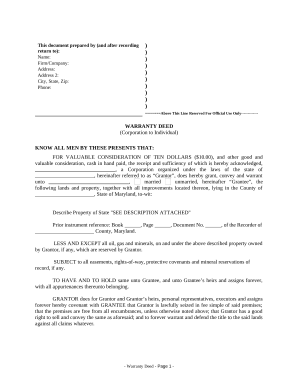

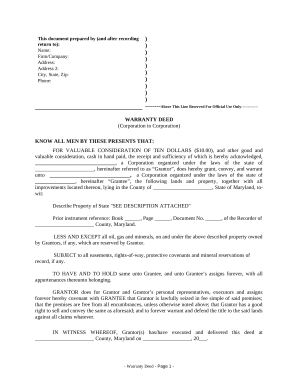

Your workflows always benefit when you can easily discover all of the forms and files you will need at your fingertips. DocHub offers a wide array of templates to alleviate your everyday pains. Get hold of Maryland Warranty Deeds category and quickly find your document.

Start working with Maryland Warranty Deeds in several clicks:

Enjoy fast and easy record management with DocHub. Explore our Maryland Warranty Deeds collection and get your form right now!