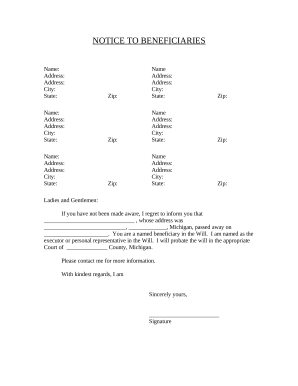

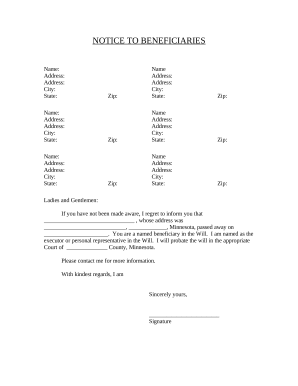

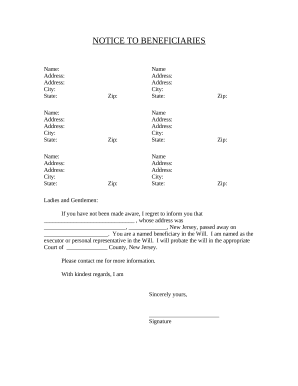

Your workflows always benefit when you can find all of the forms and documents you may need at your fingertips. DocHub supplies a wide array of forms to alleviate your daily pains. Get hold of Legal Beneficiary Forms category and quickly find your form.

Begin working with Legal Beneficiary Forms in several clicks:

Enjoy easy document managing with DocHub. Check out our Legal Beneficiary Forms category and get your form today!