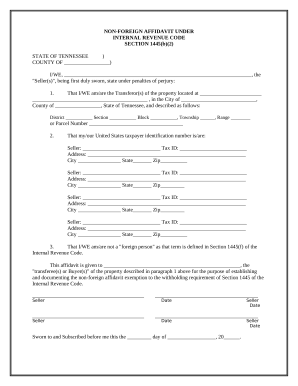

Your workflows always benefit when you can easily locate all the forms and documents you may need at your fingertips. DocHub provides a a huge collection of form templates to relieve your everyday pains. Get a hold of IRC 1445 Forms category and quickly find your form.

Begin working with IRC 1445 Forms in several clicks:

Enjoy easy document administration with DocHub. Check out our IRC 1445 Forms online library and look for your form right now!