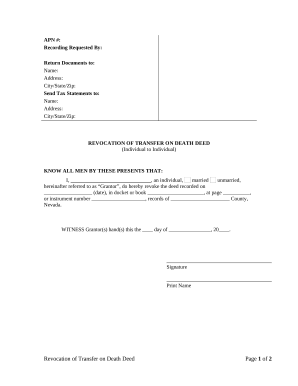

Accelerate your file administration with the Beneficiary Deed Forms collection with ready-made form templates that meet your needs. Get your document, change it, complete it, and share it with your contributors without breaking a sweat. Begin working more effectively with your forms.

How to use our Beneficiary Deed Forms:

Discover all the opportunities for your online document management with our Beneficiary Deed Forms. Get your totally free DocHub profile today!