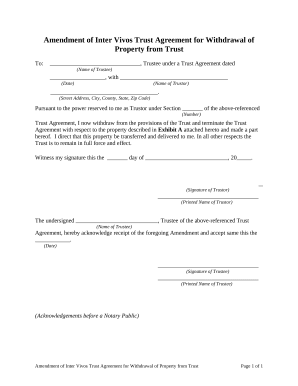

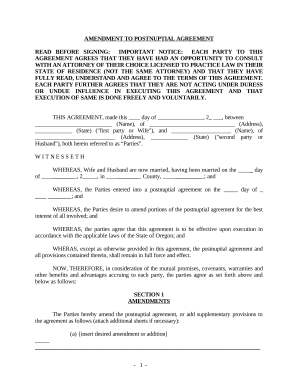

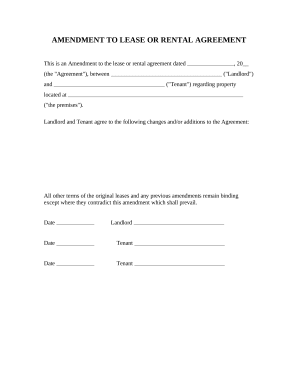

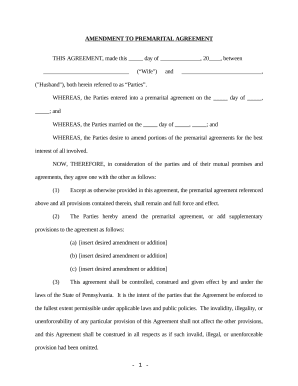

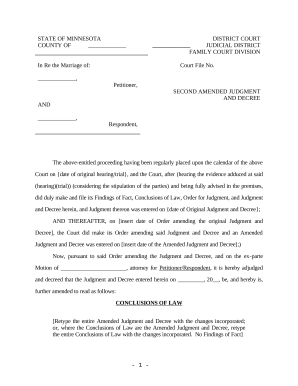

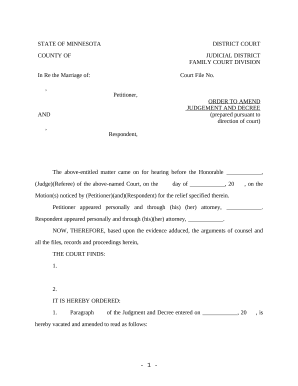

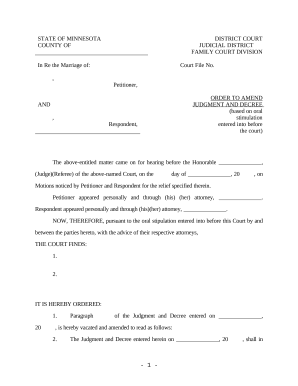

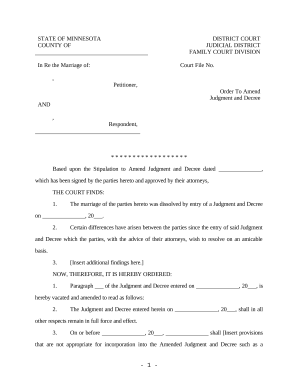

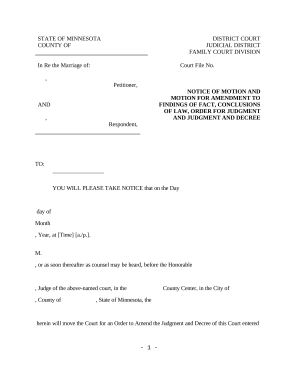

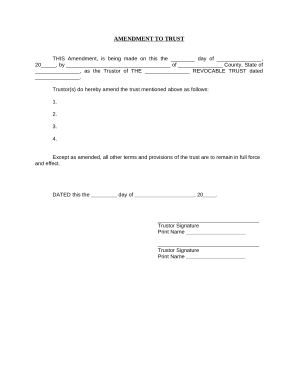

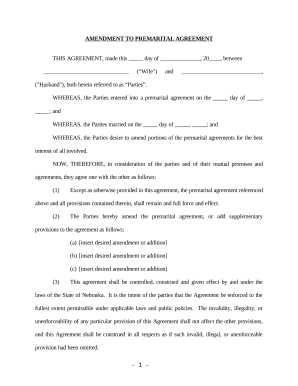

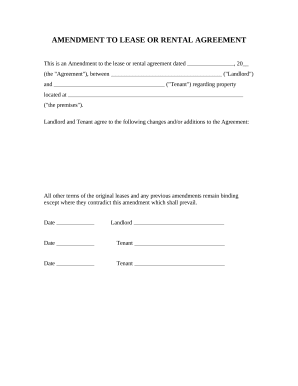

Your workflows always benefit when you can discover all of the forms and documents you require on hand. DocHub supplies a huge selection of form templates to alleviate your day-to-day pains. Get hold of Amendment Forms category and quickly find your document.

Start working with Amendment Forms in several clicks:

Enjoy effortless form administration with DocHub. Discover our Amendment Forms collection and get your form today!