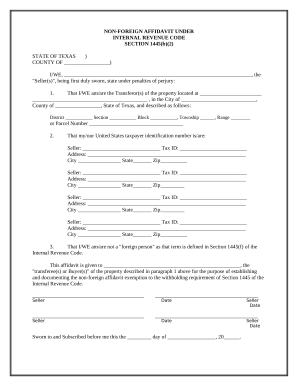

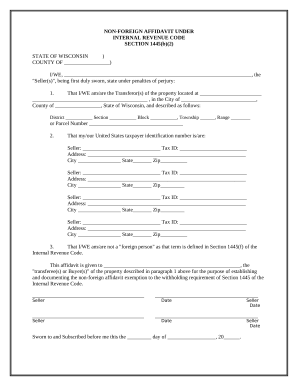

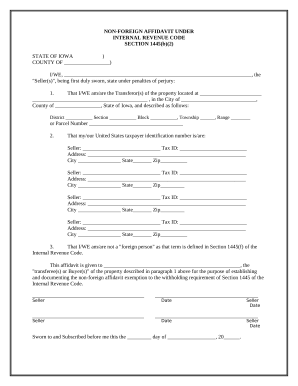

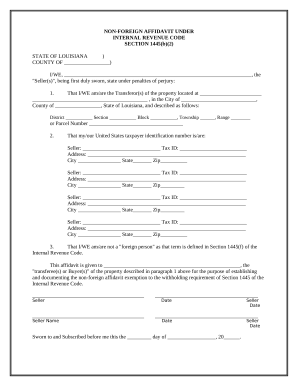

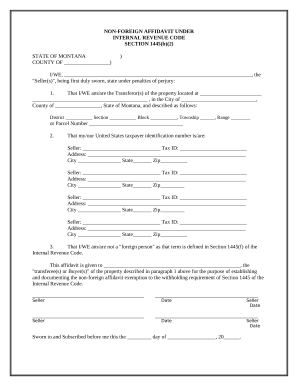

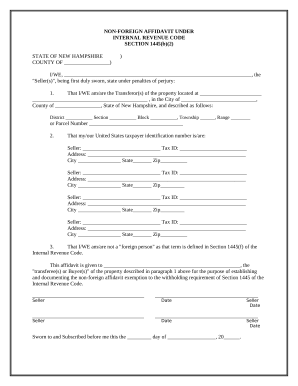

Your workflows always benefit when you are able to obtain all the forms and documents you require on hand. DocHub delivers a vast array of forms to alleviate your day-to-day pains. Get a hold of IRC 1445 Legal Forms category and easily discover your form.

Start working with IRC 1445 Legal Forms in several clicks:

Enjoy seamless file administration with DocHub. Check out our IRC 1445 Legal Forms category and find your form right now!