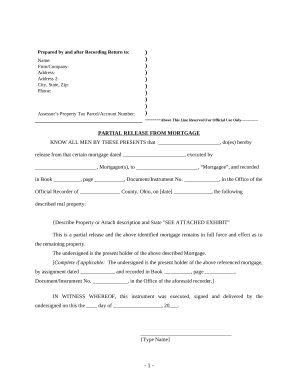

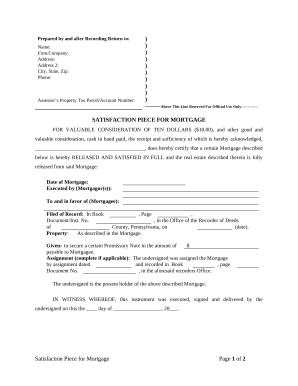

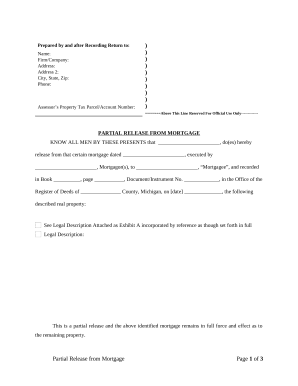

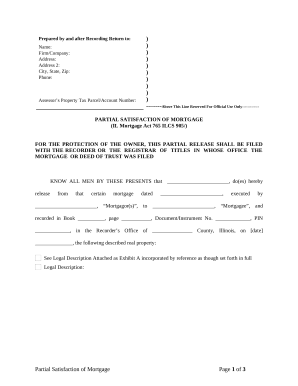

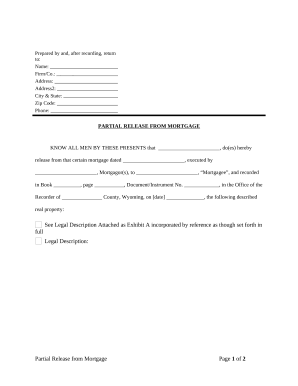

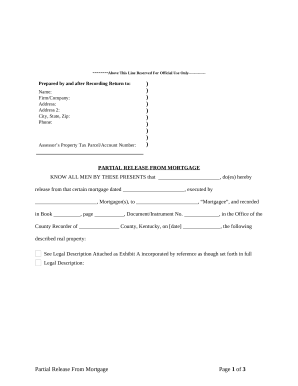

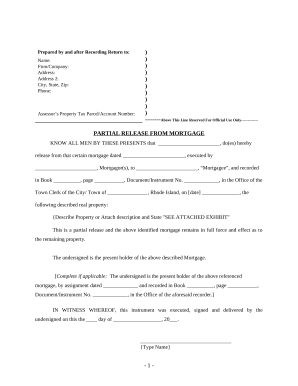

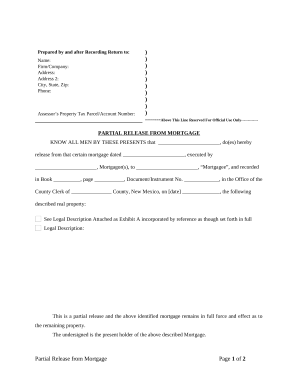

Accelerate your document management with our Individual Holder Mortgage Forms collection with ready-made form templates that meet your needs. Access your document template, modify it, fill it, and share it with your contributors without breaking a sweat. Start working more effectively with the documents.

How to use our Individual Holder Mortgage Forms:

Discover all the opportunities for your online document management with the Individual Holder Mortgage Forms. Get a free free DocHub profile today!