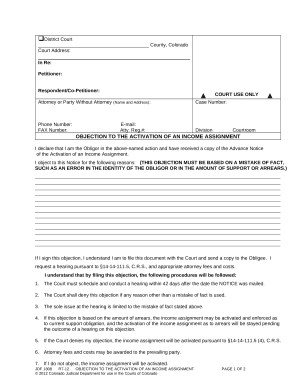

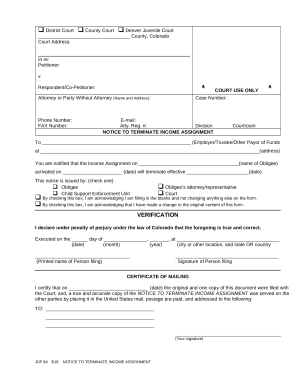

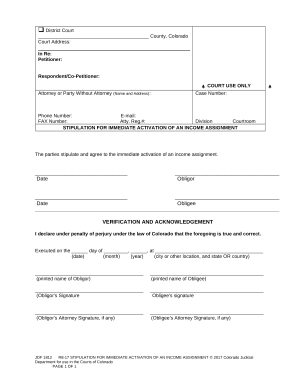

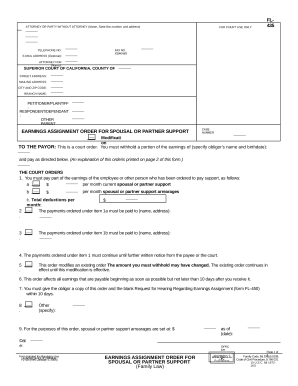

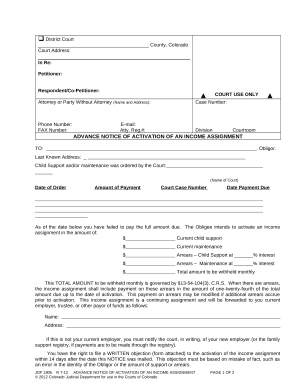

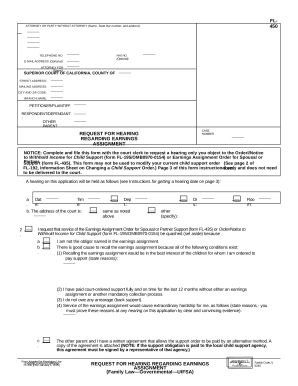

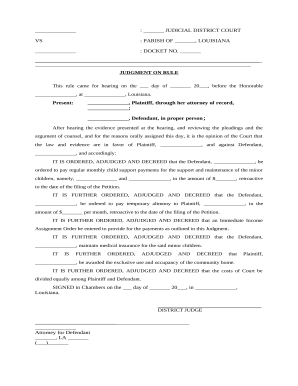

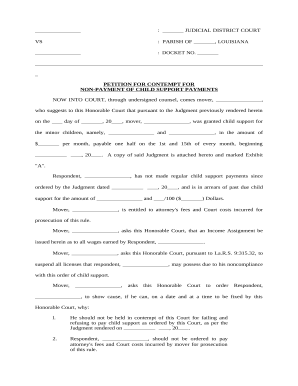

Boost your form management with our Income Assignment Forms library with ready-made document templates that suit your requirements. Access your form template, modify it, complete it, and share it with your contributors without breaking a sweat. Start working more effectively with the forms.

How to use our Income Assignment Forms:

Discover all of the possibilities for your online file administration with the Income Assignment Forms. Get a free free DocHub account today!