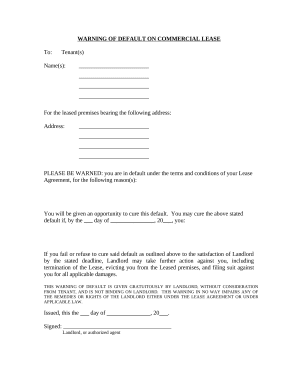

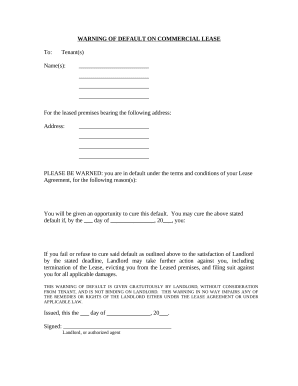

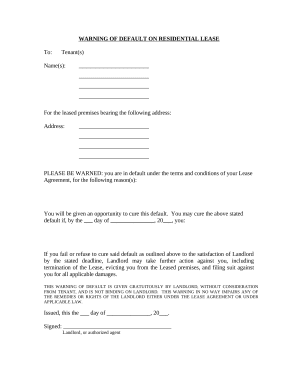

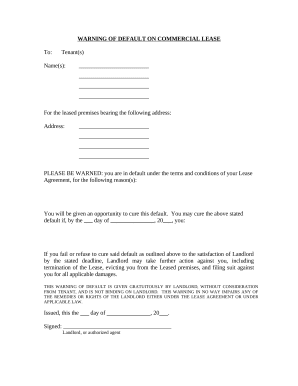

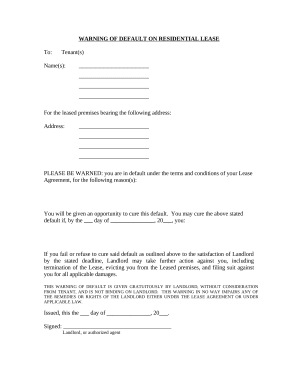

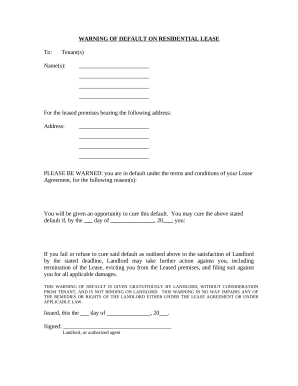

Your workflows always benefit when you are able to discover all of the forms and files you may need at your fingertips. DocHub offers a vast array of forms to relieve your everyday pains. Get a hold of Default Warning Notices category and easily discover your form.

Start working with Default Warning Notices in a few clicks:

Enjoy easy record managing with DocHub. Explore our Default Warning Notices online library and discover your form today!