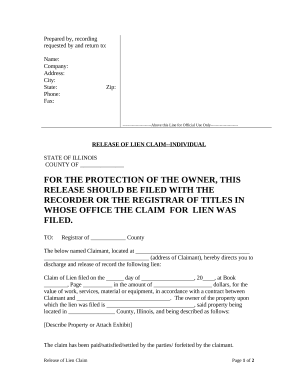

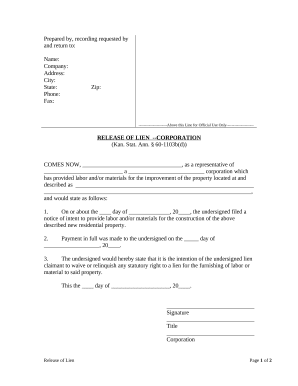

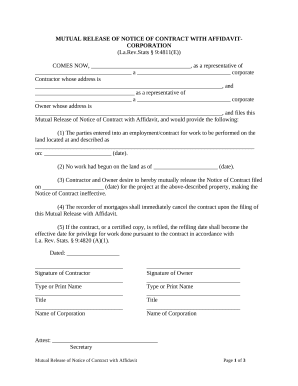

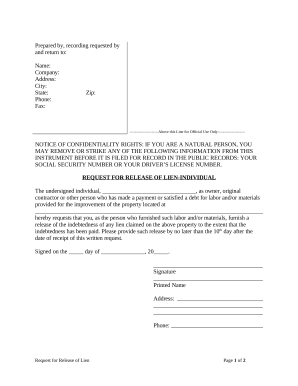

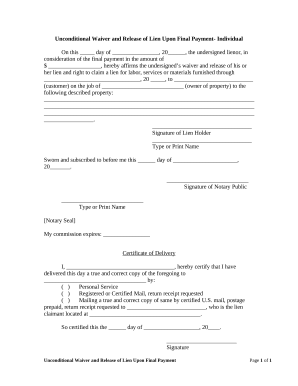

Your workflows always benefit when you are able to find all of the forms and files you require at your fingertips. DocHub provides a vast array of forms to ease your everyday pains. Get a hold of Construction Lien Release category and quickly find your form.

Begin working with Construction Lien Release in a few clicks:

Enjoy easy form managing with DocHub. Discover our Construction Lien Release online library and discover your form right now!