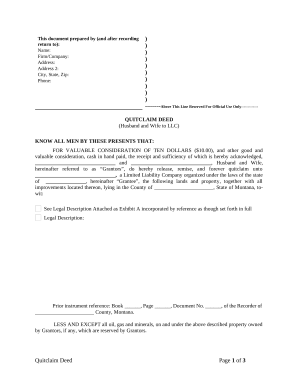

Your workflows always benefit when you can easily get all the forms and files you will need on hand. DocHub delivers a a large collection document templates to relieve your daily pains. Get a hold of Husband and Wife to LLC Forms category and quickly find your document.

Begin working with Husband and Wife to LLC Forms in a few clicks:

Enjoy fast and easy file management with DocHub. Explore our Husband and Wife to LLC Forms online library and get your form today!