Visit the DocHub website and register for the free trial. This provides access to every feature you’ll require to create your Estate Settlement Legal Form with no upfront cost.

Log in to your DocHub account and go to the dashboard.

Hit New Document in your dashboard, and choose Create Blank Document to design your Estate Settlement Legal Form from the ground up.

Place different fields such as text boxes, radio buttons, icons, signatures, etc. Organize these fields to suit the layout of your form and assign them to recipients if needed.

Rearrange your form effortlessly by adding, repositioning, removing, or merging pages with just a few clicks.

Turn your newly designed form into a template if you need to send many copies of the same document repeatedly.

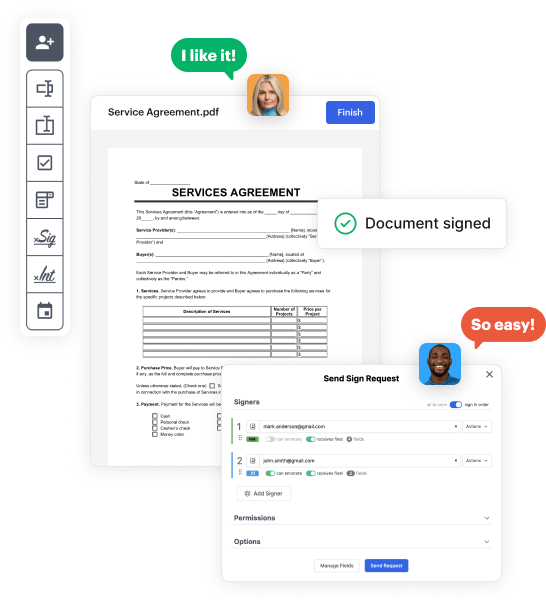

Send the form via email, share a public link, or even publish it online if you aim to collect responses from more recipients.